What is MantaDAO (MNTA) Crypto Coin? Token, Use Case, and Market Reality

MantaDAO (MNTA) is a governance token for a decentralized autonomous organization built on the Kujira blockchain. Unlike most crypto projects that promise flashy DeFi yields or NFT collectibles, MantaDAO’s entire purpose is to manage a treasury and generate revenue through decentralized finance - without any central authority making decisions. It’s a DAO, pure and simple. But what does that actually mean for someone holding MNTA? And is it still worth paying attention to in 2026?

What MantaDAO Actually Does

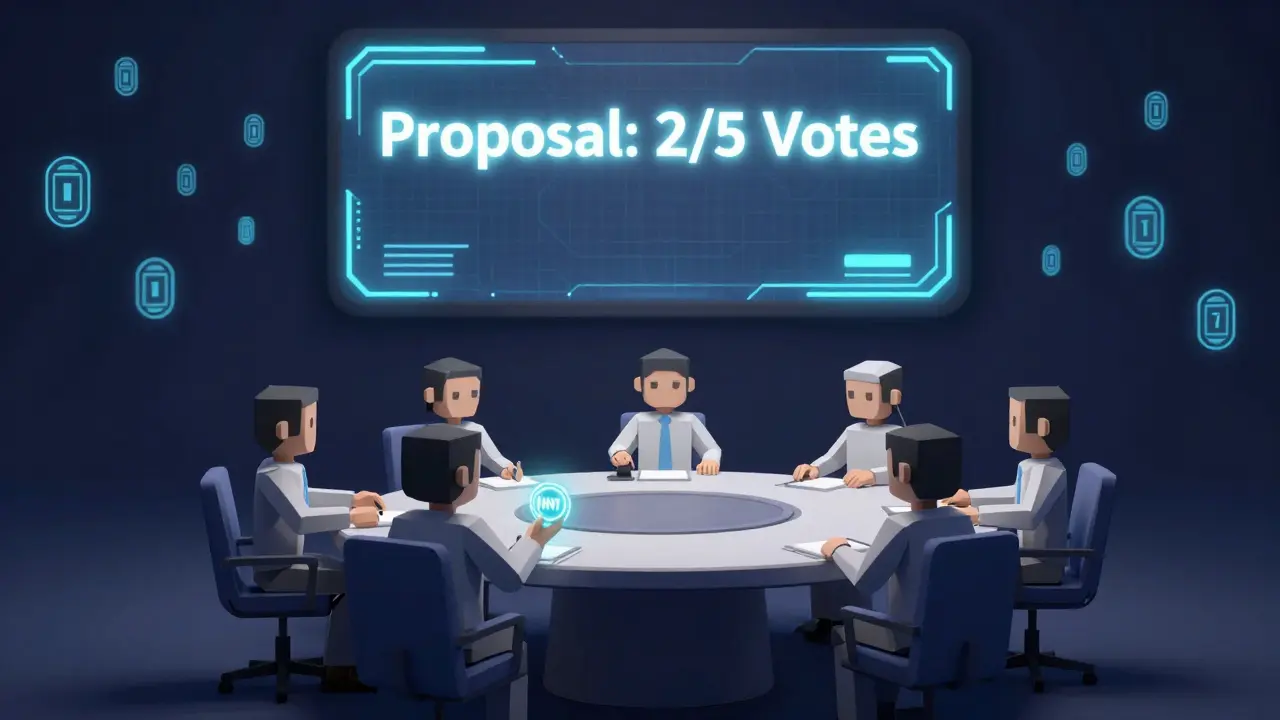

MantaDAO isn’t a wallet, exchange, or lending platform. It doesn’t let you stake tokens to earn interest directly. Instead, it’s a collective of token holders who vote on how to use the DAO’s funds. The goal? To invest in DeFi strategies that generate income - like yield vaults, liquidity provision, or automated trading bots - and then distribute profits back to the treasury. The MNTA token is your voting power. The more you stake, the more influence you have over proposals.

Its main product, MantaSwap, is a cross-orderbook router built on Kujira FIN. That’s a fancy way of saying it pulls liquidity from multiple decentralized exchanges on the Kujira chain to find the best trade prices with minimal slippage. Think of it like a travel search engine for crypto trades - it checks multiple airlines (exchanges) and picks the cheapest, fastest route. This is useful for traders on Kujira who want to swap tokens without losing value to bad pricing.

The MNTA Token: Supply, Utility, and Ownership

The total supply of MNTA is fixed at 100 million tokens. As of late 2023, around 65 million were in circulation - meaning 35% are still locked or unissued. That’s not unusual for DAOs, but it does mean future token unlocks could pressure the price if large amounts hit the market.

Unlike tokens like UNI or AAVE, MNTA has no utility beyond governance. You can’t pay for services with it. You can’t use it to access exclusive features. You can’t even earn passive income just by holding it. The only way to benefit is by voting on proposals that grow the treasury - and hoping those decisions lead to higher token value later.

