Smart Contracts Explained: Basics, Uses, and Trends

When working with smart contracts, self‑executing code that lives on a blockchain and automatically enforces the terms of an agreement. Also known as contract automation, they replace trusted third parties with transparent, tamper‑proof execution. The core idea is simple: code + immutable ledger = trustless transactions. This smart contracts model reshapes how value moves online.

Why Smart Contracts Matter in Today’s Crypto Landscape

Smart contracts enable decentralized applications (dApps) by providing the programmable backbone that runs without a central server. In turn, blockchain, the underlying ledger, offers the immutable record that guarantees every contract action is visible and irreversible. This relationship forms a semantic triple: smart contracts ⟶ run on ⟶ blockchain; blockchain ⟶ stores ⟶ contract state; contract state ⟶ powers ⟶ dApps.

Beyond pure code execution, smart contracts shape tokenomics, the economic rules behind a token’s supply, distribution and incentives. By embedding token minting, burning or rebalancing logic directly into the contract, projects can enforce monetary policy without manual oversight. Tokenomics also feeds on‑chain governance, where holders vote on protocol upgrades through contract‑based proposals. The triple here is: tokenomics ⟶ defines ⟶ incentives; incentives ⟶ drive ⟶ governance participation; governance ⟶ updates ⟶ smart contracts.

Writing these contracts usually means using Solidity, the primary language on Ethereum and compatible chains. Solidity provides the syntax to express conditional logic, loops, and event emissions that the blockchain can interpret. A solid grasp of Solidity is essential because a single bug can lock millions of dollars, as past hacks have shown. Consequently, developers pair Solidity with rigorous security audits, formal verification tools and testnets before a contract goes live. This creates another triple: Solidity ⟶ powers ⟶ contract code; contract code ⟶ requires ⟶ security audits; audits ⟶ protect ⟶ user funds.

All these pieces—blockchain safety, dApp flexibility, tokenomics design, on‑chain governance and Solidity development—combine to make smart contracts a versatile tool for finance, gaming, supply chain and more. Below you’ll find a curated set of articles that dive deeper into each of these angles, from technical reviews of new platforms to practical guides on token economics and regulatory impacts. Ready to explore how smart contracts are changing the game? Continue scrolling to see the full collection.

- Feb, 22 2026

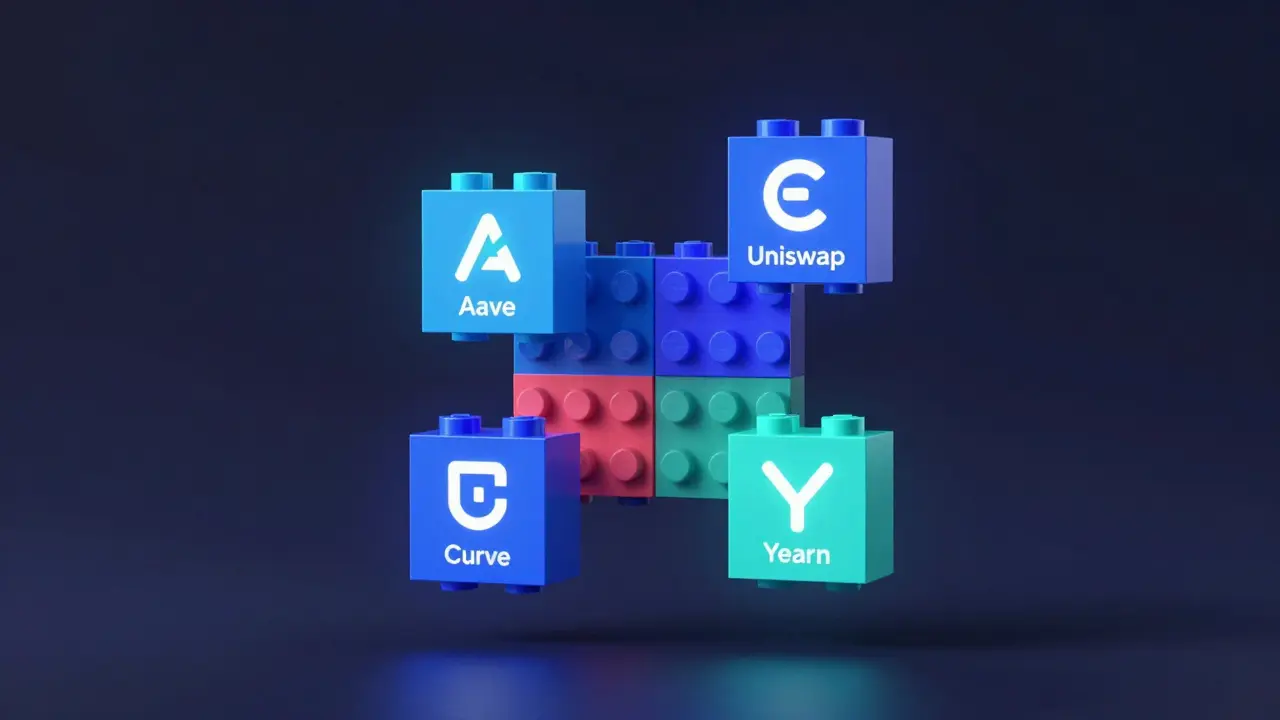

DeFi protocol composability lets financial apps work together like Lego blocks, unlocking faster innovation, better yields, and custom strategies - but also new risks. Here’s how it works and why it matters.

- Read More

- Oct, 14 2025