AirSwap Crypto Exchange Review: Features, Fees, and Future Outlook

AirSwap vs. Uniswap Comparison Tool

Use this tool to compare key features of AirSwap and Uniswap:

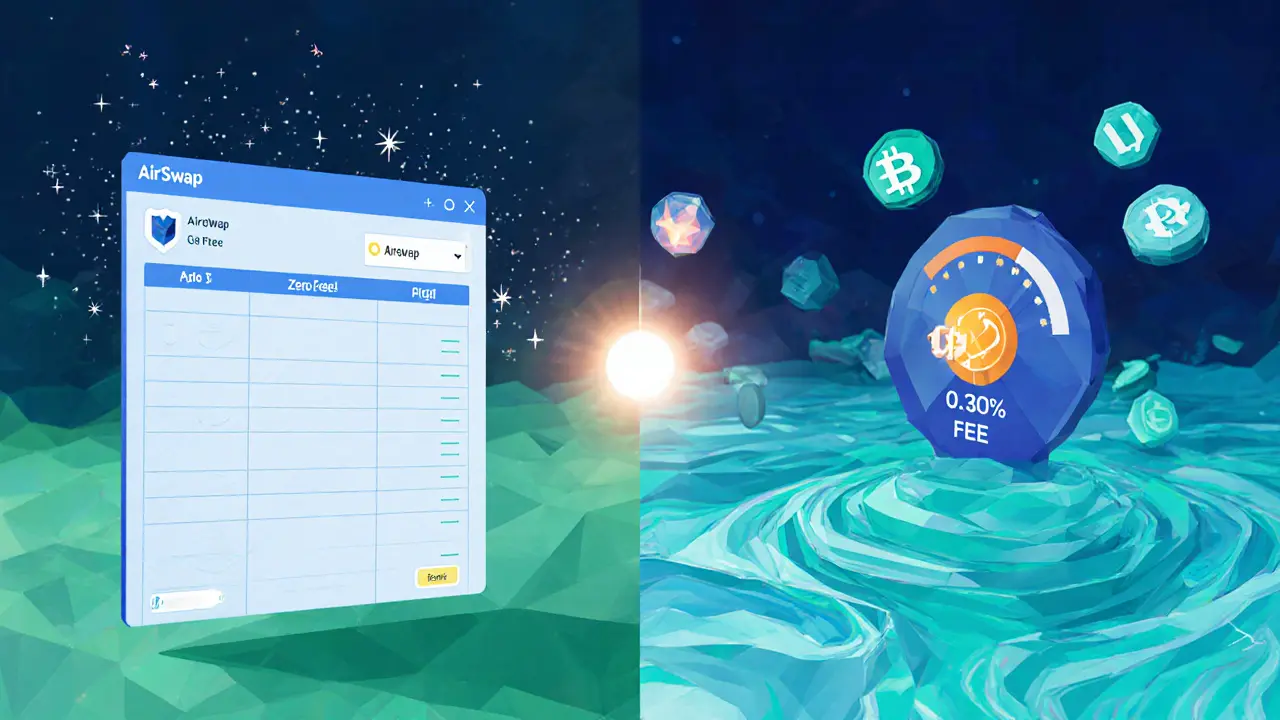

| Feature | AirSwap | Uniswap |

|---|---|---|

| Trading Fees | 0% | 0.30% |

| Gas Costs | Often subsidized (gas-free) | Paid by user |

| Liquidity | Low - thin order books | High - millions in daily volume |

| KYC Requirement | None | None |

| Supported Devices | Web, iOS, Android, desktop OSes | Web, iOS, Android |

| Advanced Features | Basic swaps only | Liquidity pools, routing, LP rewards |

Which DEX is right for you?

Select your priorities to get personalized recommendations:

Your Recommendation:

Estimate Your Trading Costs

Compare trading costs between AirSwap and Uniswap:

Estimated Trading Costs:

Quick Summary

- Zero trading fees and gas‑free swaps set AirSwap apart from most DEXes.

