Smart Contracts & dApps: What’s Next in 2025 and Beyond

Smart Contract Gas Fee Calculator

Gas Fee Calculator

Calculate estimated gas costs for your smart contract deployment and execution based on Ethereum's current network conditions.

Estimated Costs

Deployment:

Execution:

Total:

Equivalent to:

Optimization Tips

Based on the article content, optimizing gas usage is critical for smart contracts to remain viable during network congestion. Consider:

- Using struct packing to reduce storage costs

- Optimizing loops and storage operations

- Implementing proxy patterns for upgrades

- Using ZK-rollups for bulk transactions

Key Takeaways

- AI‑driven smart contracts are turning dApps into autonomous decision‑makers.

- Cross‑chain communication and ZK‑rollups are solving scalability and fragmentation.

- Private blockchain and DAO structures are boosting enterprise adoption.

- Security audits, gas optimisation, and clear governance are now must‑haves.

- By 2034 the smart‑contract market could exceed $800billion, driven by finance, healthcare, gaming and supply‑chain use cases.

When you hear people talk about the future of smart contracts, they’re not just dreaming about code that moves money. They’re envisioning a whole new way for apps to run without a boss, without a middleman, and without the paperwork that slows everything down. This article walks you through where the technology stands today, what’s coming next, and how you can position yourself or your business to ride the wave.

What Exactly Is a Smart Contract?

Smart contracts are self‑executing protocols that automatically verify, enforce and settle the terms of an agreement on a blockchain, eliminating the need for a trusted third party. Think of them as tiny programs that live on a decentralized ledger, triggering actions as soon as predefined conditions are met. Because the code and the state are immutable, anyone can audit the logic before it runs.

Decentralized Applications (dApps) - The Bigger Picture

Decentralized applications (dApps) are software built on top of blockchain networks, using smart contracts for backend logic while providing a front‑end experience similar to traditional web or mobile apps. While a regular app talks to a central server, a dApp talks to a network of nodes, which means no single entity can shut it down or tamper with its data.

How AI is Redefining Smart Contracts

AI‑driven smart contracts integrate machine‑learning models that can analyze real‑time data streams, predict outcomes, and adjust contract parameters on the fly. For example, a DeFi lending contract could use AI to assess borrower risk based on recent transaction patterns, automatically altering interest rates before any human steps in. This shift moves contracts from static rule‑books to dynamic agents that learn and optimise.

