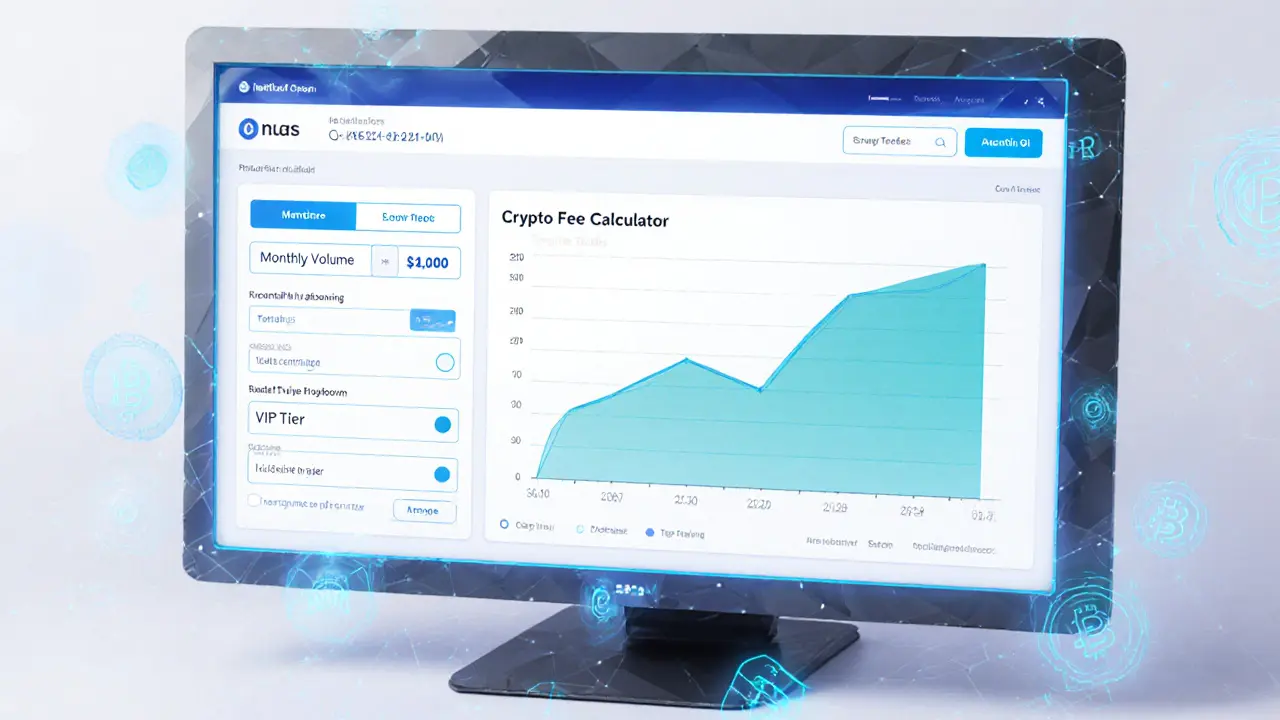

DA.SG Exchange Review 2025: Fees, Security & Features

DA.SG Exchange Fee Calculator

Estimated Monthly Trading Costs

Total Estimated Fees: $0.00

Average Fee per Trade: $0.00

Maker Fee Rate: 0.05%

Taker Fee Rate: 0.10%

Maker Fee

0.05% (0.02% for VIP tiers)

Earned when placing limit orders that get filled

Taker Fee

0.10% (0.05% for VIP tiers)

Paid when executing market orders

VIP Benefits

Fees drop to 0.02% maker / 0.05% taker

For users trading over $500K/month

When you start hunting for a new crypto platform, the first thing you ask yourself is: can I trust it with my money? DA.SG exchange review tackles that exact question, breaking down what DA.SG actually offers, where it shines, and where you might want to look elsewhere.

What Is DA.SG?

DA.SG is a cryptocurrency exchange that claims to provide fast, low‑cost trading for both retail and institutional users. Launched in 2022, the platform sits under a Singapore‑registered company, though detailed corporate information remains thin on the web.

The exchange supports a standard set of major assets-Bitcoin, Ethereum, USDT, BNB, and a handful of DeFi tokens-while also offering a modest selection of newer altcoins. Its website sports a clean, dark‑mode UI that resembles many of the industry’s big players.

Key Features Overview

- Spot Trading: Instant buy/sell on over 50 pairs.

- Futures: Limited to BTC and ETH with 5× leverage.

- Staking: Earn up to 7% APY on select tokens.

- Mobile App (iOS & Android): Full trading suite on the go.

- API Access: REST endpoints for bots and algo traders.

While the feature list feels familiar, the real test is how well each element is executed. Below we dig into the specifics.

Security Measures

Security is non‑negotiable for any exchange. DA.SG claims a three‑layer approach:

- Cold‑wallet storage for 95% of user funds, with daily audits by a third‑party custodian.

