Crypto Derivatives Exchange: What It Is and Why It Matters

When working with crypto derivatives exchange, a platform that lets you trade contracts whose value is derived from underlying crypto assets. Also known as crypto futures venue, it lets traders speculate on price moves without owning the coin itself. A crypto futures, standardized contracts that settle at a set date are one of the core products offered, while perpetual contracts, continuous contracts that never expire and use funding rates to stay anchored to spot prices provide a more flexible way to stay in a position. These platforms also support margin trading, borrowing funds to increase position size, enabling traders to amplify gains—or losses—with leverage. In short, a crypto derivatives exchange encompasses futures, perpetual contracts, and margin features, requires robust risk controls, and influences how traders manage exposure.

Key Tools and Concepts Behind Crypto Derivatives Trading

Understanding a crypto derivatives exchange means grasping a few essential attributes. First, leverage trading lets you open a position many times larger than your deposit; typical ratios range from 2x up to 100x, and the choice of leverage directly affects margin requirements and liquidation thresholds. Second, on‑chain metrics such as open interest, funding rates, and liquidation volumes act as real‑time indicators of market sentiment; they help traders spot overheating markets before a cascade. Third, the exchange’s liquidity pool determines how easily you can enter or exit a contract without slippage—higher depth means smoother execution. Finally, regulatory compliance shapes which derivatives you can access; regions like the EU and US have distinct rules around futures and perpetuals, influencing product availability and user protections. Together, these attributes form a network: leverage impacts margin calculations, margin ties to risk management, risk management depends on liquidity, and liquidity is overseen by regulators.

When you pick a crypto derivatives exchange, you’re also choosing a tech stack that supports fast order matching, real‑time data feeds, and secure custody of collateral. Many platforms integrate API access so bots can execute strategies automatically, while others focus on a user‑friendly UI for manual traders. Security audits, insurance funds, and clearing mechanisms are additional layers that protect against hacks and extreme market moves. Whether you’re a day‑trader hunting short‑term arbitrage or a long‑term speculator looking to hedge exposure, the right exchange provides the tools to match your strategy. By comparing fee structures, settlement models, and available contract types, you can pinpoint the venue that aligns with your risk appetite and trading style.

Below you’ll find a hand‑picked collection of articles that break down these topics in detail. From deep dives on specific exchanges to guides on using on‑chain signals, each post gives actionable insight you can apply right away. Browse the list to discover how futures, perpetual contracts, margin rules, and leverage options play out across real‑world platforms, and start building a more informed derivatives strategy today.

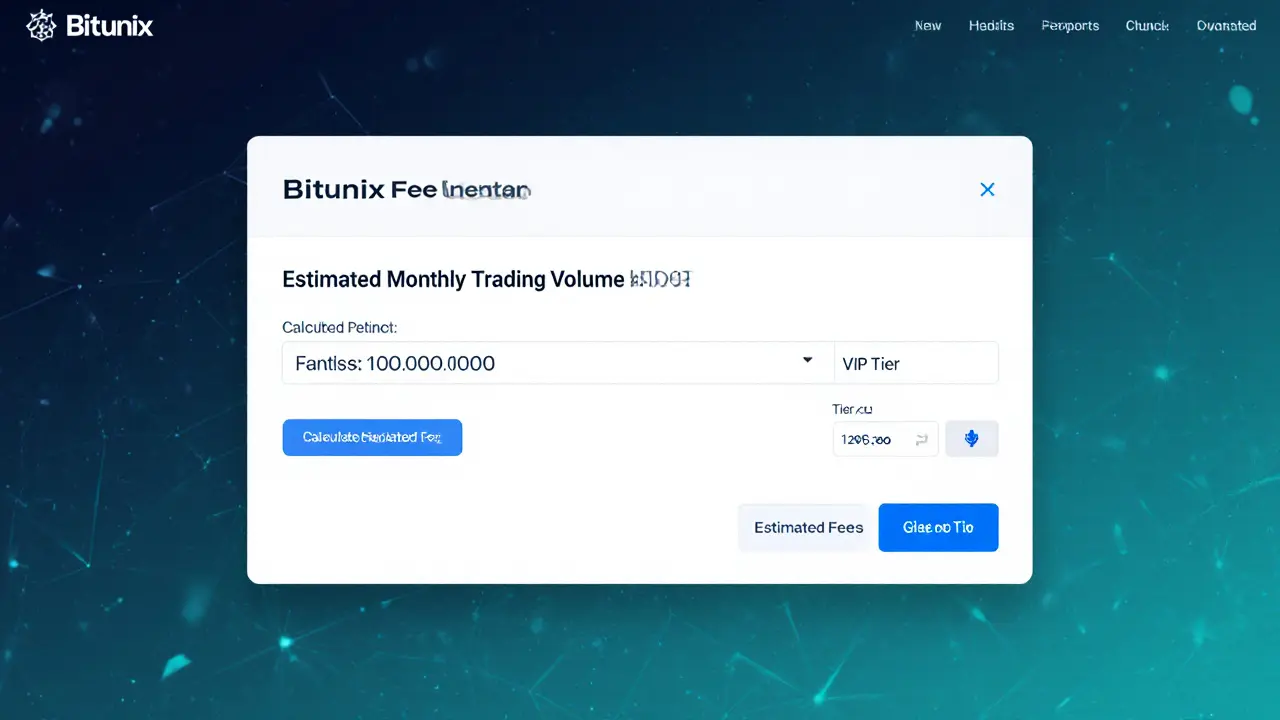

An in‑depth 2025 review of Bitunix crypto exchange covering its features, fees, security, and how it stacks up against Binance, Bybit and OKX.

- Read More