Bitunix Leverage: A Practical Guide to Crypto Margin Trading

When working with Bitunix leverage, the feature that lets traders borrow funds to amplify crypto positions on the Bitunix exchange. Also known as Bitunix margin trading, it blends spot trading with borrowed capital, letting you control larger positions than your wallet would normally allow. Understanding how it works is the first step before you risk any real money.

Key Concepts Behind Leveraged Crypto Trading

Every leveraged trade on Bitunix builds on leveraged trading, a strategy where traders use borrowed funds to increase exposure to price moves. This approach requires solid risk management, techniques like stop‑loss orders, position sizing, and regular margin checks to avoid liquidation. The underlying instruments are often crypto derivatives, contracts such as futures or perpetual swaps that track the price of an asset without owning it. Together, leveraged trading and derivatives let traders speculate on Bitcoin, Ethereum, and other tokens with as little as 5% of the trade value in their account.

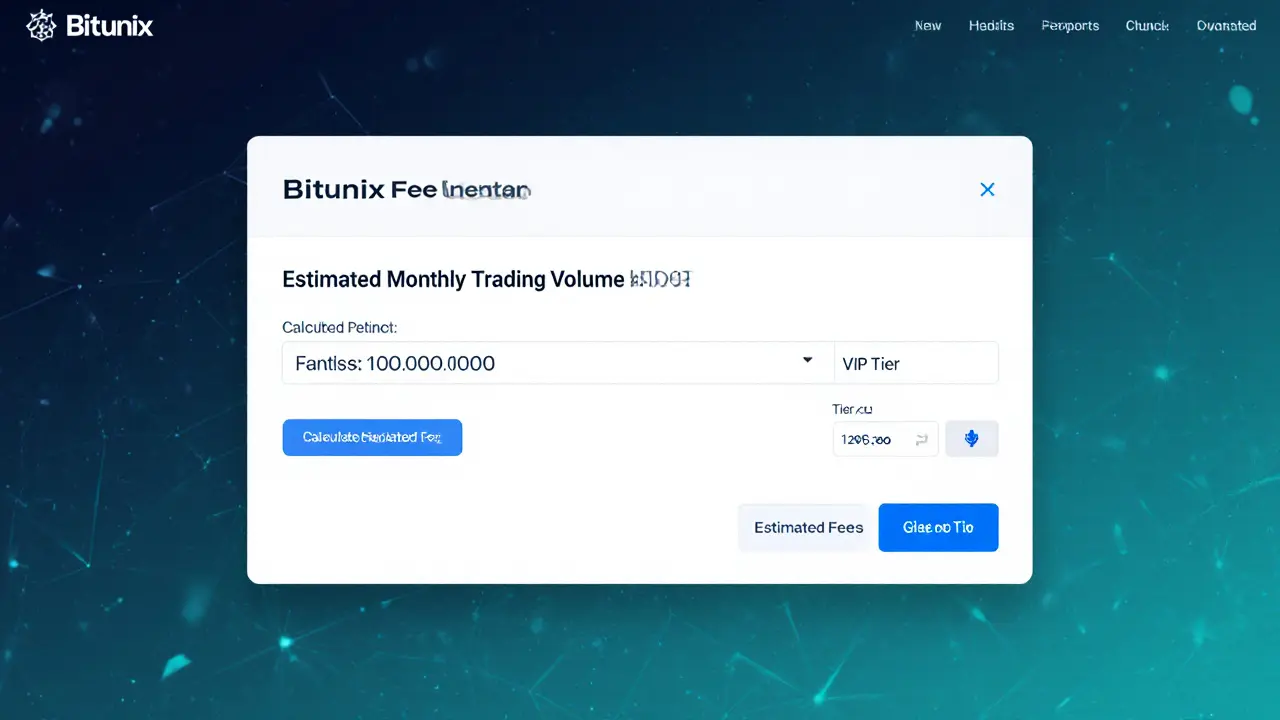

Bitunix’s platform also offers margin trading, the specific process of borrowing assets to open larger positions, governed by maintenance margin requirements and liquidation scores. Knowing the difference between margin and simple leverage helps you set realistic expectations for fees, interest, and the speed at which positions can be closed. Most traders combine margin tools with real‑time data from on‑chain metrics, earnings updates, and macro signals—resources that Market Pulse 11 provides across its crypto and stock market coverage.

Regulatory compliance and exchange security are another layer you can’t ignore. Recent posts about exchange reviews, audit costs, and new EU rules show that staying informed about platform health is just as important as mastering the math of leverage. By the time you finish reading this guide, you’ll see how Bitunix leverage fits inside a broader ecosystem of crypto exchanges, derivative products, and risk‑control practices. Below you’ll find a curated set of articles that dive deeper into exchange comparisons, audit pricing, and practical tips for safely navigating leveraged positions.

An in‑depth 2025 review of Bitunix crypto exchange covering its features, fees, security, and how it stacks up against Binance, Bybit and OKX.

- Read More