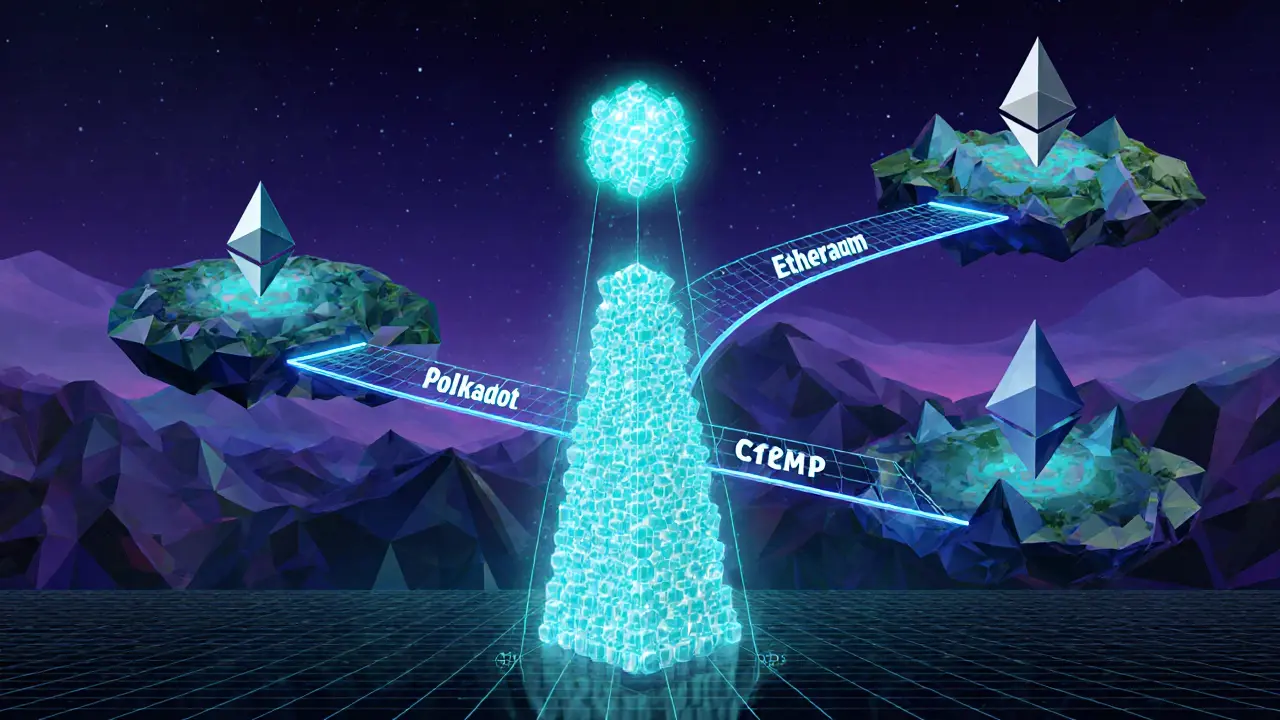

Cross‑Chain Interoperability - Breaking the Silos

Cross‑chain interoperability lets a smart contract on one blockchain call functions or read data from another chain without a trusted bridge. Projects like Cosmos IBC, Polkadot’s XCMP, and emerging “wormhole” protocols are turning the blockchain universe into a connected ecosystem. The benefit? Users no longer need to pick a single chain for every use case; assets and logic can hop where it makes sense.

Scalability Solutions: ZK‑Rollups and Split‑VMs

Two technical trends are powering the next level of throughput:

- ZK‑rollups bundle thousands of transactions off‑chain, generate a succinct zero‑knowledge proof, and submit that proof on‑chain for verification. This reduces gas fees dramatically while preserving security.

- AlkylVM (a split‑virtual‑machine architecture) separates the execution environment for resource‑constrained IoT devices from the main chain, enabling secure on‑chain interaction without overburdening the network.

Both approaches let dApps handle millions of users and sensor inputs without choking the underlying blockchain.

Private Blockchains and DAO Governance

Enterprises that need tighter access control are turning to private blockchain solutions, where participation is limited to vetted members. These networks deliver faster finality and lower transaction costs while preserving the auditability of public chains. Within these ecosystems, Decentralized Autonomous Organizations (DAOs) serve as code‑based governance layers. DAO members vote on proposals that trigger smart‑contract upgrades, fund allocations, or policy changes-all without a boardroom. The 2024 market share data shows DAOs leading the smart‑contract space, thanks to transparent operations and reduced administrative overhead.

Smart Contracts vs. Traditional Automation

Below is a quick side‑by‑side look at how smart contracts stack up against conventional automated systems and centralized applications.

| Aspect | Smart Contracts (dApps) | Traditional Automated Systems |

|---|---|---|

| Trust Model | Trustless - consensus‑based verification | Trust in a single provider or admin |

| Transparency | Publicly auditable code & state | Closed‑source or proprietary logic |

| Security | Cryptographic integrity, immutable ledger | Vulnerable to insider threats, data breaches |

| Cost | Eliminates intermediaries; gas fees only | Licensing, maintenance, third‑party fees |

| Scalability | Enhanced by ZK‑rollups, cross‑chain tech | Limited by central server capacity |

Real‑World Adoption and Pain Points

Across finance, gaming, supply chain and healthcare, early adopters are already reporting concrete wins:

- DeFi platforms have processed over $3trillion in lending and swaps without bank involvement.

- Gaming studios use NFTs and smart contracts to give players true ownership of in‑game assets, cutting royalty disputes.

- Supply‑chain consortia track provenance of goods from farm to shelf, reducing fraud by 40% in pilot studies.

- Healthcare pilots employ private‑blockchain smart contracts to share patient consent records, trimming administrative time by 30%.

Yet challenges remain. Security audits are expensive, and a single vulnerability can lead to multi‑million dollar losses. Legal frameworks are still catching up - regulators in many jurisdictions aren’t sure how to classify an autonomous contract that can enforce penalties without a human sign‑off. Developers also grapple with gas optimisation; inefficient code can make a contract unusable during network congestion.

