Flash loan attack: How instant borrowing powers DeFi exploits

Understanding flash loan attack is essential for anyone dealing with modern finance on the blockchain. When working with flash loan attack, an exploit that uses uncollateralized, instant borrowing within a single transaction. Also known as instant loan hack, it lets attackers manipulate market prices, drain funds, or force oracle errors before the loan is repaid. This technique lives at the intersection of Decentralized Finance (DeFi), a ecosystem that enables peer‑to‑peer financial services without traditional intermediaries. It also depends on smart contracts, self‑executing code that automates asset transfers and enforces rules on the blockchain. In short, a flash loan attack requires a vulnerable smart contract, a liquid market, and a fast‑executing transaction.

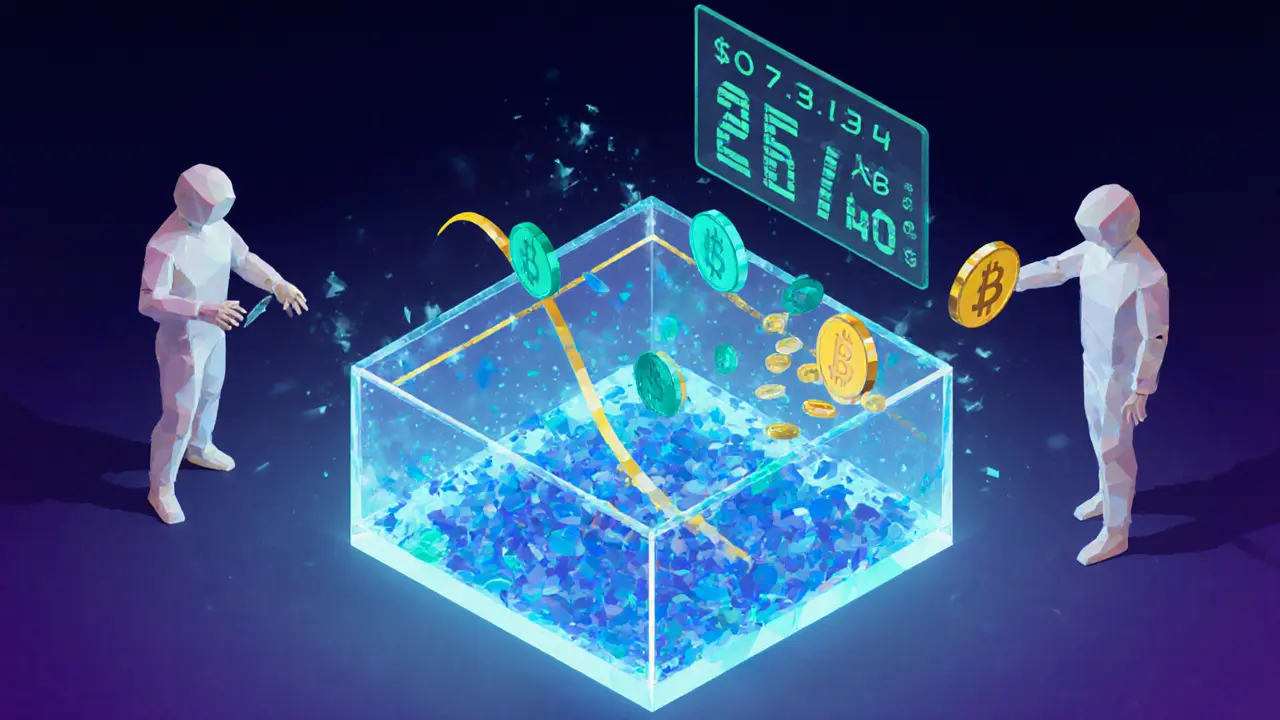

The core of a flash loan attack revolves around a liquidity pool, a reserve of tokens that offers on‑chain assets for borrowing and trading. Attackers borrow a massive amount, perform a series of actions—often price manipulation or arbitrage—then repay the loan, all within one block. This creates a semantic triple: "Flash loan attack exploits liquidity pool vulnerability." Another triple: "DeFi protocols depend on smart contract integrity." A third: "Oracle manipulation influences token pricing during a flash loan." By chaining these steps, the attacker can, for example, push a token’s price up on one exchange, sell it on another, and pocket the spread before the loan is settled. The attack’s success hinges on the atomic nature of blockchain transactions—no intermediate state is visible, so defenders can’t intervene mid‑process.

Detecting a flash loan attack isn’t easy, but a few signals help. Sudden spikes in borrowing volume from a single address, rapid price swings in a short time frame, or mismatched oracle updates are red flags. Mitigation strategies include adding time‑weighted average price (TWAP) checks, limiting loan sizes, or requiring collateral for high‑risk functions. Emerging tools like on‑chain analytics dashboards and simulation frameworks let developers test their contracts against simulated flash loan scenarios. As the ecosystem matures, we’ll see more layered defenses—still, the underlying principle remains: protect the smart contract, secure the liquidity pool, and keep the DeFi oracle honest. Below you’ll find a curated set of articles that dive deeper into real‑world flash loan attacks, breakdowns of famous incidents, and step‑by‑step guides on safeguarding your projects.

Explore the most common AMM vulnerabilities, real-world DeFi exploits, and practical steps to safeguard your automated market maker contracts.

- Read More