Bitunix Fees – What Traders Need to Know

When looking at Bitunix fees, the charges users pay for trading, depositing, and withdrawing on the Bitunix crypto exchange. Also known as Bitunix trading costs, it directly determines how much of each transaction stays in your pocket. To put those numbers in perspective, you first need to understand crypto exchange fees, the various cost components most platforms charge for executing digital‑asset trades. Whether you’re swapping Bitcoin for Ethereum or moving stablecoins to a hardware wallet, the fee structure you face influences profitability, especially on thin‑margin strategies.

Breaking Down the Main Cost Components

The core of Bitunix’s pricing model revolves around two familiar concepts: maker fee, the lower charge applied when your order adds liquidity to the order book and taker fee, the higher rate taken when you remove liquidity by matching an existing order. On Bitunix, maker rates typically sit around 0.08 % while taker rates hover near 0.12 %, though the exact numbers shift with volume tiers and promotional periods. Beyond these, you’ll encounter a flat withdrawal fee that varies by asset – for example, BTC withdrawals cost 0.0005 BTC, whereas stablecoin withdrawals might be a fixed $5. Deposit fees are generally zero, but network congestion can add a small blockchain fee that the user covers, not Bitunix.

Understanding each piece helps you spot opportunities. If you’re a high‑volume trader, aiming for maker orders can shave off a few basis points per trade, which adds up over hundreds of transactions. Conversely, casual traders who only place market orders should focus on the taker rate and consider whether a lower‑fee exchange might be more cost‑effective for occasional swaps. The fee schedule also includes occasional discounts for holding Bitunix’s native token, a feature many platforms use to reward loyal users.

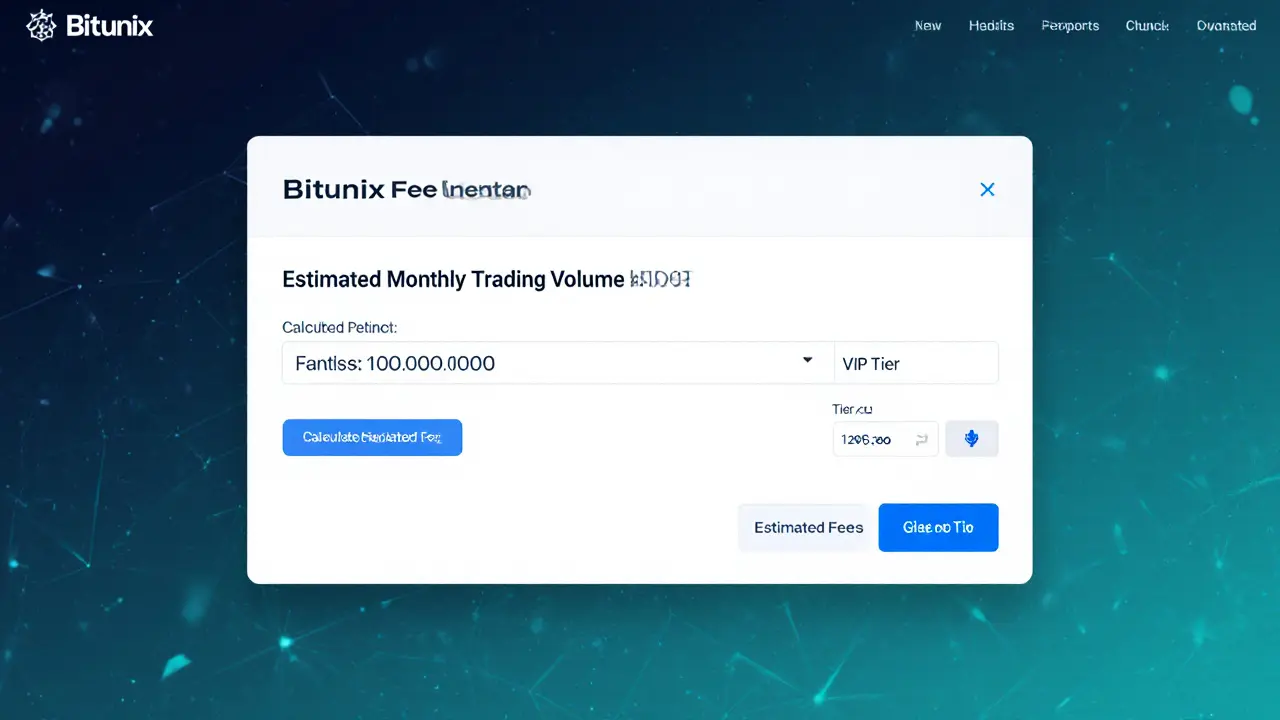

Bitunix fees are more than a static number; they’re a moving target that reacts to market conditions, user volume, and platform incentives. Tools like fee calculators and real‑time fee dashboards let you model the impact of each trade before you hit “confirm.” Comparing Bitunix’s rates against other exchanges using a fee‑comparison tool can reveal hidden savings, especially when you factor in hidden costs like spread widening on low‑liquidity pairs. By keeping an eye on how maker and taker fees evolve, you can adjust your order strategy, choose the right asset pair, and ultimately protect more of your earnings.

The collection below dives deeper into specific fee‑related topics – from detailed reviews of Bitunix’s current fee tiers to side‑by‑side comparisons with rivals like KuMEX and DA.SG. Browse the articles to see exact numbers, learn how to minimize costs, and get actionable tips for building a fee‑aware trading routine.

An in‑depth 2025 review of Bitunix crypto exchange covering its features, fees, security, and how it stacks up against Binance, Bybit and OKX.

- Read More