Wealth Tax Treatment of Crypto in Switzerland: What You Need to Know in 2025

Swiss Crypto Wealth Tax Calculator

Calculate Your Annual Crypto Wealth Tax

Switzerland taxes your crypto holdings as part of annual wealth tax (0.3%-1% depending on canton). This calculator helps you estimate your annual tax based on your holdings and canton.

Note: Swiss wealth tax is calculated on December 31st value only. This tool uses FTA-recognized rates for major cryptocurrencies.

Moving to lower-tax cantons is legal and common for crypto investors.

Compare Cantons

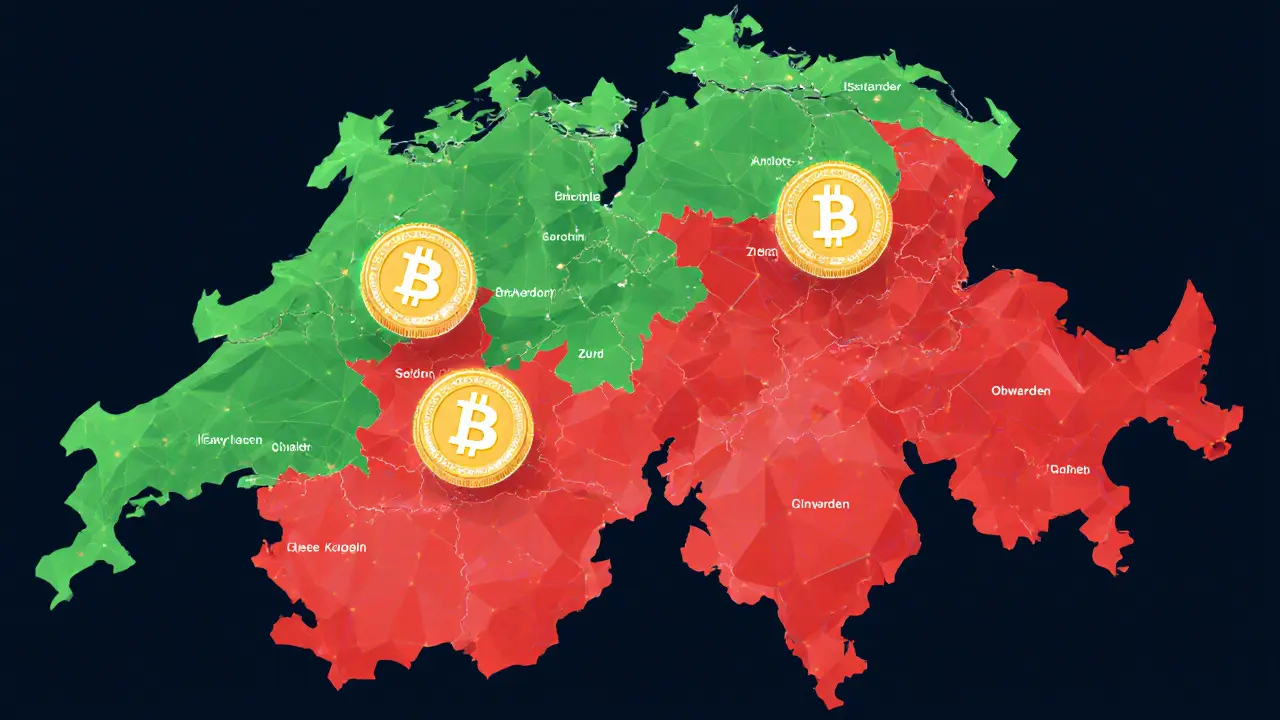

Moving from Geneva to Obwalden saves 70% on your crypto wealth tax.

Switzerland doesn’t tax your crypto profits - but it does tax your crypto holdings. That’s the big difference between Switzerland and almost every other country. If you own Bitcoin, Ethereum, or any other cryptocurrency and live in Switzerland, you won’t pay capital gains tax when you sell. But you will pay an annual wealth tax on what your crypto is worth as of December 31st. This isn’t a loophole. It’s the law. And it’s why Switzerland remains one of the most attractive places in the world for private crypto investors.

