July 2025 Market Pulse 11 Archive

When you open the Market Pulse 11 July 2025 Archive, a curated collection of real‑time crypto and stock market insights published throughout July 2025. Also known as July 2025 market pulse, it gives traders a snapshot of what moved markets last month, from Bitcoin swings to earnings surprises.

The archive encompasses cryptocurrency analysis, deep dives into price trends, on‑chain activity, and blockchain developments and stock market insights, breakdowns of equity performance, sector rotation, and index movements. Both sections on‑chain metrics, data points like transaction volume, active addresses, and miner revenue and earnings updates, company reports, revenue beats, and forward guidance rely on real‑time data feeds. The result is a toolkit that helps you spot trends, validate strategies, and act before the next wave hits.

Why this month matters for traders

July 2025 saw a cascade of macro signals – a surprise interest‑rate forecast, shifting commodities prices, and a global regulatory tweak on stablecoins. Those macro forces influence market sentiment, pushing risk‑on assets up while safe‑haven flows dip. By stitching those signals into crypto and equity narratives, the archive shows how a single policy move can ripple from Bitcoin to biotech stocks. It also highlights the tools you need: our live watchlists let you follow high‑volatility coins, while screeners filter stocks with earnings surprises above 10%.

If you’re a long‑term investor, the July files give you a sense of where fundamentals are heading. For example, the on‑chain metrics section flagged a steady rise in Ethereum active addresses, hinting at growing dApp usage. Meanwhile, earnings updates revealed that several AI‑focused firms beat expectations, suggesting a broader tech tailwind. Putting those pieces together helps you decide whether to tilt toward growth or defensive plays in the coming quarter.

On the practical side, each article in the archive embeds easy‑to‑read charts, downloadable CSVs, and a quick “actionable takeaways” box. That structure requires clear data visualization, so readers can spot patterns without wading through raw numbers. Whether you skim the headlines or deep‑dive into the methodology, you’ll walk away with a concrete idea you can test in your own portfolio.

Beyond the numbers, the July collection also touches on education. A few pieces walk through how to interpret on‑chain metrics, from hash rate trends to gas fees, and explain why those signals matter for price action. Others break down quarterly earnings jargon, helping you read between the lines of the income statement. This educational angle ensures that both newbies and seasoned traders find something useful.

In short, the July 2025 archive is a one‑stop shop for anyone who wants to stay ahead of the curve. You’ll find crypto price analysis, equity sector reports, macro‑economic context, and hands‑on tools all woven into a single, searchable feed. The next section below lists every article published in July, so you can jump straight to the topic that matters most to you.

Ready to dig into the data? Browse the posts below and start turning these insights into your next winning trade.

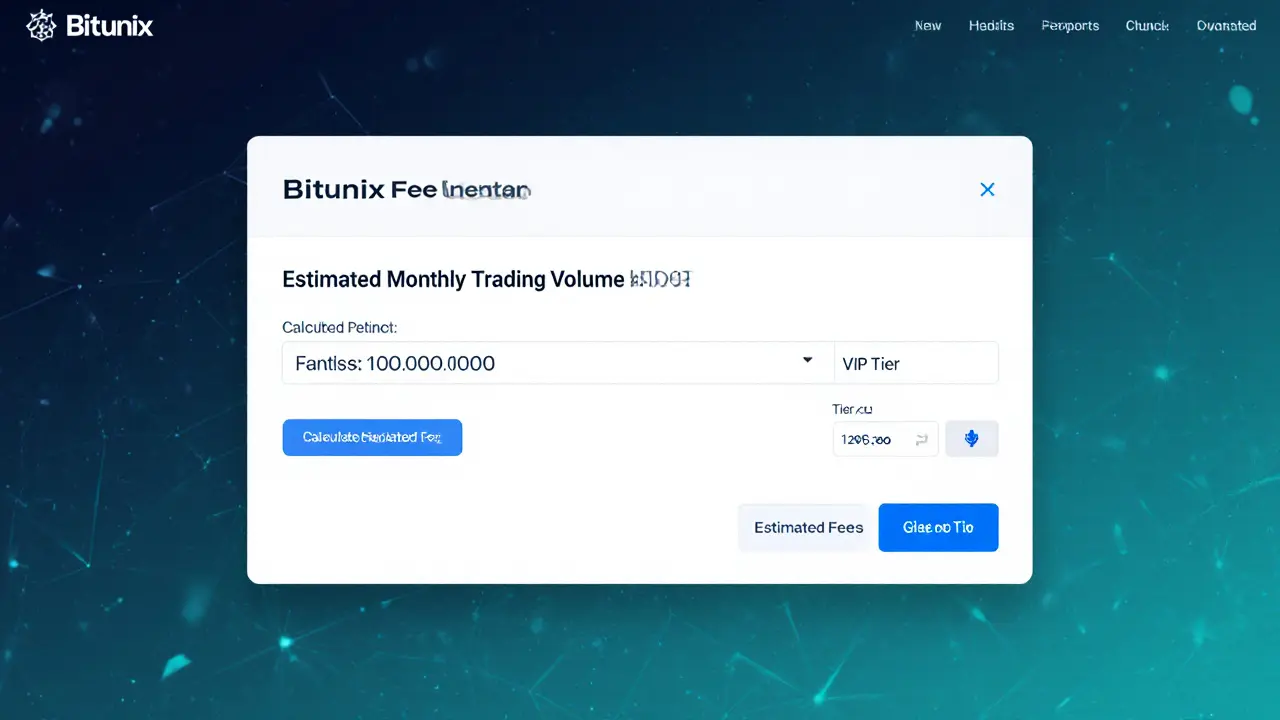

An in‑depth 2025 review of Bitunix crypto exchange covering its features, fees, security, and how it stacks up against Binance, Bybit and OKX.

- Read More