Benefits of DeFi Protocol Composability Explained

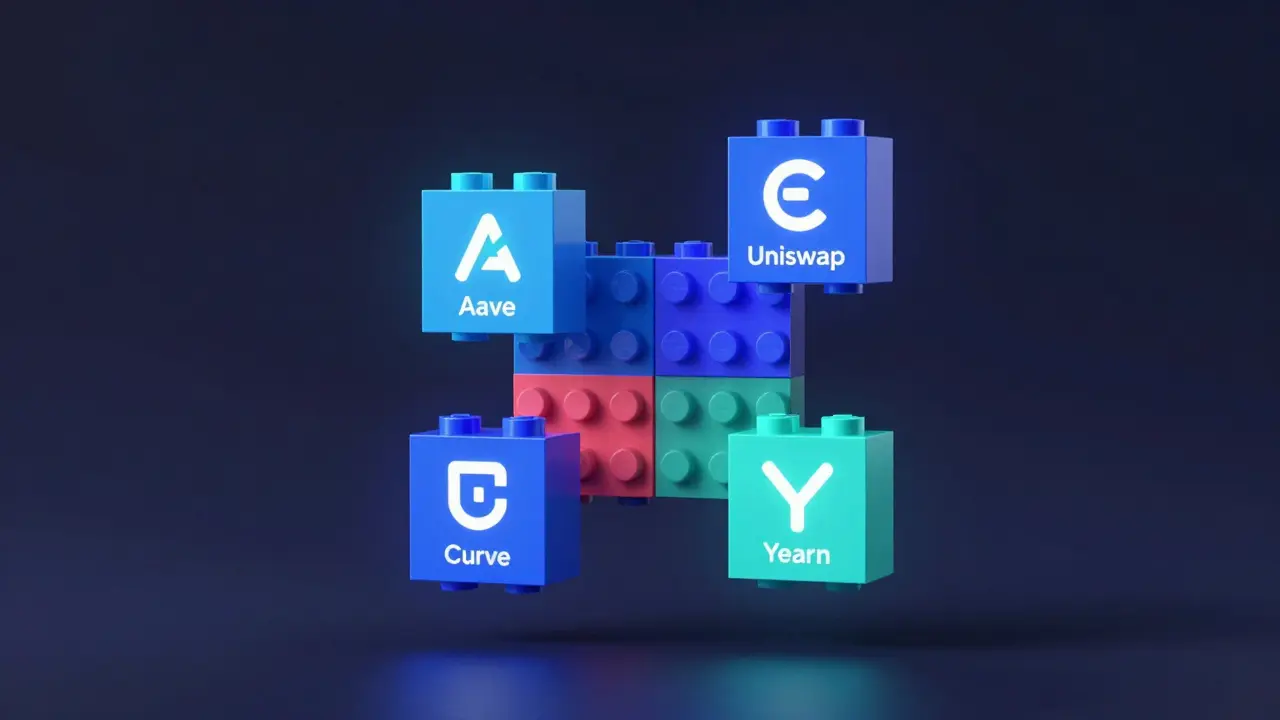

Imagine building a financial system out of Lego blocks. You don’t need to design every piece from scratch. You just grab what’s already made - a lending module, a swap tool, a yield aggregator - and snap them together. That’s DeFi protocol composability in action. It’s not just a buzzword. It’s the reason DeFi has exploded from simple token swaps into a full-stack financial ecosystem worth over $100 billion. And it’s changing how money works - forever.

What Exactly Is DeFi Composability?

DeFi composability means different decentralized finance protocols can talk to each other without asking for permission. No middlemen. No paperwork. No approval delays. If one smart contract can send and receive data, another can use it - like calling a function in a library. This isn’t just convenience. It’s a fundamental shift from how traditional finance operates.

Take ERC-20 tokens, for example. They’re the universal currency of DeFi. A token created on Uniswap works the same way on Aave, Compound, or a new yield optimizer you found on GitHub. Why? Because they all follow the same standard. That’s composability in action. It’s like every app on your phone uses the same charging cable - you don’t need a new one for every device.

How It Works: The Building Blocks

Three core pieces make composability possible:

- Smart contracts: These are self-executing programs on the blockchain. Once deployed, they run exactly as written. No human intervention. No hidden clauses. If a contract says, "Send 1 ETH to this address when conditions are met," it happens - no exceptions.

- Standardized APIs: Protocols expose clean interfaces so others can interact with them. Want to borrow against your crypto? Aave’s API lets any other app call its lending pool directly.

- Token standards (ERC-20, ERC-721): These are the glue. Whether it’s DAI, USDC, or a new stablecoin, if it follows ERC-20, any DeFi app can accept it. No need for custom integrations.

Combine these, and you get something wild: a user can deposit ETH into a liquidity pool on Curve, use the earned tokens as collateral on Aave to borrow DAI, then use that DAI to buy more ETH on Uniswap - all in one transaction. In traditional banking? That’d take days, multiple apps, and fees at every step.

The Real Benefits: Why This Matters

1. Faster Innovation

Developers don’t have to rebuild the wheel. Want to create a new yield strategy? Start with existing lending, swapping, and staking protocols. Your job isn’t to make a new wallet or a new exchange - it’s to connect them in a smarter way. That’s why new DeFi products launch in weeks, not years.

Take Yearn Finance. It doesn’t have its own lending engine. It just reads data from Aave, Compound, and others, then automatically moves your funds to the highest-yielding pool. That’s composability turning complexity into simplicity.

