Cryptocurrency Insights & Resources

When working with Cryptocurrency, a digital asset class that uses cryptography to secure transactions and control the creation of new units. Also known as crypto, it spans everything from Bitcoin to niche meme tokens. Airdrop, a free distribution of tokens to a community, often used to boost awareness or reward early adopters is one of the most talked‑about mechanisms within crypto. Crypto Exchange, a platform where users trade digital assets for fiat or other cryptocurrencies serves as the gateway for buying, selling, and swapping these assets. Meanwhile, Token, any unit of value issued on a blockchain, ranging from utility tokens to security‑linked assets represents the core building block of the ecosystem. Finally, a Decentralized Exchange, a peer‑to‑peer trading platform that operates without a central custodian provides an alternative to traditional exchanges, giving users full control over their funds. Together, these entities create a dynamic market where each influences the others: Cryptocurrency encompasses tokens, airdrops, and exchanges; airdrops require verification to avoid scams; crypto exchanges influence token liquidity; decentralized exchanges enable trust‑less trading; and tokens determine the value proposition of each platform.

Why These Pieces Matter for Every Investor

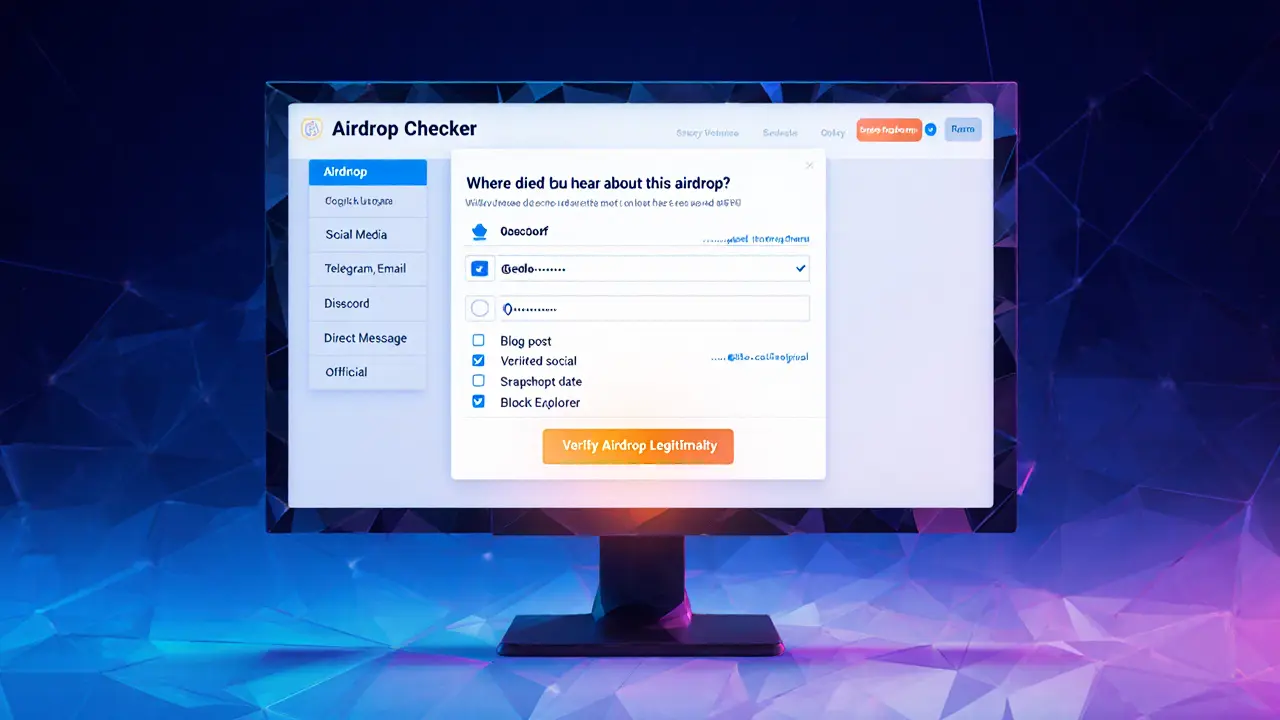

Understanding the interplay between airdrops, tokens, and exchanges is crucial for anyone looking to navigate the market effectively. An airdrop can instantly inflate the circulating supply of a token, which in turn impacts its price on both centralized and decentralized exchanges. That price movement feeds back into the token’s perceived utility, shaping future airdrop strategies and community interest. For example, a well‑executed airdrop on a reputable crypto exchange can attract seasoned traders, boost liquidity, and create a virtuous cycle of adoption. Conversely, a poorly vetted airdrop may lead to phishing attacks or pump‑and‑dump schemes, underscoring the need for thorough verification. Tokens themselves vary widely: utility tokens power network services, governance tokens grant voting rights, and security tokens tie to real‑world assets like stocks or real estate. Each type demands a different risk assessment, especially when they appear on decentralized exchanges where regulatory oversight is limited. By grasping these nuances, you can spot genuine opportunities, avoid common pitfalls, and tailor your strategy to the specific strengths of each platform.

Below you’ll find a curated collection of articles that break down the latest airdrop verification guides, in‑depth exchange reviews, token fundamentals, and decentralized trading tips. Whether you’re hunting for a free token, comparing fees on a new exchange, or trying to understand how tokenized stocks work, the resources here are built to give you actionable insight right now.

Get the real facts on the BABYDB airdrop, why it doesn't exist, and how the genuine PAWS token airdrop from BabyDoge works. Learn verification steps and avoid scams.

- Read More

- May, 24 2025