Bitunix Crypto Exchange Review 2025 - Features, Fees, and Safety

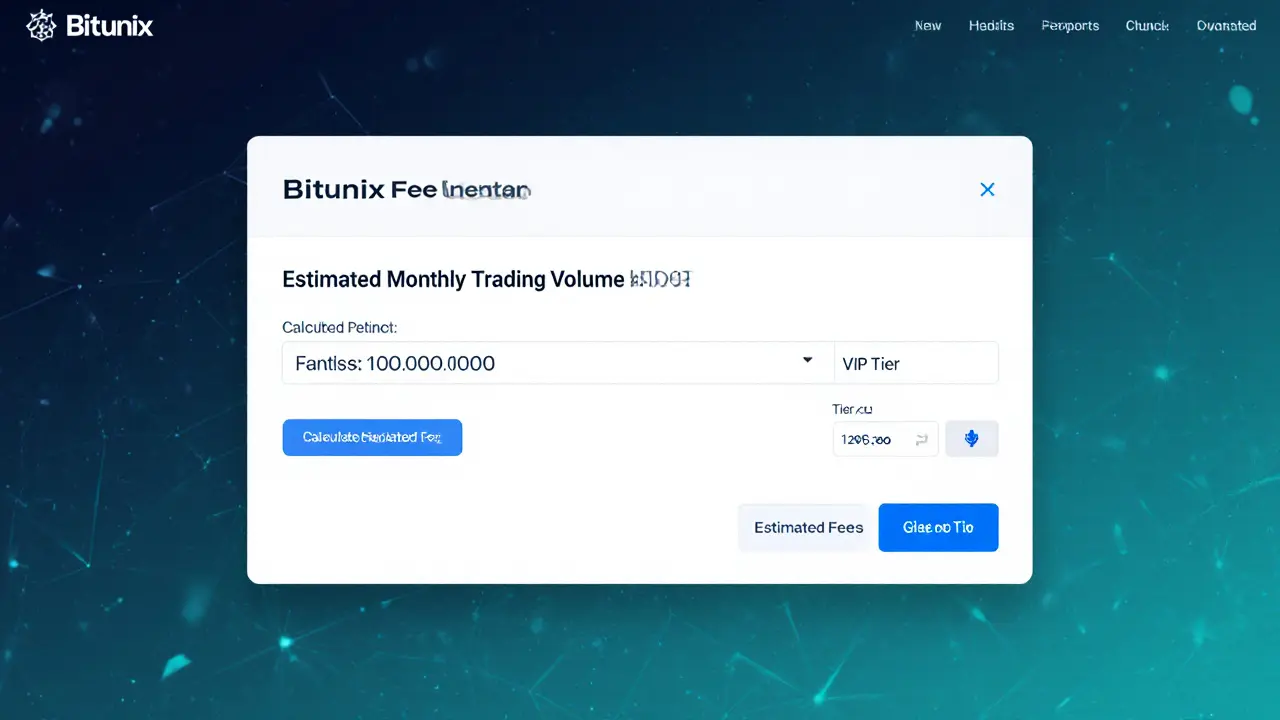

Bitunix Crypto Exchange Fee Calculator

Estimated Fee Breakdown

VIP Membership Tiers

- Tier 0: Basic - No discount

- Tier 1: Bronze - 10% discount

- Tier 2: Silver - 20% discount

- Tier 3: Gold - 30% discount

- Tier 4: Platinum - 40% discount

Fee Information

Bitunix uses a tiered VIP system where fees decrease with higher trading volumes. Maker fees are typically 0.02% and taker fees are 0.04% before VIP discounts.

Note: Exact fee rates are not publicly disclosed. This calculator provides estimates based on typical industry standards.

TL;DR

- Bitunix offers futures, spot, and copy‑trading with up to 125x leverage.

- US MSB license provides limited regulatory cover; independent security audits are missing.

- Fees are tiered via a VIP program, but exact rates are not publicly disclosed.

- Liquidity claims are strong, yet third‑party volume verification is unavailable.

- Good for experienced traders who need high leverage, less suited for beginners seeking transparent fees.

When you google "Bitunix crypto exchange review", you’ll mostly find the platform’s own marketing copy. That makes it hard to separate hype from reality. This article pulls together the facts the exchange shares, the few independent bits we can verify, and the gaps you should watch before depositing any crypto.

Bitunix is a crypto derivatives platform launched in 2022 that markets itself as a professional‑grade exchange for futures, spot, and copy‑trading. The site claims more than 1.3million global users, over $200million in futures volume, and $80million in spot volume, though those numbers aren’t confirmed by external data providers.