How Switzerland Classifies Crypto

Switzerland doesn’t treat crypto like money. It treats it like property - specifically, as a private asset, just like stocks or bonds. The Swiss Federal Tax Administration (FTA) calls these kryptobasierte vermögenswerte - crypto-based assets. This classification matters because it determines how you report and how much you pay.The FTA recognizes three main types of tokens:

- Payment tokens - like Bitcoin and Litecoin. These are used to buy goods or services. They’re the most common type and get the simplest treatment.

- Utility tokens - like Filecoin or Chainlink. These give access to a service or platform. Their tax treatment depends on how they’re used.

- Security tokens - like tokenized shares or bonds. These are treated just like traditional securities under Swiss law.

The Swiss Financial Market Supervisory Authority (FINMA) sets the rules for token classification, and the FTA follows suit for tax purposes. If your token is a security, it’s taxed like a stock. If it’s a payment token, it’s taxed like cash in your wallet - but only as part of your net worth, not your income.

Annual Wealth Tax: The Only Crypto Tax You Pay

Every year, on December 31st, you must declare the value of all your crypto holdings in Swiss francs (CHF). This is part of your total personal wealth - which includes your bank accounts, real estate, cars, and jewelry. The tax isn’t on what you earned. It’s on what you own.The FTA publishes official year-end exchange rates for major cryptocurrencies: Bitcoin, Ethereum, Ripple, Bitcoin Cash, and Litecoin. You must use these rates to value your holdings. If your crypto isn’t on that list - say, it’s a smaller altcoin or a new DeFi token - you use the price from the exchange where you usually trade. If that’s not available, you use your original purchase price in CHF.

Here’s how it works in practice:

- You bought 1 BTC for 20,000 CHF in 2021.

- On December 31, 2025, the FTA’s official rate is 95,000 CHF per BTC.

- You declare 95,000 CHF as part of your wealth.

- You pay wealth tax on that amount - not on the 75,000 CHF profit.

You don’t pay anything when you sell. You don’t pay anything when you swap one coin for another. You only pay when you report your balance at year-end.

Cantonal Differences: Where You Live Matters More Than You Think

Switzerland isn’t one country when it comes to taxes. It’s 26 cantons, each with its own rules. The federal government sets the framework, but the cantons set the rates.Wealth tax rates range from 0.3% to 1% annually, depending on where you live. Zurich and Geneva have higher rates - around 0.8-1%. Lucerne and Obwalden are lower - closer to 0.3-0.5%. Some cantons even offer tax breaks for new residents or have special rules for high-net-worth individuals.

That’s why many crypto investors in Switzerland don’t just choose where to buy crypto - they choose where to live. Moving from Zurich to a lower-tax canton can save you thousands per year. It’s legal. It’s common. And it’s one of the biggest advantages of living here.

Capital Gains Are Exempt - But Only If You’re Not a Pro

Here’s the real kicker: if you’re a private investor, you pay zero capital gains tax on crypto, no matter how much you make. Sell 10 BTC for 1 million CHF? No tax. Trade ETH for SOL and make a 500% return? No tax. Inherit Bitcoin? No tax. Gift it to your kid? Still no tax.That exemption applies to all private assets - crypto, stocks, real estate, gold. Switzerland doesn’t care if you made a profit. It only cares if you own something at year-end.

But there’s a catch.

If you’re classified as a professional trader, you’re taxed like a business. The FTA uses Circular No. 36 to decide who’s a pro. Factors include:

- Frequency of trades - buying and selling dozens of times per month

- Time spent - treating crypto like a full-time job

- Use of leverage or derivatives

- Reliance on crypto income to pay your bills

If you meet these criteria, your crypto gains are added to your income and taxed at your regular income tax rate - which can be 10-25% depending on your canton and income level. You also have to keep detailed records and file as a business.

Most people don’t qualify as professionals. But if you’re trading daily, running a crypto fund, or managing other people’s assets, you’re not a private investor anymore. And you’ll pay the price.

Staking, Mining, and DeFi: What’s Taxable?

Crypto isn’t just Bitcoin anymore. Staking, mining, and DeFi are big parts of the ecosystem - and Switzerland has clear rules for them.Mining - if you’re mining crypto as a business (using specialized hardware, electricity costs, etc.), your profits are taxable as business income. You report it like a self-employed person. You can deduct expenses like equipment and power.