- Non‑custodial, no KYC - you keep full control of your funds.

- Liquidity is thin; daily volume often stays below $200k.

- Compared with Uniswap, AirSwap is cheaper but slower and less liquid.

- AST token price forecasts are mixed, with modest upside by 2028.

What is AirSwap?

AirSwap is a decentralized cryptocurrency exchange (DEX) that lets users trade ERC‑20 tokens directly from their wallets without depositing funds on a custodial platform. Launched in 2017, the service runs on the Ethereum blockchain and relies on a peer‑to‑peer swap protocol. Because there’s no central order book, trades are executed via smart contracts that match two parties willing to exchange assets at an agreed price.

How AirSwap Works

Trading on AirSwap follows a simple three‑step flow:

- Connect your Ethereum‑compatible wallet (MetaMask, WalletConnect, etc.).

- Search for the token you want to receive; the platform shows price quotes from other users.

- Accept a quote, and the Swap Protocol creates a temporary smart contract that swaps the assets atomically.

The protocol includes an optional oracle to improve price discovery for low‑liquidity pairs. Most swaps are advertised as “gas‑free” because the protocol can subsidize the gas cost when the counter‑party includes it in the quote, effectively making the user’s experience fee‑less.

Key Advantages

- Zero fees: No trading, deposit, or withdrawal fees.

- Non‑custodial: Your private keys never leave your wallet.

- No KYC or account creation - trade anonymously.

- Instant settlement once both parties sign the contract.

- Broad device support (web, iOS, Android, Windows, macOS, Linux).

Drawbacks to Consider

- Liquidity is limited; many token pairs have wide spreads.

- Settlement can be slower than centralized exchanges because it waits for a counter‑party.

- Interface is English‑only, which hurts international adoption.

- No advanced order types (margin, futures, stop‑loss).

- Daily trading volume is under $200k, far behind leaders like Uniswap.

AirSwap vs. Major DEXes

| Feature | AirSwap | Uniswap |

|---|---|---|

| Trading Fees | 0% (zero fees) | 0.30% per swap |

| Gas Costs | Often subsidized (gas‑free swaps) | Paid by user (Ethereum gas) |

| Liquidity | Low - thin order books | High - millions in daily volume |

| KYC Requirement | None | None |

| Supported Devices | Web, iOS, Android, desktop OSes | Web, iOS, Android |

| Advanced Features | Basic swaps only | Liquidity pools, routing, LP rewards |

If you need the cheapest possible trade and can tolerate lower liquidity, AirSwap shines. If you want deep liquidity and advanced DeFi features, Uniswap remains the go‑to platform.

AirSwap Token (AST) Outlook

The platform’s native token, AST, is used for governance and fee rebates. Price forecasts for 2025 vary widely: some analysts see it near $0.02, while others project up to $0.30. By 2028 most models agree on modest growth in the $0.03-$0.05 range, implying single‑digit annual returns. The token’s future hinges on whether AirSwap can revive activity; without higher volume, staking rewards and utility stay limited.

User Experience & Security

Because AirSwap is built on smart contracts, every trade is executed exactly as programmed. Audits have shown no backdoors, and the open‑source code allows anyone to verify security. Users only need a compatible wallet and a small amount of ETH for gas (if the swap isn’t fully subsidized). The platform’s support team offers email and chat during business hours, but community resources (forums, guides) are sparse compared with larger DEX ecosystems.

Future Outlook

As of October 2025, AirSwap remains technically functional but suffers from dwindling daily volume. The development team is working on language expansion and UI tweaks, yet no major roadmap items (e.g., liquidity incentives, layer‑2 integration) have been announced. In a market where DEX volume tops hundreds of billions, AirSwap’s niche will likely stay confined to privacy‑focused traders who value zero fees over speed and depth. Without a liquidity‑boosting strategy, the platform may continue to serve a small, dedicated user base rather than expand mainstream.