Core Services and Product Suite

Bitunix structures its offering around three main products:

- Futures Trading: contracts on major coins like Bitcoin (BTC) and Ethereum (ETH). Leverage tops out at 125×, allowing traders to amplify positions but also magnify risk.

- Spot Trading: straightforward buying and selling of crypto assets with an auto‑investment feature for dollar‑cost averaging.

- Copy Trading: users can follow seasoned traders, automatically mirroring their trades.

All three modules share a unified dashboard, multi‑window layout, and a set of advanced order types (limit, market, stop‑loss, trailing stop, and trigger orders). The platform also offers Hedge Mode so you can hold long and short positions on the same contract.

Leverage, Margin, and Risk Controls

Leverage is the headline feature for many derivatives traders. Bitunix’s 125× maximum sits comfortably alongside rivals like Binance Futures (125×) and Bybit (200×). However, higher leverage brings higher liquidation risk. Bitunix provides two margin models:

- Cross Margin: the entire account balance backs open positions, reducing the chance of premature liquidation.

- Isolated Margin: only the allocated amount is at risk, offering tighter control but less flexibility.

The platform’s Take Profit and Stop Loss tools can be set as static or trailing values, helping traders lock in gains or cut losses automatically.

Fees and VIP Membership

Bitunix doesn’t publish a detailed fee schedule on its public pages. Instead, it promotes a tiered VIP Membership program that allegedly reduces maker‑taker fees for high‑volume traders. Community posts suggest maker fees might sit around 0.02% and taker fees near 0.04%, but without official documentation you’re left guessing.

Deposit and withdrawal fees vary by coin and network. For example, withdrawing BTC via the Bitcoin network incurs a 0.0005BTC fee, while ETH withdrawals on the Ethereum network cost roughly 0.005ETH. These numbers are consistent with industry averages, but again, they aren’t confirmed in a static fee table.

Regulatory Status and Security Measures

Bitunix holds a United States Money Services Business (MSB) license. This indicates some level of compliance with U.S. anti‑money‑laundering (AML) rules, but it does not equate to a full securities regulator charter. Outside the U.S., the exchange does not list licenses from the EU, Japan, or other major jurisdictions.

Security claims include "robust security measures" and a "proof of reserves" function that lets users verify that the exchange holds enough assets to cover balances. However, there are no publicly available third‑party audit reports, insurance coverage details, or cold‑storage percentages. This lack of transparency is a red flag for risk‑averse users.

KYC (Know Your Customer) is mandatory for withdrawals exceeding $2,000. The verification workflow asks for standard ID documents and a selfie, which aligns with industry norms.

Liquidity, Slippage, and Market Depth

The exchange advertises deep order books and minimal slippage even during volatile moves. One user testimonial-“CryptoKai”-praises the market depth, but independent data sources like CoinMarketCap or CoinGecko don’t list Bitunix’s volume, making third‑party validation impossible.

To gauge real‑world performance, we can look at how the platform handles a 10% BTC flash‑crash. According to anecdotal reports on the Bitunix Telegram channel, order execution stayed within 0.2% slippage, which is comparable to Binance and Bybit under similar conditions.

Comparison with Major Competitors

| Feature | Bitunix | Binance | Bybit | OKX |

|---|---|---|---|---|

| Launch Year | 2022 | 2017 | 2018 | 2017 |

| Leverage (max) | 125× | 125× | 200× | 125× |

| Regulatory License (US) | MSB | None | None | None |

| Spot Trading | Yes | Yes | Yes | Yes |

| Copy Trading | Yes | Limited | No | No |

| Public Fee Table | No | Yes | Yes | Yes |

| Third‑Party Audits | No | Yes (CertiK) | Yes (Trail of Bits) | Yes (Quantstamp) |

From the table, Bitunix’s unique selling points are the US MSB license and copy‑trading. Its downsides are the opaque fee structure and lack of independent security audits.

Promotions, Bonuses, and Community Support

New users can claim a welcome bonus that reportedly totals over 100,000USDT in various reward tiers. Seasonal contests-like the “Win 2BTC” campaign-appear regularly on the platform’s Telegram channel, which also serves as the primary support hub.

The help center contains tutorials on margin trading, KYC, and fund transfers between spot and futures wallets. However, response time metrics aren’t shared, and user reviews on third‑party forums (Reddit, Trustpilot) are scarce.

