Crypto Tax Evasion: 5 Years in Jail and $250,000 Fines You Can't Afford to Ignore

Crypto Tax Penalty Calculator

Calculate your potential tax liability and penalties for unreported crypto transactions. This tool helps you understand the financial consequences of not reporting crypto income to the IRS.

Calculate Your Penalty

For years, people thought crypto was a wild west - untrackable, anonymous, and beyond the reach of tax collectors. That myth died in 2025. The IRS isn’t just watching anymore. They’re catching people. And the price for hiding crypto income? Up to five years in prison and a $250,000 fine. No joke. No warning. Just federal charges.

Why the IRS Cares About Your Crypto

The IRS doesn’t treat Bitcoin or Ethereum like cash. They treat it like property. That means every time you sell, trade, or spend crypto, you’ve triggered a taxable event. Even if you traded $100 worth of Dogecoin for Shiba Inu, you owe taxes on the gain. Same goes for mining, staking, or getting paid in crypto. If you didn’t report it, you’re not being clever - you’re breaking the law.Before 2025, many crypto users got away with ignoring taxes because exchanges didn’t report transactions. Now? Every U.S.-based exchange - Coinbase, Kraken, Binance.US - has to file Form 1099-DA for every trade, transfer, or payout you made in 2024. That form goes straight to the IRS. They get your name, your wallet addresses, your transaction history, and the exact dollar value of every gain or loss.

It’s not just exchanges either. The IRS uses blockchain analytics tools like Chainalysis and Elliptic to trace transactions across wallets, even if you moved crypto between platforms. If you sent 5 BTC from your Coinbase account to a private wallet, then sold it on another exchange, they can still find it. Blockchain is public. Every move leaves a digital fingerprint.

What Happens If You Get Caught

The penalties aren’t just financial. They’re criminal. Under U.S. tax code Section 7201, willfully failing to report crypto income is tax evasion - a felony. The maximum punishment? Five years in federal prison. And a $250,000 fine. That’s the same penalty as hiding income from a job, rental property, or stock trades.But here’s the kicker: the fine is just the start. On top of that, you’ll owe back taxes plus interest - which compounds daily. Then there are civil penalties. If you didn’t file at all, you could be hit with a 25% penalty on the unpaid tax. If you didn’t pay what you owed, another 25% penalty. That’s 50% right there. Add in the 75% failure-to-pay penalty for underreporting, and you could end up paying more in penalties than you ever owed in taxes.

One man in Texas got caught in 2024 for hiding $187,000 in crypto gains from 2020 to 2023. He didn’t file a single return. The IRS found his transactions through wallet linking and blockchain tracing. He paid $142,000 in back taxes, $98,000 in penalties, and was sentenced to 30 months in federal prison. He’s not an outlier. In 2024, the IRS opened over 1,200 crypto tax criminal investigations. That’s up 67% from 2023.

It’s Not About How Much You Made

A lot of people think, “I only made $500 in crypto. No one cares.” Wrong. The IRS doesn’t have a minimum threshold. Even $10 in gains must be reported. That’s not a suggestion. It’s the law. And the IRS doesn’t care if you didn’t know. Ignorance isn’t a defense.What they care about is intent. If you knowingly didn’t report, you’re guilty of evasion. If you just forgot, you’re still in trouble - but you might avoid jail. The difference? Civil penalties vs. criminal charges. Civil penalties mean fines and back taxes. Criminal charges mean a federal prosecutor, a judge, and a cell.

There’s a big gap between tax avoidance and tax evasion. Avoidance is legal. You use tax-loss harvesting. You hold crypto for over a year to get lower capital gains rates. You put crypto in a Roth IRA if your broker allows it. These are smart moves. They’re allowed.

Evasion is hiding. It’s lying on your return. It’s claiming your crypto was a gift when it wasn’t. It’s using mixers or privacy coins to obscure transactions. That’s not smart. That’s criminal.

What You Need to Do Right Now

If you’ve ever traded, earned, or spent crypto and didn’t report it - here’s what you do:- Stop ignoring it. The clock is ticking. The IRS has your data.