- Two‑Factor Authentication (2FA) via authenticator apps; SMS 2FA is optional but discouraged.

- KYC/AML compliance powered by a regulated identity verification service based in Singapore.

The platform also offers IP‑whitelisting for API keys and device‑recognition alerts. However, there is no public bug bounty program, and the exchange has not disclosed any security audits by major firms such as CertiK or Trail of Bits. For risk‑averse users, that lack of third‑party validation is a red flag.

Fees and Pricing

DA.SG positions itself as a low‑fee alternative. Its fee schedule looks like this:

- Maker fee: 0.05% (drops to 0.02% for VIP tiers).

- Taker fee: 0.10% (drops to 0.05% for VIP tiers).

- Deposit fees: Free for most major crypto, fiat deposits via bank transfer incur a 1% surcharge.

- Withdrawal fees: Fixed network fees (e.g., 0.0005 BTC, 5 USDT) plus a 0.2% platform surcharge.

Compared with Binance’s 0.10% taker fee and Coinbase’s 0.50% base fee, DA.SG is competitive on the maker side but not dramatically cheaper on taker trades. The real cost‑saving comes from its tiered VIP program-users who trade over $500k monthly can see fees dip below 0.02%.

Liquidity and Trading Options

Liquidity is the lifeblood of any exchange. DA.SG aggregates order flow from several regional liquidity providers, resulting in average spreads of 0.3% on BTC/USDT and 0.5% on smaller altcoins. While these numbers are respectable for a nascent platform, they lag behind the sub‑0.1% spreads you’d see on Binance.

Beyond spot, the futures offering is limited to BTC and ETH contracts with a maximum of 5× leverage-far less aggressive than the 125× leverage on platforms like Bybit. For most everyday traders, DA.SG’s liquidity and product depth are adequate, but high‑frequency or margin‑heavy users may find it restricting.

User Experience & Mobile App

The web UI loads in under two seconds on a typical 4G connection and features a customizable dashboard where you can pin favorite pairs, watchlists, and recent trades. The charting tools integrate TradingView widgets, giving you access to over 100 technical indicators.

The mobile app mirrors the desktop experience closely. It supports push notifications for price alerts, order fills, and security events. Users frequently praise the app’s intuitive navigation but note occasional syncing delays when switching between devices.

Regulatory Status and Compliance

DA.SG is registered as a financial services company in Singapore under the Monetary Authority of Singapore (MAS) fintech sandbox. This gives it a veneer of legitimacy, but the exchange does not hold a full MAS licence for digital token services. Consequently, it cannot publicly advertise to Singapore residents, limiting its user base to “international” customers.

On the AML front, the platform enforces a standard KYC flow: passport or national ID scan, selfie verification, and proof of address. Users from high‑risk jurisdictions (e.g., Iran, North Korea) are blocked outright.

Because the exchange is not fully regulated, funds are not covered by any compensation scheme. Traders should treat DA.SG as a custodial service and consider moving large holdings to self‑custody wallets.

Pros, Cons & Bottom Line

| Feature | DA.SG | Binance | Coinbase |

|---|---|---|---|

| Spot Trading Pairs | 50+ | 1,200+ | 250+ |

| Maker Fee (Base) | 0.05% | 0.02% | 0.50% |

| Taker Fee (Base) | 0.10% | 0.04% | 0.50% |

| Leverage Options | Up to 5× (BTC/ETH) | Up to 125× (multiple assets) | No native leverage |

| Regulatory Standing | MAS‑sandbox entity (not full licence) | Registered in Cayman, no major regulator | US‑based, regulated in 30+ states |

| Security Audits | Internal audit only | Third‑party audits (CertiK) | Third‑party audits (SOC‑2) |

Pros:

- Low maker fees, attractive VIP tier discounts.

- Clean UI and solid mobile app experience.

- Cold‑wallet majority storage and 2FA support.

- Basic KYC aligns with global AML standards.

Cons:

- Limited liquidity compared with top‑tier exchanges.

- No publicly disclosed third‑party security audits.

- Futures product line is narrow.

- Regulatory status is a sandbox, not a full licence.

Bottom line: DA.SG is a decent choice for traders who value a tidy interface, modest fees, and are comfortable with a smaller, Singapore‑based platform. If you need deep liquidity, extensive derivatives, or a fully regulated environment, you’ll probably look elsewhere.

Frequently Asked Questions

Is DA.SG safe to use?

DA.SG employs cold‑wallet storage for the majority of assets and offers two‑factor authentication. However, the lack of third‑party security audits means you should only keep amounts you’re willing to risk on the platform.

What are the trading fees on DA.SG?

Base maker fees are 0.05% and taker fees are 0.10%. High‑volume traders can qualify for VIP tiers that lower fees to as little as 0.02% maker and 0.05% taker.

Does DA.SG support fiat deposits?