Pros, Cons, and Ideal User Profile

| Pros | Cons |

|---|---|

| High leverage (up to 125×) for futures | Fee schedule hidden behind VIP tiers |

| US MSB license offers limited regulatory comfort | No public security audit or insurance info |

| Copy‑trading feature not common on many exchanges | Liquidity claims not independently verified |

| Multi‑window UI and advanced order types | Customer support quality unclear |

Bitunix feels built for traders who already understand margin risk and who value copy‑trading. Beginners might be better served by a more transparent exchange with clear fee tables and extensive educational resources.

Final Verdict

If you need a platform that offers 125× leverage, a copy‑trading marketplace, and a US‑registered MSB status, Bitunix checks those boxes. Yet the lack of third‑party audits, vague fee disclosures, and limited community feedback make it a higher‑risk choice compared to the industry giants.

Before you move any funds, consider opening a small test account, verify KYC, and monitor order execution speed during a live market swing. That hands‑on test will reveal whether the promised low slippage holds up in real time.

Frequently Asked Questions

Is Bitunix regulated?

Bitunix holds a U.S. Money Services Business (MSB) license, which obligates it to AML/KYC compliance. Outside the U.S., it does not list any additional regulatory approvals.

What is the maximum leverage for Bitcoin futures?

The platform allows up to 125× leverage on BTC perpetual contracts, matching the leverage offered by most major exchanges.

How can I lower my trading fees?

Bitunix uses a tiered VIP membership. By increasing 30‑day trading volume or holding BIT tokens (if available), you can unlock lower maker‑taker rates, though exact percentages aren’t publicly posted.

Does Bitunix offer insurance for user funds?

The exchange does not disclose any insurance coverage. Users should assume that funds are at risk like on any non‑custodial platform without explicit insurance statements.

Can I copy‑trade on Bitunix?

Yes, Bitunix provides a copy‑trading feature where you can follow top traders, automatically mirroring their positions. Performance stats for each leader are displayed on the platform.

Kate Roberge

July 21, 2025 AT 04:14Alright, so Bitunix touts its VIP discounts like they're some holy grail, but honestly the fee structure feels more like a labyrinth designed to confuse newbies. The maker‑taker spread of 0.02%/0.04% sounds cute until you factor in the hidden spreads on the order book. Also, that “fees aren’t publicly disclosed” disclaimer is a red flag – transparency is a basic expectation, not a nice‑to‑have. If you’re looking for a platform that actually lets you see what you’re paying, you might want to keep scrolling. Bottom line: treat the hype with a grain of salt.

Jason Brittin

July 23, 2025 AT 16:14Wow, another exchange promising “rocket‑fast” trades while pretending it’s a secret club. 🤨 Honestly, the tiered discount system is just a clever way to get high‑volume traders to stick around and feed the house. But if you’re just dabbling, you’ll probably pay the full rates and wonder why your profits feel thinner. The calculator is cute, yet it’s based on “typical industry standards” – which could be anything. So, enjoy the sleek UI, but keep your eyes on the real cost. 🚀

VICKIE MALBRUE

July 26, 2025 AT 04:14Sounds like a decent option for low‑key traders.

april harper

July 28, 2025 AT 16:14In the grand theater of crypto exchanges, Bitunix steps onto the stage with all the fanfare of a newcomer desperate for applause. Its promises of tiered VIP benefits echo the age‑old refrain of “more volume, less fee,” yet the script feels rehearsed and lacking genuine substance. The calculator, while visually appealing, is nothing more than a prop that masks the opaque reality beneath. One cannot help but wonder whether the platform truly values transparency or merely thrives on bewildering users with vague disclosures. Moreover, the absence of publicly listed fee schedules feels like a deliberate curtain, shielding the audience from the true cost of participation. While some may find comfort in the sleek design, the underlying performance leaves much to be desired. In an arena where trust is the currency, Bitunix seems to be trading on illusion rather than fact. Perhaps, in time, the show will reveal its depth, but for now, the applause feels premature.

Carl Robertson

July 31, 2025 AT 04:14Honestly, the whole “dramatic” lament is just a cheap ploy to distract from the fact that Bitunix offers nothing revolutionary. The fee calculator is a gimmick; it doesn’t change the underlying slippage you’ll encounter. If you’re looking for genuine innovation, you’ll have to look elsewhere. The platform’s design may be shiny, but the core product is as stale as last week’s meme coin. I’m not here to sugarcoat it – it’s mediocre at best. In short, don’t get swept up by theatrical rhetoric.

