Cryptocurrency Guides – Your Go‑To Resource

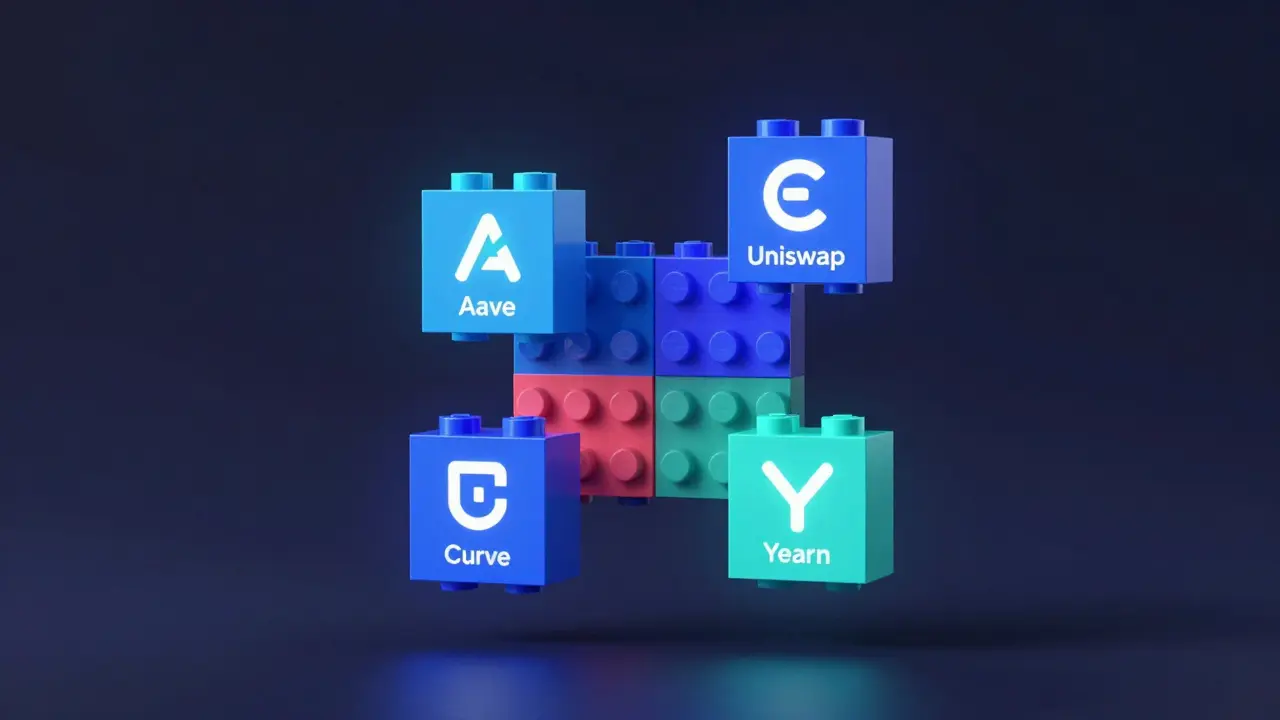

Welcome to our Cryptocurrency Guides. When working with Cryptocurrency Guides, a curated set of how‑to articles, deep dives, and practical checklists that help traders and builders navigate the fast‑moving crypto space, you’ll also run into Airdrop, free token distribution events that reward early participants or community members and NFT, unique digital assets stored on a blockchain, often used for art, tickets, or gaming items. These three concepts form a core triangle: guides teach you how to spot a profitable airdrop, explain why NFTs matter for ownership proof, and show how to secure your stake in a validator node. The triangle expands when you add DeFi strategies, cross‑chain bridges, and security audit best practices—each guide links back to the central idea of making informed crypto decisions. By the end of this intro you’ll see why a solid guide library is as essential as a good wallet: it keeps you ahead of rugged launches, helps you avoid costly mistakes, and gives you a roadmap for scaling up from hobbyist to pro.

Why These Guides Matter Right Now

In 2025 the crypto ecosystem is cluttered with new tokens, layered scaling solutions, and a flood of community incentives. Our guide on Staking, the process of locking up assets to support network security and earn rewards breaks down the exact hardware specs you need for an Ethereum validator, from CPU cores to bandwidth thresholds. The security audit cost guide shows you how pricing varies across smart contracts, DeFi protocols, and enterprise blockchains, letting you budget before you hire a firm. Meanwhile, the IPFS tutorial explains step‑by‑step how to store NFT metadata in a decentralized way, ensuring your collectibles survive any single point of failure. Each article follows a clear template: definition, real‑world impact, step‑by‑step actions, and a quick checklist. This template mirrors the way a seasoned trader approaches a new market—first understand the fundamentals, then test with a small move, and finally scale up once confidence builds. By mapping each guide to a concrete use‑case, we turn abstract buzzwords into actionable tools you can apply today.

What you’ll find below is a hand‑picked collection that spans the whole crypto lifecycle. From airdrop claim walkthroughs and meme‑coin risk assessments to deep dives on cross‑chain platforms like Coinweb, every post is designed to give you a clear next step. Whether you’re hunting for the next free token, setting up a validator node, or figuring out how NFT royalties affect your revenue, the guides answer the “how” and the “why” without drowning you in jargon. Dive in, take notes, and start applying the tips right away—your next smart move in the crypto world is just a read away.

- Feb, 24 2026

AIRENE by Virtuals is a crypto token built on the Base blockchain with a community-driven focus on discipline and resilience. Unlike most coins, it has no roadmap or team-just a loyal group holding through market crashes.

- Read More

- Feb, 22 2026

- Feb, 20 2026

- Feb, 19 2026

- Feb, 3 2026

- Jan, 26 2026