2. Better Capital Efficiency

In traditional finance, your money sits in one place - a savings account, a brokerage, a bank. In DeFi, it can be working 24/7 across multiple protocols. You can stake your tokens, use them as collateral, and earn yield from liquidity mining - all at once. No idle cash. No silos.

Example: A user deposits USDC into Aave, borrows DAI against it, then uses that DAI to provide liquidity on Uniswap. The same capital is earning yield from two sources simultaneously. In banking? That’s impossible.

3. Custom Financial Products

DeFi lets you build your own financial strategy. Want to hedge your ETH against price drops while earning interest? Combine a lending protocol with a perpetual futures contract on dYdX. No bank offers that. No broker lets you design it. But in DeFi? You can - and people do.

There are now dozens of "yield aggregators" that automatically optimize your returns across 10+ protocols. They exist because of composability. Without it, they’d be impossible to build.

4. Transparency and Auditability

Every smart contract is public. You can read the code. You can see exactly how it works. No black boxes. No fine print. If a protocol is risky, you can check the audit reports, review the code, and decide for yourself. That’s a level of control no traditional financial product gives you.

Compare that to a hedge fund. You don’t know what assets they hold. You don’t know how they’re leveraged. You just trust them. In DeFi? You verify.

Where It Gets Dangerous

Composability isn’t magic. It’s powerful - but it has a dark side.

When protocols are linked, a bug in one can ripple through others. Remember the 2022 Wormhole bridge exploit? A vulnerability in one contract let attackers drain $320 million. That money didn’t just vanish - it was moved through multiple DeFi apps before being laundered. One flaw. Hundreds of protocols affected.

Another risk? Over-leveraging. If you borrow against your collateral, then use that loan to buy more collateral, then borrow again… you’re stacking risk. One price drop can trigger a cascade of liquidations. That’s not a bug - it’s a feature of composability. And it’s why users need to understand how their strategies connect.

Experts agree: the more protocols you chain together, the more you need to audit each one. A 99% secure protocol becomes 96% secure when connected to another 99% secure one. It’s math. And it’s often ignored.

Who Benefits Most?

Developers? Absolutely. They get to build on top of giants instead of digging foundations. But everyday users benefit too.

If you’re a crypto holder, composability means your assets can work harder. You’re not just holding - you’re earning, lending, trading, hedging - all in one place.

If you’re a small business owner using crypto for payments? Composability could soon let you automatically convert crypto to fiat, pay suppliers, and reinvest profits - all without touching a bank.

Even regulators are watching. The ability to trace every transaction across protocols is a double-edged sword. It makes money laundering harder - but also makes oversight more complex.

What’s Next?

The next wave of DeFi won’t be standalone apps. It’ll be orchestras of protocols working in harmony.

Think: automated insurance that triggers payouts when a lending protocol’s collateral ratio drops. Or decentralized credit scores based on your borrowing history across 20+ platforms. Or a single wallet that manages your taxes, yields, and asset allocation - all automatically.

These aren’t sci-fi. They’re being built right now. And they only exist because of composability.

But here’s the catch: the more complex the system, the more you need to understand it. You can’t just throw money into a yield farm and hope for the best. You need to know what’s connected to what. You need to check audits. You need to track risks.

Composability doesn’t remove risk. It just moves it - and makes it visible. That’s the trade-off.

Final Thought

DeFi composability is the closest thing finance has ever had to an open-source revolution. It’s not about replacing banks. It’s about giving anyone the tools to build their own financial infrastructure - without asking permission.

That’s powerful. And dangerous. And inevitable.

The future of money isn’t centralized. It’s connected. And it’s built on legos.

What does DeFi protocol composability mean?

DeFi protocol composability means decentralized finance applications can interact with each other seamlessly without needing approval or intermediaries. Protocols like lending platforms, exchanges, and yield aggregators can be combined like building blocks, allowing users to create complex financial strategies using multiple services in a single transaction.

How does composability improve capital efficiency?

Composability lets the same crypto asset work across multiple protocols at once. For example, you can deposit ETH into a liquidity pool, use the earned tokens as collateral to borrow stablecoins, and then use those stablecoins to earn yield elsewhere - all in one go. In traditional finance, each step would require separate accounts, approvals, and fees, leaving capital idle.

Can composability cause financial risks?

Yes. Because protocols are interconnected, a bug or exploit in one can trigger cascading failures. For instance, a vulnerability in a lending protocol might cause liquidations across multiple platforms that rely on its price feeds. This systemic risk is why users must audit every protocol they interact with and avoid over-leveraging.

Do I need to be a developer to benefit from composability?

No. While developers build the connections, everyday users benefit through apps like Yearn Finance or Balancer that automatically combine protocols to maximize yields. You don’t need to code - but you do need to understand how your funds are being used across different services.

Why are token standards like ERC-20 important for composability?

ERC-20 and similar standards define how tokens behave on the blockchain. When all tokens follow the same rules, any DeFi app can accept them without custom integration. This universal compatibility is what lets a DAI token from one platform work seamlessly in a lending protocol, a swap, or a yield farm elsewhere.

What’s the biggest advantage of DeFi over traditional finance because of composability?

The biggest advantage is permissionless innovation. In traditional finance, creating a new financial product requires regulatory approval, bank partnerships, and years of development. In DeFi, a developer can combine existing protocols to launch a new service in days - with no one’s permission. That’s why DeFi evolves faster than any financial system in history.

George Suggs

February 22, 2026 AT 11:13