- Collect every transaction from every exchange and wallet. Include buys, sells, trades, staking rewards, airdrops, and even gas fees.

- Calculate your cost basis. Starting in 2025, you can’t use average cost anymore. You have to track each coin individually - wallet by wallet.

- Use crypto tax software like Koinly, CryptoTaxCalculator, or CoinLedger. They connect to your wallets and auto-generate Form 8949 and Schedule D.

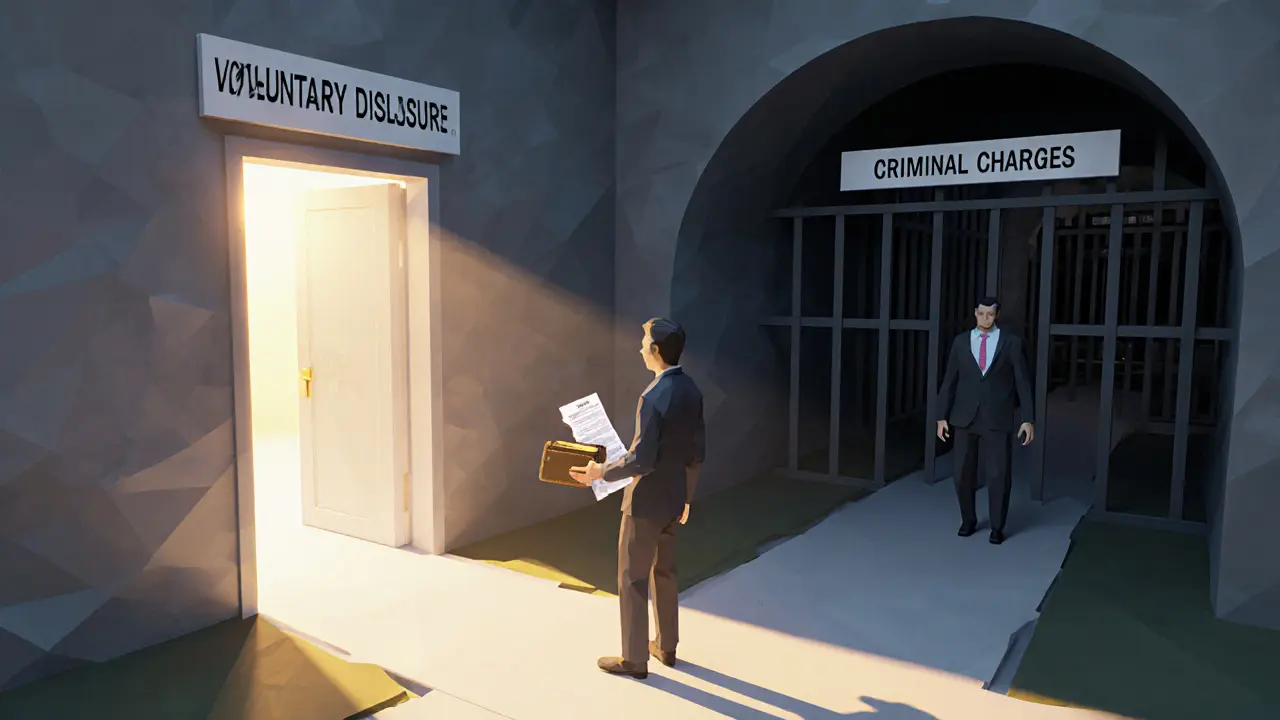

- If you missed previous years, file amended returns (Form 1040-X). The IRS has a Voluntary Disclosure Program. It won’t erase your penalties, but it cuts them in half and keeps you out of jail.

Don’t wait for a letter. Don’t hope they don’t find you. The IRS already has your data. They’re just waiting to see if you come clean.