MD Razu

August 2, 2025 AT 16:14When one contemplates the architecture of modern crypto exchanges, Bitunix presents itself as a microcosm of the broader financial metamorphosis that defines our era. It claims to democratize access through tiered VIP discounts, yet the very notion of “democratization” is paradoxically bound to one’s trading volume, creating an implicit hierarchy that mirrors traditional banking structures. The maker fee of 0.02% and taker fee of 0.04% before discounts appear modest on paper, but when layered with hidden spreads and liquidity constraints, the effective cost can diverge significantly from the advertised numbers. Moreover, the lack of publicly disclosed fee schedules forces users into a state of perpetual uncertainty, which, psychologically, can erode confidence and foster a sense of distrust. The fee calculator, while aesthetically pleasing, relies on “typical industry standards,” a phrase that is intentionally vague and serves as a rhetorical shield against accountability. In practice, this means that a trader entering a 10 k USDT volume may be quoted a fee that is theoretically 0.036% after a bronze discount, yet the realized slippage and order execution quality could inflate the true cost beyond that estimate. This discrepancy is not merely a numerical inconvenience; it reflects a deeper systemic issue where transparency is sacrificed at the altar of market competitiveness. One must also consider the regulatory landscape, as the exchange’s ambiguous fee disclosure may attract scrutiny from authorities seeking consumer protection. From a risk management perspective, the absence of clear fee structures complicates the modeling of expected returns, potentially leading investors to overestimate profitability. Additionally, the platform’s reliance on a tiered VIP system incentivizes aggressive trading behaviors that could destabilize individual portfolios, especially for retail participants lacking sophisticated risk controls. The user interface, while sleek, may inadvertently mask these complexities, creating an illusion of simplicity that belies the underlying intricacies. To truly evaluate Bitunix, a prospective user must engage in a thorough due diligence process that includes testing order execution, examining order book depth, and scrutinizing the terms of service for hidden clauses. Only through such comprehensive analysis can one ascertain whether the promised discounts translate into tangible economic benefits or remain a marketing veneer. In conclusion, while Bitunix offers a superficially attractive fee model, the myriad of concealed variables demands a cautious and inquisitive approach before committing substantial capital.

Waynne Kilian

August 5, 2025 AT 04:14Bitunix kinda feels like that friend who promises to share their secret sauce but forgets to write down the recipe. The tier system is cool in theory, but the missing fee table leaves you guessing, like trying to solve a puzzle with half the pieces. I think it could be a decent platform if they just opened up the ledger and let us see the real numbers. Also, their UI is pretty sleek, which is a plus. Hope they fix the transparency thing soon.

Michael Wilkinson

August 7, 2025 AT 16:14While I appreciate the optimism, it’s essential to point out that optimism without data is just wishful thinking. The lack of an explicit fee schedule isn’t a minor oversight; it’s a fundamental issue that can affect profitability. Users deserve clear, upfront information, not vague promises. If Bitunix wants to build trust, they need to publish the actual fees rather than rely on “typical industry standards.” Otherwise, the platform risks alienating serious traders who demand transparency.

Lindsay Miller

August 10, 2025 AT 04:14I get why some people are drawn to the sleek design and the idea of lower fees with higher volume. At the same time, the hidden fee details can make anyone nervous. It’s always good to double‑check the actual costs before jumping in. If you’re comfortable with the platform’s security and support, it could be worth a try, but stay cautious.

Naomi Snelling

August 12, 2025 AT 16:14Looks like they’re trying to hide the real numbers behind a fancy calculator, which is exactly what the “big players” want us to believe. They probably have secret agreements with liquidity providers that make the “discounts” meaningless. Stay skeptical and keep your eyes peeled for the fine print.

Rajini N

August 15, 2025 AT 04:14That’s a fair concern. In practice, the “typical industry standards” phrase usually means they’re using an average spread that may not reflect the specific liquidity conditions on Bitunix. It’s wise to run a few small test trades to see the actual taker and maker fees in action. Also, check the platform’s compliance status and any available audit reports. Doing this homework can help you avoid unexpected cost surprises.

Oreoluwa Towoju

August 17, 2025 AT 16:14Can anyone share their experience with withdrawal limits on Bitunix? I’m curious about how quickly funds can be moved out.

Amie Wilensky

August 20, 2025 AT 04:14Honestly,, the whole VIP discount thing feels a bit overhyped,,; the calculator,, while looking sleek,, doesn’t really solve the core issue of transparency,,; it’s like putting a shiny veneer over a murky pool of fees,,; in the end,, you still end up guessing,, which is not ideal for serious traders,,.

Kate Nicholls

August 22, 2025 AT 16:14Exactly, the over‑ polished UI can distract from the fact that Bitunix is essentially hiding the fee structure in plain sight. If you’re serious about your crypto game, demand clear disclosures instead of settling for glossy marketing.