Yes, the exchange accepts fiat via bank transfer, but deposits carry a 1% surcharge and are limited to certain currencies (USD, EUR, SGD).

Can I trade on margin or futures?

DA.SG offers limited futures contracts on Bitcoin and Ethereum with up to 5× leverage. It does not provide broader margin trading options.

Is DA.SG regulated?

The platform operates under a Singapore fintech sandbox registration, which is less stringent than a full MAS licence. Users should treat it as a custodial service rather than a fully regulated broker.

Rob Watts

July 7, 2025 AT 14:44DA.SG fees look decent.

Alex Gatti

July 21, 2025 AT 12:04Yeah the maker rates are pretty sweet for low volume traders. It’s nice to see a platform that actually rewards activity. Still, keep an eye on the taker side if you swing big.

John Corey Turner

August 4, 2025 AT 09:24When you peel back the glossy UI of DA.SG, a tapestry of compromises emerges, each thread telling a story about the trade‑offs that newer exchanges inevitably make. The fee structure, on paper, dazzles the casual observer with its low‑cost maker tier and the promise of deeper discounts for high‑volume whales. Yet the reality of liquidity paints a different picture; with average spreads hovering around three‑tenths of a percent on BTC/USDT, the cost of slippage can erode those nominal savings in a heartbeat. Security, while boasting cold‑wallet storage for ninety‑five percent of assets, remains shadowed by the absence of third‑party audit reports, leaving the risk‑averse to wonder about undisclosed vulnerabilities. The two‑factor authentication is solid, but the optional SMS fallback feels like a relic from an era when user convenience trumped security rigor. Their KYC workflow, though compliant with basic AML standards, locks out users from high‑risk jurisdictions, which is both a regulatory safeguard and a barrier for legitimate global traders. On the product side, the futures offering is limited to Bitcoin and Ethereum with a meagre five‑times leverage, starkly contrasting the megaleverage spectacles on platforms like Bybit. This narrow scope may deter aggressive speculators looking for diversified perpetual contracts. The mobile app mirrors the desktop’s clean aesthetic, and while most users praise its responsiveness, occasional sync lags between devices hint at underlying infrastructure constraints. In terms of regulatory posture, operating under a Singapore fintech sandbox grants a veneer of legitimacy, but without a full MAS licence, the exchange sits in a gray zone that may worry institutional participants. Finally, the VIP tier discounts are appealing for those with the capital to qualify, yet the tier thresholds are steep enough to exclude the average retail trader. All in all, DA.SG positions itself as a respectable middle‑ground exchange: better than the pricey, highly regulated incumbents for fee‑sensitive traders, but still lagging behind the deep‑liquidity giants in terms of market breadth and audited security assurances.

Eva Lee

August 18, 2025 AT 06:44From an architectural standpoint, the API endpoints follow REST conventions and embed WebSocket streams for real‑time order books. However, the lack of granular rate‑limit documentation can trip up algo developers during peak volatility.

Adarsh Menon

September 1, 2025 AT 04:04Oh great another “low‑fee” exchange that pretends to be the next big thing. Sure, the UI is slick, but without deep order book depth you’re just paying for pretty pictures.

Promise Usoh

September 15, 2025 AT 01:24The platform's compliance framework adheres to standard anti‑money‑laundring protocols, albeit with occasional typographical errors in the user agreement that could sause confusion.

Tyrone Tubero

September 28, 2025 AT 22:44Honestly, if you're chasing the faintest edge in fee differentials, DA.SG might as well be a boutique coffee shop – charming but not worth the hype. The UI feels crafted for a press release, yet the underlying engine struggles to keep up when the market heats up, leaving traders perched on a shaky platform while the so‑called “low fees” evaporate in slippage.

Cathy Ruff

October 12, 2025 AT 20:04Stop glorifying a sandbox exchange that can’t match real liquidity. You’ll get burned faster than you can say “maker fee”.

Marc Addington

October 26, 2025 AT 16:24American traders deserve a home‑grown platform that doesn’t hide behind foreign regulations.

Scott McReynolds

November 9, 2025 AT 13:44While national pride can be a powerful motivator, the pragmatic trader knows that security, liquidity, and regulatory clarity matter more than the flag on the exchange’s website. By diversifying across vetted platforms, you mitigate the risk of a single point of failure that could jeopardize your holdings. Moreover, establishing a resilient portfolio strategy that balances risk‑adjusted returns will always outshine the fleeting satisfaction of supporting a “home‑grown” service that may not meet global standards. In short, let’s keep emotions out of the ledger and focus on what truly protects our assets.

Kimberly Kempken

November 23, 2025 AT 11:04People love to hype up every new exchange as if it’s the holy grail of crypto. Spoiler: it’s not.

Laurie Kathiari

December 7, 2025 AT 08:24We must remember that blind optimism can lead us down dangerous paths, especially when the safety nets are thin. Choose platforms that prioritize user protection over flashy marketing.