Real Stories From Real People

Reddit threads are full of panic. One user in Florida got a letter from the IRS in March 2025 asking about $23,000 in unreported gains from 2021. He thought he was safe because he didn’t cash out. The IRS didn’t care. He paid $18,000 in penalties and filed amended returns for 2021-2024. He’s now terrified to trade again.Another guy in California tried to hide his crypto by sending it to a friend’s wallet. The friend got audited. The IRS traced it back to him. He was hit with a $110,000 penalty and had to pay $45,000 in back taxes. He lost his job. His credit score crashed. He’s still paying it off.

On the other side, a woman in Colorado realized she hadn’t reported $15,000 in staking rewards from 2020-2023. She hired a CPA, filed amended returns, and paid $12,000 in total - taxes and penalties combined. No jail. No public record. Just a lesson learned.

What’s Coming Next

The IRS is just getting started. In 2025, they rolled out new AI tools that scan crypto transactions for patterns of evasion. They’re cross-referencing wallet addresses with real estate purchases, car buys, and bank deposits. If you suddenly bought a $400,000 house in 2024 and never reported $200,000 in crypto gains? They’ll connect the dots.Global crypto enforcement hit $5.1 billion in 2024. The U.S. accounted for nearly half of it. And it’s not slowing down. Other countries are following suit. Canada, the UK, Australia - all are tightening rules and sharing data with the IRS.

There’s no coming back from a criminal conviction for crypto tax evasion. It follows you forever. You can’t get a government job. You can’t travel to some countries. You lose your right to vote in some states. Your children might be denied student loans.

You’re Not Alone - But You’re Running Out of Time

Most people who evade crypto taxes aren’t criminals. They’re confused. They didn’t know the rules. They thought it was a gray area. But the gray area is gone. The lines are drawn. The IRS has the tools. The laws are clear.If you’ve been avoiding this, the best thing you can do is act now. File what you can. Pay what you owe. Get help from a tax pro who understands crypto. Don’t wait for a letter. Don’t hope you’ll get lucky. The system is designed to catch you. The only way out is through honesty.

The fine isn’t just money. The jail sentence isn’t just time. It’s your freedom. Your reputation. Your future. And it’s not worth risking for a few thousand dollars in unreported gains.

Can the IRS track crypto if I use a non-U.S. exchange?

Yes. Even if you use a foreign exchange like Binance (non-U.S.), the IRS can still find your transactions if you ever transferred crypto to a U.S. wallet, sold it to a U.S. buyer, or used it to pay for goods or services in the U.S. They also get data from international tax treaties and bank reporting. If you’re a U.S. taxpayer, you’re subject to U.S. tax law - no matter where you trade.

What if I lost my crypto transaction records?

You’re still required to report. Use blockchain explorers like Etherscan or Blockchain.com to look up your wallet history. Most crypto tax software can import wallet addresses and reconstruct your activity. If you can’t recover exact numbers, estimate based on your memory and document how you calculated it. The IRS prefers honest estimates over no report at all.

Do I owe taxes on crypto I received as a gift?

You don’t owe tax when you receive crypto as a gift. But when you sell or trade it later, you owe capital gains tax based on the original cost basis of the person who gave it to you. If they don’t provide that info, you may have to use $0 as the cost basis - which could mean a huge tax bill. Always ask for the donor’s cost basis.

Can I go to jail for not reporting a $50 crypto gain?

Technically, yes - if you intentionally hid it. The law doesn’t set a minimum amount for tax evasion. But in practice, the IRS focuses on cases over $10,000 in unreported gains. Still, even small unreported gains can trigger an audit. If they find a pattern of hiding income over multiple years, they can escalate to criminal charges regardless of the amount.

Is there a deadline to fix past crypto tax mistakes?

The IRS doesn’t have a public cutoff date for voluntary disclosures, but the longer you wait, the riskier it gets. With new reporting rules in 2025, they’re matching data across millions of transactions. The window for clean, low-penalty corrections is closing fast. File amended returns before the next tax season to reduce your exposure.

Tejas Kansara

November 23, 2025 AT 10:49Just filed my 2023 crypto taxes using Koinly. Took 45 minutes. Saved myself from a nightmare. Seriously, don’t wait. The IRS already has your data.