Staking rewards - if you earn ETH from staking, that’s considered income. You pay income tax on the CHF value when you receive it. But the underlying ETH you staked? Still part of your wealth tax base.

DeFi yields - if you’re lending, farming, or providing liquidity, the rewards are income. Again, taxed when received. But the tokens you hold? Still subject to annual wealth tax.

Here’s the key: income is taxed when earned. Wealth is taxed once a year. They’re two separate systems. You might pay income tax on staking rewards, then pay wealth tax on the total value of your staked ETH at year-end. Both apply.

What You Need to Keep Track Of

Switzerland doesn’t make it easy - but it makes it fair. The burden is on you to prove what you own and what it’s worth.You need to track:

- Every crypto purchase - date, amount, CHF value at time of buy

- Every sale or trade - even if you swapped BTC for ETH

- Wallet addresses - especially if you use multiple exchanges or cold wallets

- Year-end values - use FTA rates or exchange prices

- Staking and DeFi rewards - record the CHF value when received

Many Swiss crypto investors use apps like Koinly or CoinTracking to auto-import transactions and generate tax-ready reports. These tools pull data from exchanges, wallets, and blockchains. They’re not required - but they’re practically essential.

Forget Excel spreadsheets. They’re too error-prone. One wrong decimal place, one missed transaction, and you risk an audit. Switzerland takes tax compliance seriously. Don’t gamble with it.

Why Switzerland Still Leads the World

In 2025, most countries are scrambling to tax crypto aggressively. The U.S. taxes every trade. The UK taxes staking as income. France imposes a 30% flat tax on gains. Even Germany taxes crypto after one year.Switzerland? It stays calm. It stays clear. It doesn’t punish investors. It doesn’t create new taxes. It applies existing rules - fairly, consistently, and transparently.

That’s why crypto companies keep moving here. Why hedge funds open offices in Zug. Why private investors from Germany, Italy, and the UK relocate to Swiss cantons with lower wealth tax rates. It’s not about being tax-free. It’s about being predictable.

The FTA updates its guidance regularly - the last major update was December 3, 2024. But the core principles haven’t changed: private investors pay wealth tax, not capital gains tax. Professionals pay income tax. Everything else is just details.

What’s Coming in 2026 and Beyond

There are no plans to change the system. No new crypto taxes on the horizon. No wealth tax hikes. No capital gains tax proposals. Switzerland’s approach is built into its legal DNA - through the DLT Act of 2021 and reinforced by years of court rulings and FTA guidance.Even as NFTs, tokenized real estate, and AI-driven DeFi protocols grow, the Swiss system is designed to handle them. They fall under existing categories: wealth if held, income if earned. No special rules needed.

That’s the real strength of Switzerland’s system. It’s not flashy. It’s not trendy. But it works - and it lasts.

Do I have to pay tax on crypto if I don’t sell it in Switzerland?

Yes - but only as part of your annual wealth tax. Switzerland doesn’t tax crypto sales for private investors. Instead, you pay a small annual tax (0.3%-1%) on the value of your crypto holdings as of December 31st. You pay this even if you never sell.

Is staking crypto taxable in Switzerland?

Yes - the rewards you earn from staking are considered income and are taxed in the year you receive them. You pay income tax on the Swiss franc value at the time you get the reward. The underlying staked coins still count toward your annual wealth tax.

What if I hold crypto on an exchange outside Switzerland?

You still must declare it. Swiss tax law requires you to report all worldwide assets, including crypto held on foreign exchanges or in cold wallets. You use the year-end value in CHF, regardless of where it’s stored. Failing to declare foreign crypto can lead to penalties.

Can I avoid wealth tax by moving to a different canton?

Yes - and many people do. Wealth tax rates vary significantly between cantons. Moving from Zurich (around 1%) to a lower-tax canton like Obwalden (around 0.3%) can cut your crypto wealth tax by 70%. It’s a legal and common strategy for crypto investors.

Are NFTs taxed the same as crypto in Switzerland?

Yes - NFTs are treated as private assets. If you hold them for personal use, they’re included in your annual wealth tax calculation. If you trade them frequently, you may be classified as a professional trader and face income tax on profits. The same rules apply as for other crypto assets.

What happens if I can’t find the exact value of my crypto on December 31st?

