What is Pine (PINE) Crypto Coin? The Complete Low-Volume NFT Liquidity Token Explained

PINE Investment Risk Calculator

Calculate Your Risk Exposure

Based on PINE's 99.8% price drop, $10k daily volume, and inactive community

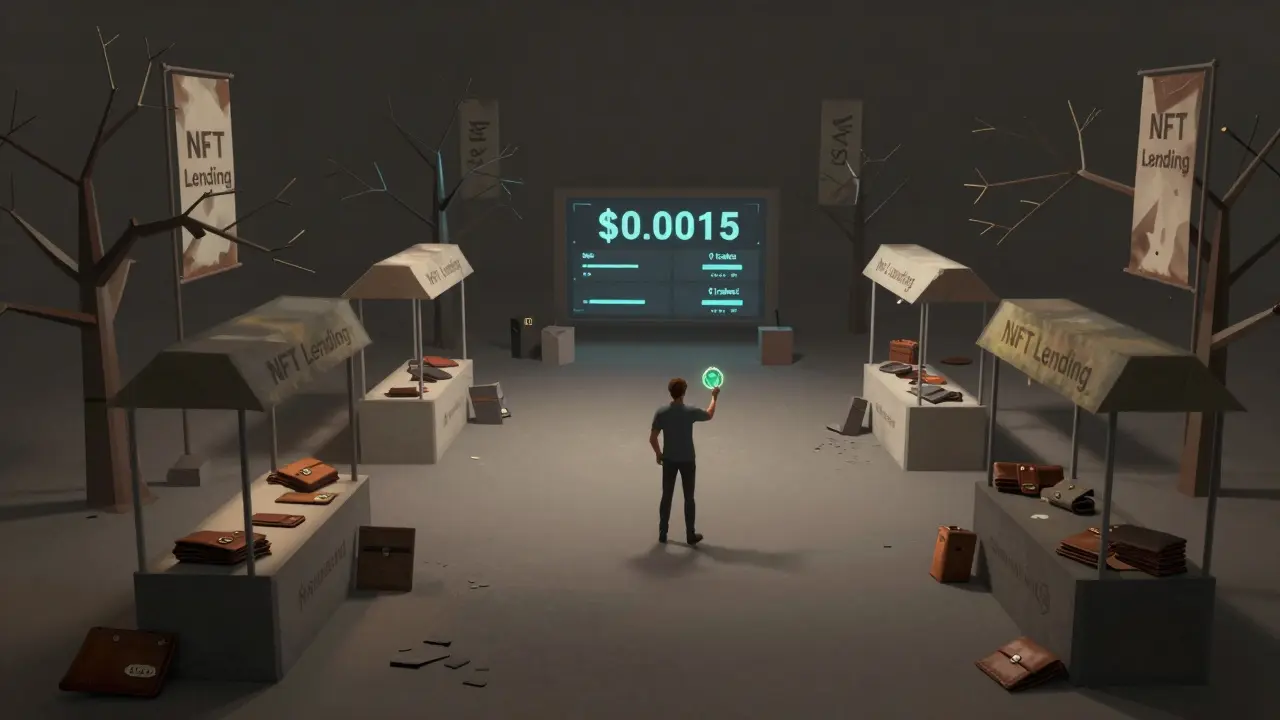

When you hear "Pine (PINE)" in crypto circles, it’s not another Bitcoin or Ethereum. It’s a tiny, obscure token tied to a niche idea: making NFTs easier to borrow and lend. If you’re wondering if PINE is worth your time, the answer isn’t about potential-it’s about what’s actually happening right now.

What Exactly Is Pine (PINE)?

Pine (PINE) is the native token of the Pine protocol, a small blockchain project built to solve one specific problem: NFT liquidity. Unlike regular cryptocurrencies, PINE isn’t meant for everyday spending. It’s designed to keep an NFT lending platform running by rewarding people who lock up their crypto to back loans made against NFTs.

Think of it like this: someone owns a rare digital artwork worth $10,000 but needs cash right away. Instead of selling it, they use it as collateral to borrow $5,000. The Pine protocol lets that happen. But who funds those loans? Users who deposit ETH or other assets into liquidity pools. In return, they earn PINE tokens.

PINE isn’t just a reward-it’s also a governance token. Holders can vote on changes to the protocol, like adjusting interest rates or adding new NFT collections. Without PINE, the system has no way to motivate users to participate. That’s the core idea.

How Does Pine Work Technically?

PINE runs as an ERC-20 token on the Ethereum blockchain. Its contract address is 0x5694...443a51, which you can verify on Etherscan. There’s also a version called "Pine AI (PINE)" on Solana, but it’s unrelated and often confused due to the same ticker.

The total supply is capped at 200 million PINE tokens. As of late 2023, only about 22 million are in circulation-meaning most are still locked up or unsold. That’s not unusual for early-stage tokens, but here’s the catch: trading volume is barely above $10,000 per day across all exchanges.

Here’s how users interact with it:

- Deposit ETH, USDC, or other assets into a Pine liquidity pool.