Getting Started: From Idea to Live dApp

If you’re thinking about building a smart‑contract‑powered dApp, here’s a practical roadmap:

- Define the Business Logic. Write a plain‑language description of the agreement you want to automate. Identify inputs, triggers, and outcomes.

- Choose the Blockchain. Public chains (Ethereum, Polygon) give maximum reach, while private chains (Hyperledger Besu, Quorum) offer speed and confidentiality.

- Pick a Language. Solidity dominates the EVM world; Rust is gaining ground on Solana and Near. For AI‑enhanced contracts, consider hybrid designs where off‑chain AI services feed signed data onto‑chain.

- Prototype & Test. Use local testnets (Hardhat, Truffle) to iterate quickly. Simulate gas costs and run static analysis tools (Slither, MythX).

- Security Audit. Engage a third‑party firm for formal verification. Even if you’re on a private chain, an audit catches logic bugs before they become costly.

- Deploy & Monitor. Publish the bytecode, verify the source on block explorers, and set up alerting for abnormal activity (e.g., unusually high gas usage).

- Plan for Upgrades. Use proxy patterns or DAO‑governed upgrade modules so you can patch bugs without breaking existing state.

The whole process typically takes 3‑6months for a medium‑complexity contract, but the timeline can stretch if you’re integrating AI models or cross‑chain bridges.

The Road Ahead: 2025‑2034 Forecast

The market research numbers speak for themselves: $3.69billion in 2025, soaring to $815.86billion by 2034 - a CAGR north of 50%. What’s driving this explosion?

- AI‑Blockchain Fusion. Platforms like Ocean Protocol are already monetising data for AI training via smart contracts. Expect autonomous agents that negotiate compute power, data, and payments without human oversight.

- Metaverse & Gaming. Virtual worlds will rely on smart contracts for land ownership, asset leasing, and instant micropayments.

- Digital Identity. Self‑sovereign IDs (Polygon ID, Worldcoin) are built on zero‑knowledge proofs and smart contracts, streamlining KYC for finance and public services.

- Supply‑Chain 4.0. Real‑time IoT feeds will be validated by AlkylVM‑enabled contracts, unlocking auto‑settlement when goods meet temperature or location thresholds.

- Regulatory Acceptance. As governments adopt blockchain‑based credential verification, they’ll mandate smart‑contract‑based audit trails for high‑value transactions.

In short, smart contracts are moving from niche code snippets to the operating system of the decentralized internet.

Key Risks to Keep on Your Radar

- Code Inflexibility. Once deployed, a contract is immutable unless you build upgrade mechanisms.

- Gas Volatility. Sudden spikes can render a contract too expensive to use.

- Legal Uncertainty. Jurisdictions differ on enforceability and liability.

- Interoperability Bugs. Cross‑chain bridges have been hacked; rigorous audits are essential.

- AI Model Drift. Off‑chain AI predictions can become stale; you need a process to retrain and re‑sign data.

Next Steps for Builders and Decision‑Makers

Whether you’re a developer, CTO, or investor, here’s how to act now:

- Start a small pilot - perhaps a token‑gated loyalty program on a testnet.

- Allocate budget for a professional security audit early in the project.

- Join a developer community (Ethereum Discord, Polkadot Forum) to stay on top of bridge updates.

- Map regulatory requirements for your target market - consider engaging a legal tech specialist.

- Experiment with AI‑as‑a‑service providers that offer signed data feeds (e.g., Chainlink Functions).

By iterating quickly and hardening security from day one, you position your dApp to capture value as the ecosystem matures.

Frequently Asked Questions

What is the biggest advantage of using smart contracts over traditional databases?

Smart contracts store state on a tamper‑proof ledger, making every change publicly auditable and irreversible. Traditional databases rely on a central authority, which can alter data or be compromised without a trace.

How do AI‑driven contracts get real‑time data safely?

They use oracle networks that cryptographically sign off‑chain data (like price feeds or sensor readings). The signed payload is then verified on‑chain before the AI model can act on it.

Can I run a smart contract on a private blockchain and still interact with public chains?

Yes. Cross‑chain bridges or relay protocols let private‑chain contracts call functions on public networks, enabling hybrid workflows that keep sensitive data private while still leveraging public liquidity.

What are the main cost factors when deploying a smart contract?

Gas fees for contract deployment, execution cost for each transaction, and any fees charged by oracle or bridge services. Optimising bytecode and using layer‑2 solutions can dramatically cut these expenses.