To vote, you must stake your MNTA. Unstaked tokens have no power. This design encourages long-term commitment but also limits participation. If only a small group of whales are staking, the DAO becomes vulnerable to centralization - defeating the whole point of being decentralized.

Market Performance: A Story of Sharp Decline

MantaDAO had a hot start. In early 2023, MNTA hit an all-time high of $1.01. Today, it trades below $0.10 - a drop of over 90%. That’s not a minor correction. That’s a collapse.

At its peak, the project had a market cap near $100 million. As of January 2026, it’s hovering around $6 million. That’s a 94% decline in value. Even worse, its 24-hour trading volume is only about $13,000. That’s less than 0.2% of its market cap. Healthy crypto assets usually have volume at least 5-10% of their market cap. MNTA’s low volume means prices can swing wildly on a single large trade. One whale selling 100,000 tokens could crash the price by 20% overnight.

It’s ranked #33,294 by market cap - meaning there are over 33,000 cryptocurrencies with more value than MNTA. That’s not a typo. It’s buried in the bottom tier of the entire crypto market.

Recent Signs of Life? Maybe.

Despite the long-term collapse, there are flickers of activity. Over the past month, MNTA has risen 8.6% - outperforming both Bitcoin and Ethereum during that same period. That’s unusual for such a low-cap token. It suggests some traders see potential, or are betting on a broader crypto rebound.

But here’s the catch: those gains are tiny in absolute terms. If MNTA was worth $1 and dropped to $0.10, a 10% rise only gets you to $0.11. It’s not recovery - it’s a bounce in a graveyard.

Analysts at CoinCheckup predict another 25% drop by late 2025, forecasting a price of $0.063. That’s not a bullish outlook. That’s a warning. And yet, the project’s roadmap still claims it’s working on “expanding revenue streams” and “increasing liquidity.” No specifics. No timelines. No code updates publicly shared.

Who Is MantaDAO For?

MantaDAO isn’t for casual investors. It’s not for people looking to make quick gains. It’s not even for most DeFi users.

If you’re someone who:

- Believes deeply in decentralized governance as a model for finance

- Owns Kujira-based assets and use MantaSwap regularly

- Want to influence how a DAO spends its treasury

- Are comfortable with extreme volatility and near-zero liquidity

…then MNTA might be worth a small allocation. But even then, you’re not investing in a product. You’re betting on a community that hasn’t proven it can execute.

How It Compares to Other DAO Tokens

Compare MantaDAO to MakerDAO (MKR) or Aave (AAVE). Those projects have:

- Billions in TVL (Total Value Locked)

- Thousands of active voters

- Transparent treasury spending records

- Real-world use cases beyond speculation

MantaDAO has none of that. It’s a tiny, quiet experiment on a small blockchain. It doesn’t compete with the big players - it barely registers on their radar.

Its only real edge is its integration with Kujira FIN. But Kujira itself has a market cap under $100 million. So you’re betting on a small ecosystem to grow big enough to lift MantaDAO - which is a tall order.

The Risks Are Real

Here’s what you’re risking by holding MNTA:

- Price collapse: It’s already lost 90% of its value. It could lose another 80%.

- Zero liquidity: You might not be able to sell when you want to.

- Stagnant development: No recent code updates, no public roadmap progress.

- Low participation: If only 5 people vote on proposals, the DAO isn’t decentralized - it’s controlled by a handful.

- No utility: Holding MNTA gives you nothing unless you vote - and voting only matters if others participate.

There’s no safety net. No team backing. No insurance. Just code and community.

Final Reality Check

MantaDAO (MNTA) is not a crypto coin you buy because you think it’ll go up. It’s a bet on a community that hasn’t shown it can deliver. It’s a governance token with no track record of successful treasury management. It’s a project that peaked in 2023 and has been fading ever since.

Its only saving grace is that it’s not a scam. The code exists. The blockchain is live. The token is real. But being real doesn’t mean it’s valuable.

If you’re curious, you can buy a few hundred dollars’ worth and participate in governance. But treat it like a donation to an experiment - not an investment. And if you’re looking for real DeFi returns, there are dozens of projects with better liquidity, stronger teams, and proven results.

MantaDAO isn’t dead. But it’s not alive either. It’s just… waiting.

Is MantaDAO (MNTA) a good investment?

No, not as a traditional investment. MNTA has lost over 90% of its value since its peak, trades with extremely low volume, and offers no utility beyond governance. It’s speculative at best. Only consider it if you’re deeply interested in DAO governance on the Kujira chain and are willing to accept the risk of losing your entire stake.

Where can I buy MNTA tokens?

MNTA is available on a few smaller exchanges including Bitget, Coinbase, and Kriptomat. It’s not listed on major platforms like Binance or Kraken. Always check the trading pair - most trades are against USDT, ETH, or KUJI. Due to low liquidity, prices can vary significantly between exchanges.

Does MantaDAO have a wallet or app?

