Uniswap v2 on Base: A Practical Review for Crypto Traders in 2025

Uniswap v2 on Base Fee Calculator

How This Calculator Works

Calculate your total trading cost on Uniswap v2 on Base. Includes a 0.3% swap fee plus Base network fees (typically $0.05-$0.30). Compare to Ethereum mainnet costs ($5-$30) to see the savings.

Your Trade Summary

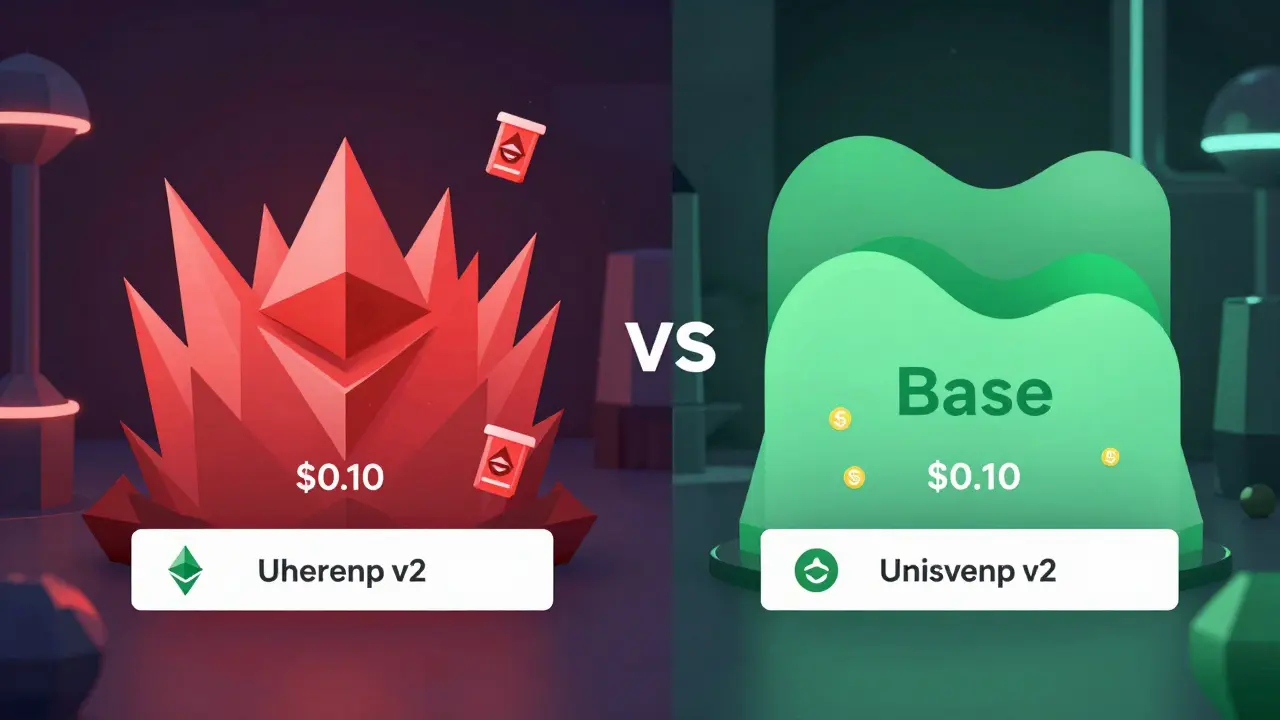

Base vs. Ethereum

Uniswap v2 on Base isn’t just another crypto exchange. It’s one of the most straightforward ways to trade tokens without handing your keys to a company. If you’ve ever felt overwhelmed by centralized exchanges like Coinbase or Binance-where you’re trusting someone else with your money-Uniswap v2 gives you back control. And now, running on Base, it’s faster and cheaper than ever. But is it right for you? Let’s cut through the noise.

What Uniswap v2 Actually Does

Uniswap v2 is a decentralized exchange (DEX) built on Ethereum. That means no middlemen. No deposit forms. No KYC. You connect your wallet-like MetaMask or Trust Wallet-and swap tokens directly from your device. There’s no order book. Instead, trades happen through liquidity pools. These are smart contracts filled with pairs of tokens, like ETH/USDC or WBTC/DAI. When you swap, you’re trading against the pool, not another person.

It launched in 2018, and even today, it’s still one of the most used DEXes on Ethereum. Why? Because it’s simple. You pick two tokens. You enter how much you want to trade. It shows you the price and fee. You confirm. Done. No hidden menus. No confusing tabs. It works like Google Search: type in what you want, get the answer.

Why Base Matters

Base is a Layer 2 network built by Coinbase. It’s compatible with Ethereum-meaning all Uniswap v2 smart contracts work the same way-but it’s way cheaper and faster. Ethereum mainnet fees can spike to $20 or more during busy times. On Base, the same swap costs less than $0.10. That’s not a small difference. For people swapping small amounts daily, it makes the difference between trading and just watching.

Uniswap v2 on Base doesn’t mean a new version of the app. It’s the same interface, same pools, same rules. But now you’re using Base’s blockchain instead of Ethereum’s. That’s it. And because Base is EVM-compatible, any wallet that works on Ethereum works here too.

What You Can Trade

Uniswap v2 supports over 10,000 ERC-20 tokens. That includes major ones like ETH, USDC, DAI, LINK, UNI, and WBTC. But it also includes obscure DeFi tokens you’ve never heard of. That’s both a strength and a risk.