Kathy Alexander

November 24, 2025 AT 07:27Typical fearmongering. The IRS doesn’t care about your Dogecoin trades. They’re chasing billion-dollar hedge funds. You’re being manipulated into buying tax software.

Emily Michaelson

November 25, 2025 AT 02:32Actually, Kathy, that’s not true. I work in tax compliance. The IRS started flagging small-time traders last year because they’re using AI to spot patterns-like repeated small transfers between wallets to hide gains. Even $200 in unreported staking rewards gets flagged if it’s part of a pattern. It’s not about the amount, it’s about the behavior. And yes, software like Koinly isn’t a scam-it’s a lifeline for people who don’t have a CPA.

Lisa Hubbard

November 26, 2025 AT 00:50I read this whole thing and I’m still not sure if I’m supposed to be scared or just annoyed. Like, I made $800 in crypto last year and spent it all on rent and ramen. So now I’m supposed to pay taxes on food money? And get jail time for it? That’s not justice, that’s capitalism with a side of bureaucracy. Also, who has time to track every single trade? I’m not an accountant. I’m just trying to survive.

Belle Bormann

November 26, 2025 AT 03:27i had no idea i owed tax on my airdrops… i thought they were free money. i just got a letter from the irs last week. i’m panicking. i didn’t even know you had to report gifts. now i’m scrambling to find old wallet addresses. someone pls help.

Dave Sorrell

November 27, 2025 AT 02:49Belle, you’re not alone. The IRS has a Voluntary Disclosure Program specifically for people in your situation. File amended returns as soon as possible. Even if you can’t reconstruct every transaction, estimate honestly and document your process. They’ll appreciate the effort. Jail is for people who lie and hide. Not for people who panic and fix it.

stuart white

November 29, 2025 AT 01:35Oh wow, so now I’m a criminal because I traded Solana for Shiba on Binance in 2021? That’s wild. I didn’t even know the IRS was watching my wallet. Next they’ll be tracking my TikTok views and taxing my memes. This is the dystopia they warned us about. I’m selling everything and moving to Portugal tomorrow.

Rajesh pattnaik

November 29, 2025 AT 12:21from india here. we dont have crypto tax yet but i see what u mean. my cousin in usa got fined 10k for not reporting 3000 usd gain. he thought it was like gambling. now he cant get visa for europe. so yes, this is real. dont wait.

preet kaur

November 30, 2025 AT 12:58Just want to say-this isn’t about punishment. It’s about fairness. People who work, pay taxes. People who trade crypto and hide it? They’re getting a free ride. That’s not cool. I’m not rich, but I file my crypto gains. It’s the right thing to do. And honestly? It’s less stressful than living in fear.

Sky Sky Report blog

December 1, 2025 AT 06:57There’s a difference between ignorance and evasion. The government made this complicated on purpose. They didn’t provide clear guidance until 2024. Now they’re coming for everyone who didn’t know. That’s not justice. That’s trap-setting.

jocelyn cortez

December 2, 2025 AT 18:59I lost my entire crypto portfolio to a scam last year. I didn’t report it because I thought I had nothing left to report. Then I got a letter saying I owed taxes on the $12,000 I lost. I cried for three days. I don’t know what to do anymore.

Soham Kulkarni

December 2, 2025 AT 20:38u guys are overthinking. i use koinly. it connect to my wallet. it tell me what i owe. i pay. done. no stress. no jail. simple. if u dont know how, ask someone. dont wait till irs knock on ur door.

Amanda Cheyne

December 2, 2025 AT 22:05They’re using this to build a national surveillance system. Crypto was supposed to be free. Now they’re tracking every transaction, linking it to your bank, your house, your car. This isn’t tax enforcement. This is the beginning of the financial police state. They’re coming for your freedom. Don’t trust the system.

Jody Veitch

December 3, 2025 AT 05:26If you’re too lazy to track your crypto gains, you don’t deserve to keep them. This isn’t a game. You’re a U.S. citizen. You have responsibilities. The fact that you think this is unfair shows how entitled you are. Pay your taxes or get out. This country doesn’t owe you a free ride.