If the FTA doesn’t publish a rate for your token, use the price from the exchange where you usually trade. If that’s not available, use your original purchase price in CHF. The FTA accepts this as a reasonable estimate. Don’t guess - document your source.

Mike Stadelmayer

November 18, 2025 AT 14:42Switzerland’s system is just smart. No capital gains tax? Sign me up. I’ve seen too many people in the US get crushed by tax bills after selling crypto. This is how you attract real investors.

neil stevenson

November 19, 2025 AT 13:50Living in Zurich and holding BTC? Oof. My wealth tax would eat my entire staking rewards 😅

Devon Bishop

November 19, 2025 AT 20:17just a heads up - if you use cointracking, make sure you manually verify the FTA rates for year-end. their auto-import sometimes pulls from binance or coinbase and those prices are off by 5-10%. i got audited last year because of this. took 3 months to fix. don’t be me.

Sunita Garasiya

November 20, 2025 AT 05:10Oh wow so Switzerland doesn’t tax profits but taxes your dreams? That’s like charging rent on hope. At least in the US, if you don’t sell, the IRS doesn’t care - here they’re like ‘we see your 10 BTC and we want 0.8% of your fantasy.’

sky 168

November 21, 2025 AT 03:50Staking rewards = income. Held ETH = wealth. Two taxes. Got it. Simple.

Charan Kumar

November 22, 2025 AT 18:49India treats crypto like gambling but Switzerland treats it like real estate. I wish we had this clarity. I just want to hold without being taxed every time I move coins

Norm Waldon

November 23, 2025 AT 14:17This is a trap. The FTA is watching you. They know where your wallets are. They track every swap. They know you moved from Zurich to Obwalden. They know you’re hiding your NFTs in a cold wallet. This isn’t freedom - it’s surveillance with a smile.

Lynn S

November 24, 2025 AT 17:55If you're holding crypto and think you're 'just a private investor,' you're delusional. The FTA doesn't care about your intentions - they care about your transaction volume. If you're trading more than twice a month, you're a professional. Stop lying to yourself.

Peter Mendola

November 26, 2025 AT 01:15Switzerland’s system is elegant. No capital gains tax = no behavioral distortion. Investors hold. They don’t chase tax-loss harvesting. It’s rational. And yes - it’s better than the US. 🇨🇭

Marilyn Manriquez

November 26, 2025 AT 07:23I moved from New York to Zug last year. My crypto wealth tax is 1/3 of what I paid in NY income tax on the same gains. I don’t miss the bureaucracy. I don’t miss the panic before April 15. This is what financial dignity looks like.

Khalil Nooh

November 27, 2025 AT 03:30Let’s be real - if you’re not using Koinly or CoinTracking, you’re playing Russian roulette with your tax return. I used Excel for two years. One missed trade. One wrong timestamp. One FTA letter. My life changed. Don’t be a hero. Use the tool. It’s not expensive. It’s not hard. It’s just necessary.

And yes - you have to declare your Binance holdings even if you’re in Switzerland. The FTA has data-sharing agreements with 80+ countries. They know.

Also - if you’re mining at home with a rig, you need to log your electricity costs. Deductible. But you need receipts. Paper receipts. Not screenshots.

And yes - NFTs are included. Even the bored ape you bought for fun. Even the pixel art you got for free. If it’s on your wallet on Dec 31, it’s taxable. No exceptions.

And no - you can’t say ‘I didn’t know.’ Ignorance isn’t a defense. The FTA published 34 pages of guidance last year. They even made a YouTube video. You had your chance.

And yes - they check your phone’s location history if they suspect you’re hiding assets. I’m not joking.

Switzerland isn’t tax-free. It’s tax-smart. And if you treat it like a game, you’ll lose.

Anthony Demarco

November 27, 2025 AT 16:44Why do Americans keep pretending Switzerland is some crypto paradise? They tax your wealth, they track your wallets, they force you to report every single token you own, and then they laugh when you panic at year-end. This isn’t freedom - it’s a velvet cage. And you’re paying to live in it.

Jack Richter

November 29, 2025 AT 07:50cool

Chris G

November 30, 2025 AT 05:12Switzerland doesn’t tax capital gains because they already taxed you on the value of your crypto when you bought it. The wealth tax is just the second bite. It’s not a loophole - it’s a two-step tax. You’re not getting a deal. You’re just being taxed differently.