DA.SG Fees – What Traders Need to Know

When looking at DA.SG fees, the cost structure applied by the DA.SG cryptocurrency exchange for trades, withdrawals, and other services. Also known as Decentralized Asset fees, it determines how much you pay per transaction on the platform. In plain terms, every time you buy, sell, or move crypto on DA.SG, a small percentage is taken. This percentage can change based on volume, order type, and whether you’re providing liquidity. The fee model is built on the maker‑taker model, a pricing scheme where makers (liquidity providers) pay lower fees than takers (liquidity seekers), so understanding your role in the order book matters. Another piece of the puzzle is the baseline cryptocurrency exchange fees, standard charges most exchanges levy for trading, deposits, and withdrawals that DA.SG inherits and tweaks. Finally, remember that on‑chain actions still incur gas fees, network costs paid to miners or validators to confirm transactions, which sit on top of the exchange’s own charges. Knowing how these three entities interact helps you see the real cost of each move.

Why does this matter? Because fee differences can turn a seemingly good trade into a loss. DA.SG uses a dynamic tier system: the more you trade in a month, the lower your maker rate gets, sometimes dropping below 0.05%. Takers, however, usually start around 0.20% and may only shave a few basis points with volume. Compare that to platforms like DuckSwap or NEXT.exchange, where base rates sit at 0.15% for makers and 0.30% for takers. If you’re a frequent trader, the tiered discounts on DA.SG can shave off a noticeable slice of profit. On the flip side, if you only place market orders (taker side), you’ll pay the higher rate and might want to look for rebate programs or limit‑order strategies to become a maker. Some users also combine DA.SG with other DeFi swaps to route orders where fees are cheapest, a practice known as fee‑optimised routing.

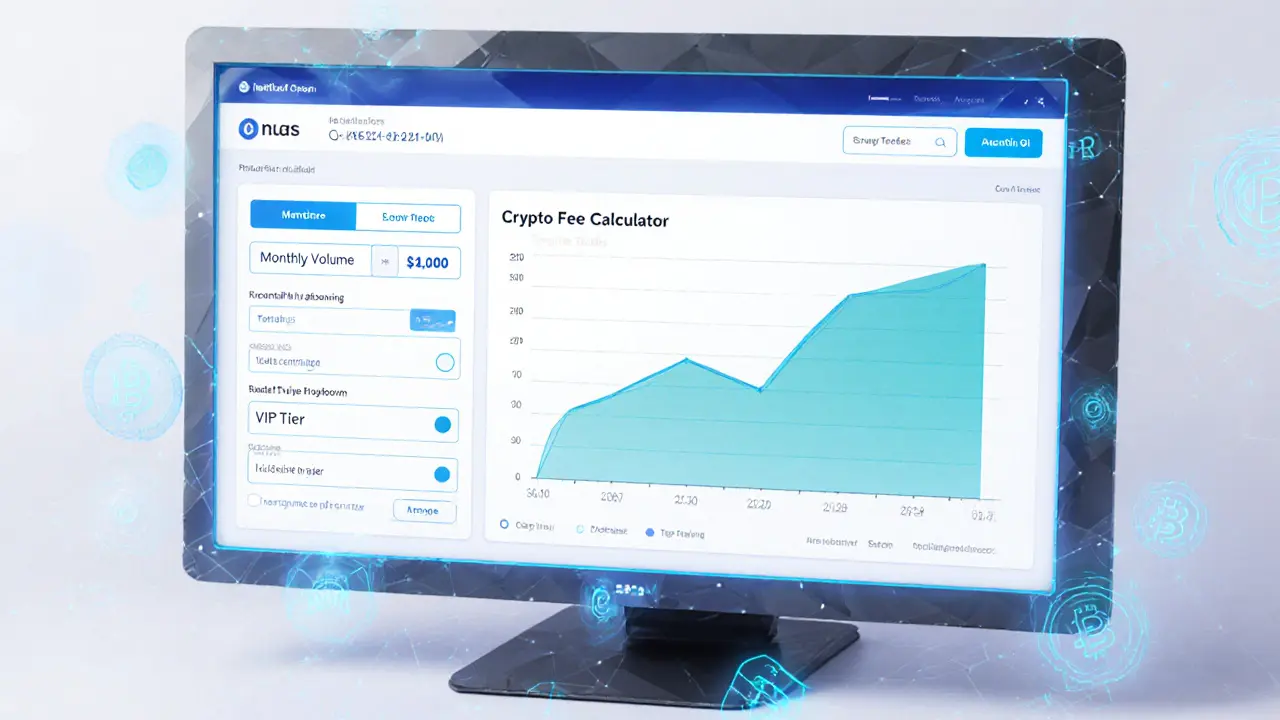

Putting the numbers together is easier than you think. Start with the raw trade fee, then add the network gas fee for the blockchain you’re using—Ethereum, Binance Smart Chain, or others. For example, a $1,000 trade on Ethereum with a 0.10% maker fee costs $1, plus the gas fee, which might be $2‑$5 depending on congestion. If you trade the same amount on a layer‑2 solution with lower gas, your total cost drops dramatically. Tools like fee calculators and the DA.SG API let you pull live fee data, so you can model different scenarios before you hit “confirm.” Knowing the exact cost lets you set realistic profit targets and avoid surprise slippage. This is why many of our exchange reviews—DuckSwap, KuMEX, Core Dao Swap—spend a whole section just breaking down fee structures; they’re the hidden variable that separates profitable traders from the rest.

What You’ll Find Next

Below is a hand‑picked collection of articles that dive deeper into exchange fee comparisons, security assessments, and practical tips for cutting costs on DA.SG and other platforms. Whether you’re hunting for a low‑fee swap, need to understand maker‑taker dynamics, or want to see real‑world examples of fee‑saving strategies, the posts ahead have you covered. Let’s get into the specifics and help you keep more of your earnings.

An in‑depth 2025 review of DA.SG crypto exchange covering fees, security, liquidity, user experience, and regulatory status to help you decide if it's right for you.

- Read More