Deep liquidity means big trades won’t crush your price. If you swap $5,000 worth of ETH for USDC on Uniswap v2, you’ll likely get close to the market rate. On a smaller DEX, that same trade might move the price by 5% or more. That’s slippage. Uniswap v2 minimizes it because so many people are providing liquidity.

But here’s the catch: just because a token is listed doesn’t mean it’s safe. Scams, rug pulls, and fake tokens are everywhere. Always check the contract address. Never trust a link from Twitter. Use tools like Etherscan or BaseScan to verify before you swap.

How Much It Costs

There are two types of fees on Uniswap v2:

- Swap fee - 0.3% for most pairs. Some pools have lower fees (0.01%, 0.05%) for stablecoins or high-volume pairs.

- Network fee (gas) - This is what you pay to the blockchain to process your transaction. On Ethereum, this can be $5-$30. On Base, it’s usually $0.05-$0.30.

That’s why Base is such a big deal. If you’re swapping regularly, Ethereum gas fees eat into your profits. Base fixes that. And unlike centralized exchanges that charge 0.6% or more, Uniswap’s 0.3% is competitive-even better when you factor in no deposit/withdrawal fees.

Wallets You Can Use

You need a non-custodial wallet. That means you hold your own keys. Popular options:

- MetaMask (most common)

- Trust Wallet

- Coinbase Wallet

- Argent

Uniswap doesn’t have its own wallet anymore. The old Uniswap Wallet app was shut down in 2023. Now you connect your wallet directly to the Uniswap interface. It’s more secure-no app to download, no extra login. Just click ‘Connect Wallet’ and approve the connection.

Important: Base only works with EVM-compatible wallets. That means no Bitcoin, no Solana, no XRP. If you’re holding those, you’ll need to bridge them to Base or use another exchange.

Pros and Cons

Pros:

- No KYC or account creation

- Low swap fees (0.3%)

- Extremely low gas fees on Base

- Thousands of tokens available

- Full control over your funds

- Simple, clean interface

Cons:

- No fiat on-ramps-you can’t buy crypto with a credit card

- No customer support-if something goes wrong, you’re on your own

- Only works on EVM chains (Ethereum, Base, Arbitrum, Polygon)

- Risk of scams-many fake tokens are listed

- Slippage can still happen on low-liquidity pairs

For beginners, the lack of fiat on-ramps is a big hurdle. You need to already own ETH or USDC on Base to start. That means buying crypto elsewhere first-like on Coinbase or Kraken-then sending it over. It’s an extra step, but it’s also safer. You’re not handing your card details to a DeFi app.

How It Compares to Uniswap v3

Uniswap v3 came out in 2021 with advanced features: concentrated liquidity, multiple fee tiers (0.05% to 1%), and price ranges. It’s powerful-for experienced traders who want to optimize returns.

But most people don’t need it. v3 requires you to pick price ranges, manage positions, and monitor liquidity. It’s like using a DSLR camera when you just want to take a photo. Uniswap v2 is the point-and-shoot. You swap. You earn fees passively if you provide liquidity. You don’t need to understand gamma or impermanent loss.

That’s why v2 still handles over 40% of all Uniswap volume in 2025. It’s not outdated. It’s intentional. Simplicity wins.

Who Should Use It

Uniswap v2 on Base is perfect for:

- People who want full control over their crypto

- Traders who swap tokens frequently and want low fees

- Users already familiar with wallets like MetaMask

- Those who want to avoid centralized exchanges

It’s not for:

- People who want to buy crypto with a credit card

- Users who need customer support when things go wrong

- Those holding Bitcoin, Solana, or other non-EVM assets

- Complete beginners with zero crypto experience

If you’re new, start by buying ETH or USDC on a centralized exchange. Send it to your MetaMask. Connect to Uniswap on Base. Do a small swap-say $20 of ETH for USDC. Watch how it works. Then try a bigger one. That’s the best way to learn.

Final Thoughts

Uniswap v2 on Base isn’t flashy. It doesn’t have staking, lending, or NFT marketplaces. But it does one thing extremely well: letting you swap tokens safely, cheaply, and without asking for permission. In a world full of crypto apps that promise the moon but deliver complexity, Uniswap v2 is refreshingly honest.

It’s not the future of crypto trading. It’s the present. And for most people, that’s enough.

Jess Bothun-Berg

December 5, 2025 AT 18:58Joe B.

December 6, 2025 AT 21:35Rod Filoteo

December 8, 2025 AT 20:30Layla Hu

December 10, 2025 AT 04:49Nora Colombie

December 11, 2025 AT 21:47Bhoomika Agarwal

December 11, 2025 AT 21:56alex bolduin

December 13, 2025 AT 08:32Vidyut Arcot

December 14, 2025 AT 06:56Ankit Varshney

December 15, 2025 AT 23:09Ziv Kruger

December 16, 2025 AT 17:58Heather Hartman

December 18, 2025 AT 02:33Catherine Williams

December 18, 2025 AT 14:50Mohamed Haybe

December 19, 2025 AT 14:04Marsha Enright

December 21, 2025 AT 04:48Andrew Brady

December 22, 2025 AT 11:12Sharmishtha Sohoni

December 23, 2025 AT 11:06Althea Gwen

December 23, 2025 AT 23:30Durgesh Mehta

December 24, 2025 AT 15:46Sarah Roberge

December 26, 2025 AT 11:57