Frequently Asked Questions

Is AirSwap really free to use?

Yes. AirSwap charges 0% trading fees and does not levy deposit or withdrawal fees. Most swaps are advertised as gas‑free, though you still need a tiny amount of ETH if the counter‑party does not cover the gas.

Do I need to create an account or verify my identity?

No. You simply connect a wallet like MetaMask and start swapping. There is no KYC, no email sign‑up, and no personal data collected.

What wallets are compatible with AirSwap?

Any Ethereum‑compatible wallet works - MetaMask, WalletConnect, Coinbase Wallet, Trust Wallet, and hardware wallets like Ledger or Trezor.

How does liquidity on AirSwap compare to larger DEXes?

Liquidity is considerably lower. Daily volume often stays under $200k, and many token pairs have wide price spreads. By contrast, Uniswap processes billions daily.

Can I trade non‑ERC‑20 assets on AirSwap?

Currently AirSwap supports Ethereum‑based ERC‑20 tokens only. No Bitcoin, Solana, or other chain assets are directly tradeable.

Is there a way to earn rewards with the AST token?

AST can be staked for modest governance rewards, but the return rates are low unless the platform revives higher trading activity.

MD Razu

November 28, 2024 AT 15:24When one contemplates the notion of “zero fee” in a decentralized exchange, the mind drifts toward the paradox of costless exchange in a world where every transaction consumes computational resources.

AirSwap’s claim of a 0% trading fee is indeed an alluring proposition, yet it masks the implicit subsidies that are often shouldered by the protocol’s liquidity providers.

In the grand tapestry of on‑chain economics, the gas fees that users pay to execute swaps become the silent tax that underwrites the promise of fee‑free trading.

Moreover, the thin order books observed on AirSwap introduce a hidden slippage cost, which can erode the apparent savings from the nominal fee structure.

One must also consider the opportunity cost of capital being locked in less liquid markets, a factor that the simple fee table fails to capture.

From a philosophical perspective, the quest for “no fees” mirrors the human desire for utopia, a state that exists only in abstract theory.

Yet when the protocol’s architecture is scrutinized, it becomes evident that the cost is simply transferred from the exchange to the user in another guise.

Liquidity, therefore, is the true price of freedom in decentralized finance, and AirSwap’s lower liquidity relative to Uniswap imposes a premium on execution certainty.

For a trader whose primary metric is the headline fee percentage, AirSwap may appear as a beacon of salvation, but for the seasoned strategist, the hidden variables dominate the decision matrix.

Furthermore, the regulatory landscape poses an external risk; while AirSwap does not require KYC, the same anonymity can attract illicit activity, potentially drawing scrutiny that could disrupt the platform’s continuity.

In practice, the cost of gas on congested networks can eclipse the advertised fee, especially for smaller trades where the fixed gas price represents a larger fraction of the trade value.

Thus, the “zero fee” claim should be contextualized within the broader ecosystem of network fees, liquidity depth, and slippage risks.

When evaluating the platform, one should construct a holistic model that integrates on‑chain gas costs, price impact, and the probability of order fulfillment within a desired time frame.

Only then can the true economic efficiency of AirSwap be measured against its more liquid counterpart, Uniswap.

In summary, the allure of zero fees is a compelling narrative, but like all narratives, it must be dissected with rigorous analysis to separate illusion from reality.

Charles Banks Jr.

November 30, 2024 AT 22:58Zero fees? Yeah, sure, if you love watching your transaction sit in a thin order book forever while the network fees bleed you dry.

Uniswap’s 0.30% may feel like a tax, but at least you get instant fills and deep pools.

AirSwap’s “gas‑free” vibe is cute until you realize the liquidity is so sparse you might as well be trading with a hamster.

Honestly, if you’re just swapping a few dollars, the difference is negligible.

Pick the platform that actually moves your assets without a marathon of waiting.

