Bitunix Crypto Exchange Review: Fees, Security, Liquidity & Regulation

When evaluating Bitunix, a cryptocurrency trading platform that offers spot, futures, and margin products to retail and institutional users. Also known as Bitunix Crypto Exchange, it aims to combine low‑cost trading with robust security measures and deep market access.

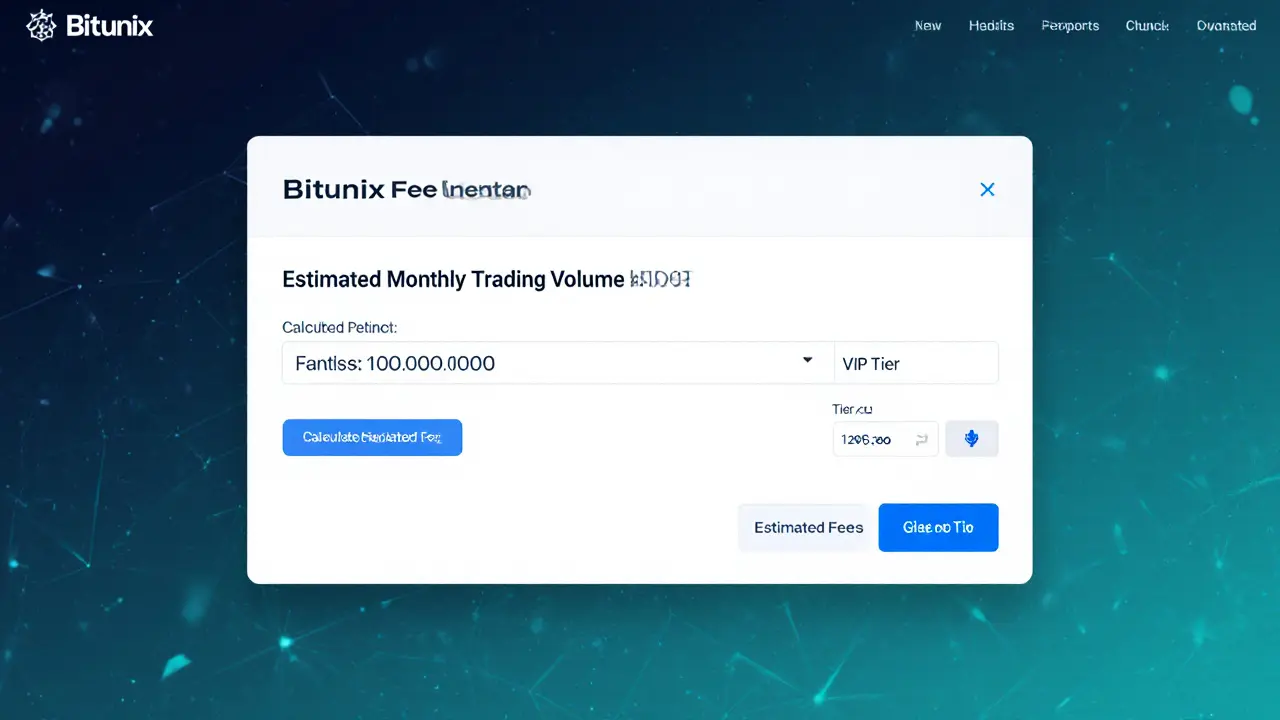

The first thing most traders look at is exchange fees, the percentage charged per trade, withdrawal costs, and any hidden spreads that can erode profit. Bitunix advertises a tiered maker‑taker model that starts at 0.08% for makers and 0.12% for takers, dropping further as volume climbs. Compared with larger players, those rates sit comfortably in the mid‑range, offering a decent balance between cost and service. Bitunix crypto exchange review also dives into fee transparency – the fee schedule is visible on the dashboard, and there are no surprise fees for deposits, which is a rarity among newer platforms.

Next up is exchange security, the set of protections including two‑factor authentication, cold‑storage of assets, and regular security audits. Bitunix stores over 90% of user funds in offline cold wallets and employs multi‑signature controls for withdrawals. Their security audit reports, last released in early 2024, show no critical vulnerabilities, and the platform supports IP whitelisting and hardware‑based 2FA. For anyone who’s seen a hack story, those features are a relief, and they directly influence the platform’s credibility in the market.

Liquidity, Regulation & Feature Set

Liquidity is the lifeblood of any exchange, and Bitunix offers deep order books on major pairs like BTC/USD, ETH/USD, and several altcoins. The platform connects to multiple liquidity providers, resulting in sub‑second order execution and tight spreads. In practice, that means less slippage for large orders – a point often overlooked in surface‑level reviews. Regulation is another crucial piece; Bitunix holds a license from the Seychelles Financial Services Authority and complies with KYC/AML standards in line with the Global AML Framework. While not as regulated as U.S. exchanges, the licensing gives traders a legal safety net and affects how the exchange can expand into new jurisdictions.

Beyond the core pillars, the platform packs useful tools: an integrated charting suite, API access for bots, and a mobile app that mirrors desktop functionality. These features tie back to the three main entities – low fees keep cost‑focused traders happy, strong security reassures risk‑averse users, and high liquidity meets the needs of high‑frequency and institutional participants. Together, they create a well‑rounded trading environment that many newer exchanges struggle to match.

Below you’ll find a curated set of articles that break each of these areas down further – from a step‑by‑step fee calculator to an in‑depth security audit walkthrough, plus a look at how Bitunix stacks up against its biggest rivals. Dive in to get the actionable details you need before deciding if Bitunix fits your trading strategy.

An in‑depth 2025 review of Bitunix crypto exchange covering its features, fees, security, and how it stacks up against Binance, Bybit and OKX.

- Read More