- Get rewarded in PINE tokens based on your share of the pool.

- Hold PINE to unlock tiers: higher holdings mean better loan rates or first access to discounted NFTs.

- Use PINE to vote on protocol upgrades via PineDAO.

It sounds smart on paper. But real-world usage? Almost non-existent.

Where Can You Buy PINE?

You won’t find PINE on Coinbase, Binance, or Kraken. It’s only listed on a handful of decentralized exchanges: Uniswap (Ethereum), Quickswap (Polygon), and Gate.io (a smaller centralized exchange).

To buy PINE, you need:

- An Ethereum-compatible wallet (MetaMask, Trust Wallet)

- Ethereum (ETH) to pay for gas fees

- Understanding of how to swap tokens on a DEX

There’s no simple "buy now" button. On Kriptomat, the minimum purchase is €15 plus network fees. On SimpleSwap, you have to manually enter the recipient’s wallet address. For someone new to crypto, this isn’t user-friendly-it’s a barrier.

Price History: A 99.8% Crash

PINE’s biggest story isn’t its tech-it’s its price.

At its peak in 2022, PINE hit $0.975531. As of December 2023, it trades around $0.0015. That’s a drop of nearly 99.8%.

Why? Because the NFT market collapsed. Projects built on hype-especially those tied to NFT lending-lost funding, users, and attention. Pine didn’t adapt. No major updates. No marketing. No community growth.

Compare it to NFTfi, a similar project: NFTfi’s token is worth $16.7 million in market cap. Pine’s? Around $280,000. That’s less than 2% of NFTfi’s value.

Is Pine a Good Investment?

Let’s cut through the noise.

Pros:

- Unique dual role: governance + liquidity incentive

- Real use case in NFT lending

- Low entry price (under $0.002)

Cons:

- Trading volume: under $20,000/day (nearly zero liquidity)

- No active Discord, Telegram, or social media presence

- No official whitepaper or developer updates since 2022

- Market rank: #8411 out of over 25,000 coins

- 99.8% price drop from ATH-classic sign of abandonment

There are no credible analyst reports on Pine. No Messari, no Delphi Digital, no CoinDesk. Just promotional snippets from Bitget and CoinMarketCap-platforms that list almost anything.

If you’re looking for a long-term bet, Pine doesn’t pass the basic tests: no community, no development, no volume. If you’re gambling on a micro-cap rebound, you’re playing Russian roulette with crypto’s most dangerous category: dead projects with low prices.

Who Uses Pine Today?

No institutions. No NFT marketplaces. No DeFi aggregators. Just a handful of speculative traders who found it on CoinGecko and thought, "It’s cheap-maybe it’ll pump."

There are no reviews on Trustpilot. No meaningful threads on Reddit. No tweets from devs. The entire ecosystem feels frozen in time.

Even the NFT lending sector, which grew 147% in 2023, has left Pine behind. Projects like BendDAO and NFTfi have better funding, better teams, and better user bases. Pine didn’t just fall behind-it disappeared.

Should You Even Try Pine?

If you’re a beginner: don’t touch it. The learning curve is steep, the risk is extreme, and the reward is nonexistent.

If you’re an experienced trader looking for a high-risk, low-reward gamble: fine. But treat it like a lottery ticket. Put in $50 you’re okay losing. Don’t expect returns. Don’t expect support. Don’t expect it to last.

And if you’re thinking of investing real money because someone called it "innovative"? Walk away. Innovation without adoption is just a demo.

The Bigger Picture: Why Most NFT Tokens Fail

Pine isn’t unique in its failure. Over 80% of tokens launched during the 2021 NFT boom are now worthless or inactive. Why? Because they were built on hype, not utility.

NFT lending sounded revolutionary. But in practice, most people don’t want to borrow against their digital art. They’d rather sell it. And lenders don’t want to risk $10,000 on a JPEG that could vanish if the platform shuts down.

Pine’s model was sound in theory. But theory doesn’t pay bills. Real users do. And Pine has none.

The future of NFT finance isn’t in obscure tokens like PINE. It’s in established protocols with real users, active teams, and transparent roadmaps. Pine is a relic of a bubble that popped.

Jonathan Sundqvist

December 6, 2025 AT 22:29Jerry Perisho

December 7, 2025 AT 03:28Tara Marshall

December 8, 2025 AT 11:24Renelle Wilson

December 9, 2025 AT 10:32Isha Kaur

December 9, 2025 AT 13:20Mairead Stiùbhart

December 11, 2025 AT 09:54Chloe Hayslett

December 12, 2025 AT 08:23Uzoma Jenfrancis

December 13, 2025 AT 11:24Nelson Issangya

December 14, 2025 AT 21:36Manish Yadav

December 16, 2025 AT 00:20Elizabeth Miranda

December 16, 2025 AT 16:19Glenn Jones

December 18, 2025 AT 05:15Billye Nipper

December 19, 2025 AT 06:13Roseline Stephen

December 20, 2025 AT 07:43Annette LeRoux

December 21, 2025 AT 21:19Noriko Robinson

December 22, 2025 AT 01:21