How do DAOs govern upgrades to smart contracts?

Members propose an upgrade, vote using token‑based or reputation‑based mechanisms, and if approved, a predefined proxy contract routes calls to the new implementation. The process is transparent and stored on‑chain.

Ben Johnson

October 15, 2025 AT 08:19Oh great, another endless list of buzzwords about AI and rollups. Like we needed another hype cycle.

Jason Clark

October 25, 2025 AT 18:19While the article enumerates potential use‑cases, it glosses over the practical limitations of cross‑chain bridges, which remain fragile and expensive.

Steve Cabe

November 5, 2025 AT 03:19Look, the United States has always led in tech innovation, and anyone trying to claim otherwise is just jealous. The push for AI‑driven contracts is a natural evolution, not a fad. If you’re not on board, you’re already falling behind. That’s the reality.

shirley morales

November 15, 2025 AT 13:19The prose drips with self‑importance; substance is noticeably absent.

Mandy Hawks

November 25, 2025 AT 23:19One might ponder whether a contract that can modify itself truly retains the notion of trust, or merely reshapes it into a new philosophical framework.

Scott G

December 6, 2025 AT 09:19It is imperative to consider both the technical specifications and the broader legal implications when deploying autonomous agreements; thorough due diligence ensures compliance across jurisdictions.

VEL MURUGAN

December 16, 2025 AT 19:19Your optimism about ZK‑rollups is refreshing, but remember that not every rollup lives up to the promised latency and cost savings; rigorous testing on testnets is essential.

Russel Sayson

December 27, 2025 AT 05:19When I first read about AI‑augmented smart contracts, I imagined a seamless future where code and cognition co‑evolve.

What actually transpires is a series of incremental steps, each fraught with technical and regulatory challenges.

First, data integrity must be guaranteed; an oracle feeding corrupted information will break the entire premise.

Second, the cost of on‑chain verification of AI outputs can be prohibitive, demanding clever off‑chain computation proofs.

Third, governance models need to accommodate dynamic updates without compromising decentralization.

Fourth, developers must reconcile the deterministic nature of blockchains with the probabilistic outputs of machine‑learning models.

Fifth, security audits now have to encompass not only contract code but also the surrounding AI pipelines.

Sixth, user experience suffers when transaction fees spike during network congestion, deterring adoption.

Seventh, cross‑chain bridges introduce additional attack vectors that must be hardened.

Eighth, legal frameworks lag behind, leaving practitioners vulnerable to uncertain liability.

Ninth, the market’s appetite for token‑incentivized AI services can inflate valuations beyond sustainable levels.

Tenth, community trust is eroded each time a high‑profile exploit occurs.

Eleventh, the environmental footprint of training large models adds ethical concerns to the equation.

Twelfth, standards for model provenance and reproducibility are still nascent.

Thirteenth, integrating privacy‑preserving techniques like homomorphic encryption remains computationally expensive.

Fourteenth, the talent shortage in both blockchain and AI domains hampers rapid development.

Fifteenth, despite these hurdles, pilot projects in supply‑chain verification and dynamic insurance underwriting are already demonstrating tangible value.

In summary, the convergence of AI and smart contracts is a marathon, not a sprint, and success will belong to those who navigate both technical and regulatory landscapes with patience and rigor.

Matthew Homewood

January 6, 2026 AT 15:19Contemplating the ethical dimensions of autonomous contracts invites a quiet, necessary dialogue.

Luke L

January 17, 2026 AT 01:19Honestly, the article pretends to be progressive while ignoring the fact that most of these solutions are designed by Western tech giants to dominate the global market.

Jennifer Bursey

January 27, 2026 AT 11:19From a cultural integration standpoint, the interoperability frameworks could act as lingua francas for cross‑border decentralized economies, unlocking unprecedented synergies.

Maureen Ruiz-Sundstrom

February 6, 2026 AT 21:19Sure, the piece lists a bunch of trends, but it feels like a lazy drop‑the‑mic summary without any real critical insight.

Kevin Duffy

February 17, 2026 AT 07:19Nice stuff! 😊

DeAnna Greenhaw

February 27, 2026 AT 17:19While the enumerated prospects are undoubtedly fascinating, the narrative invariably succumbs to a veneer of elitist gratuitousness, sacrificing technical precision on the altar of grandiosity.