Lindsay Miller

December 3, 2024 AT 06:31AirSwap’s zero fee is appealing for small, casual swaps.

Waynne Kilian

December 5, 2024 AT 14:04yeah but even a tiny fee can pile up if you trade a lot, and the low liquidity on airs wap might make you pay more in slippage.

april harper

December 7, 2024 AT 21:38The drama of fee‑free trading is a siren song that lulls the novice into a false sense of security.

Behind the curtain, the market’s thinness whispers threats of missed opportunities.

While the headline dazzles, the underlying mechanics demand respect.

Choose wisely, lest the allure become a lament.

Kate Nicholls

December 10, 2024 AT 05:11When dissecting DEX options, one must weigh not only the advertised fee schedule but also the systemic resilience of the platform.

Uniswap’s proven liquidity depth offers a safety net that AirSwap currently lacks.

The absence of KYC on both sides is a plus for privacy, yet it does not compensate for execution risk.

For traders prioritizing capital efficiency, Uniswap remains the more reliable venue.

The fee differential, while noteworthy, is secondary to order fulfillment certainty.

Thus, assess both price impact and network conditions before committing.

Carl Robertson

December 12, 2024 AT 12:44oh please, you’re just scared of change because you cling to the familiar.

AirSwap may be small now, but “big” isn’t always better-centralization of liquidity can lead to hidden manipulation.

Don’t let the “proved” label blind you to the fact that deep pools often mean you’re just feeding whales.

VICKIE MALBRUE

December 14, 2024 AT 20:18Zero fees can be a great way to start experimenting with DeFi without worrying about extra costs.

Naomi Snelling

December 17, 2024 AT 03:51Everyone talks about “free” trades but forget that the real cost is data harvested by the hidden hands behind the scenes.

The lack of KYC is marketed as privacy, yet it’s a perfect cover for surveillance.

Stay alert, the platform could be a sandbox for larger schemes.

Michael Wilkinson

December 19, 2024 AT 11:24While caution is wise, the technical reality is that AirSwap’s smart contracts are open source and auditable, offering genuine privacy without hidden agendas.

Billy Krzemien

December 21, 2024 AT 18:58For newcomers, it’s useful to compare the total cost of a trade: include the on‑chain gas fee, the quoted exchange fee, and any potential slippage.

By running a simple spreadsheet, you can see whether the zero‑fee model truly saves money in different market conditions.

Clint Barnett

December 24, 2024 AT 02:31Picture this: you’re navigating a bustling marketplace where each stall offers a different flavor of freedom.

AirSwap’s zero‑fee banner shines like a neon sign promising no hidden charges, while Uniswap’s deep pools ripple with confidence and volume.

If you’re the type who loves experimenting, the novelty of swapping on a platform that subsidizes gas can feel like a secret handshake among the crypto‑savvy.

However, remember that every marketplace has its quirks-thin order books can mean you wait longer for a match, and the price you receive may drift as the limited liquidity absorbs your order.

On the other hand, Uniswap’s robust liquidity ensures rapid fills, but the 0.30% fee stacks up over time, especially for high‑frequency traders.

So the choice really hinges on your personal trading style: are you a cautious voyager who values speed and depth, or a cost‑conscious explorer who doesn’t mind a slower, more intimate trade?

Either way, the ecosystem thrives because of this diversity, and your experience adds to the collective knowledge.

Jacob Anderson

December 26, 2024 AT 10:04Sure, “zero fees” sounds like a dream, but in practice it’s just another marketing gimmick that hides the real cost of low liquidity.

Kate Roberge

December 28, 2024 AT 17:38maybe the gimmick is exactly what the market needs – a reminder that not every platform has to chase the biggest volume to stay relevant.

Jason Brittin

December 31, 2024 AT 01:11Looks like we’ve got the fee‑free brigade and the deep‑liquidity loyalists duking it out – guess we’ll see who ends up with the better ROI 🙃.