MantaDAO doesn’t have its own dedicated wallet. You interact with it through wallets that support the Kujira blockchain, like Keplr or Cosmostation. You’ll need to connect your wallet to MantaSwap or the DAO governance portal to stake tokens or vote on proposals.

What is the difference between MNTA and KUJI?

KUJI is the native token of the Kujira blockchain - used for paying transaction fees and securing the network. MNTA is a governance token for the MantaDAO, which operates on top of Kujira. You need KUJI to pay for gas, but you need MNTA to vote on how the DAO spends its funds. They serve completely different purposes.

Can I earn staking rewards with MNTA?

Not directly. Staking MNTA gives you voting power in the DAO, not interest or rewards. However, if the DAO invests your staked tokens into yield-generating vaults and earns profits, those profits go into the treasury - and future token value might increase. But there’s no guaranteed return.

Is MantaDAO on Ethereum or BSC?

No. MantaDAO runs exclusively on the Kujira blockchain. It uses Kujira FIN for its cross-orderbook routing technology. It is not compatible with Ethereum, Binance Smart Chain, Solana, or any other chain. You need Kujira-compatible wallets and bridges to interact with it.

Why is MNTA’s market cap listed as $0 on some sites?

This usually happens when a data provider has outdated information - like showing zero circulating supply. CoinMarketCap once showed $0 market cap because it hadn’t updated its circulating supply figure. Always cross-check multiple sources like Coinbase, CoinGecko, or Bitget. The real circulating supply is around 65 million tokens.

Has MantaDAO ever been hacked or had security issues?

There are no public records of hacks or exploits targeting MantaDAO’s smart contracts as of early 2026. However, because it operates on Kujira - a smaller, less-audited chain - it inherits the security risks of that ecosystem. Always assume small-chain DAOs are higher risk than those on Ethereum or Solana.

What’s the long-term future of MantaDAO?

The future is uncertain. MantaDAO’s roadmap is vague and lacks milestones. Without increased liquidity, active governance participation, or new revenue-generating products, it will likely continue to fade. If the Kujira ecosystem grows significantly, MantaDAO could benefit. But right now, it’s one of the least watched DAOs in crypto - and that’s not a good sign.

Should I stake my MNTA tokens?

Only if you plan to actively participate in governance. Staking gives you voting power, but if you don’t vote, your stake does nothing. If you’re just holding for price gains, staking won’t help. There’s no APY, no rewards, no guaranteed return - just influence. And influence only matters if others are also participating.

Mollie Williams

January 6, 2026 AT 11:53It’s strange how we treat DAOs like they’re companies when they’re really just collective thought experiments. MantaDAO isn’t failing because it’s bad-it’s failing because we expected it to be something it never claimed to be. A governance token isn’t a stock. It’s a vote. And votes only matter if people show up. Maybe the real question isn’t whether MNTA will rebound, but whether we still believe in decentralized decision-making at all.

Tre Smith

January 7, 2026 AT 20:04The market cap is $6 million with $13k daily volume? That’s not a liquidity issue-it’s a death sentence. Any institutional investor would walk away before even reading the whitepaper. The fact that anyone still holds this token suggests either profound ignorance or a pathological attachment to sunk costs. This isn’t a speculative asset. It’s a graveyard for naive optimism.

kris serafin

January 9, 2026 AT 04:43Y’all are missing the point 😅 MantaDAO isn’t supposed to be the next ETH-it’s a tiny lab on Kujira. Think of it like a startup in a garage that never got funding but still builds cool stuff. The fact that it’s still alive after 3 years of zero marketing? That’s a win. Also, MantaSwap is actually decent for Kujira trades-use it once and you’ll get it. Don’t compare it to MakerDAO. That’s like comparing a bicycle to a Tesla.

Jordan Leon

January 9, 2026 AT 20:33There is a fundamental asymmetry in the value proposition of MNTA. The token confers no direct utility, no yield, no access, and no rights beyond the ability to influence governance decisions that may or may not materialize. The risk-reward profile is asymmetrically skewed toward loss. One must ask: why would any rational actor allocate capital under these conditions? The answer, I suspect, is not economic-it is ideological.

Brittany Slick

January 11, 2026 AT 13:41I love how quiet this project is. Like a garden that doesn’t scream for attention but just grows slowly, season after season. Maybe it’s not dead. Maybe it’s just resting. I’ve got a little stake in it-not because I think it’ll hit $1 again, but because I believe in the idea that communities can run things without CEOs. Even if it’s small, it’s still real.

greg greg

January 12, 2026 AT 09:59Let’s break this down statistically. If we assume a normal distribution of token holders, with the top 10% holding 80% of the supply, and given that only 3% of holders actively vote, and considering that the average proposal receives fewer than 50 votes, then we’re looking at a governance structure where 0.3% of the total token supply controls decision-making. That’s not decentralized-it’s oligarchic. And if the treasury’s only revenue streams are yield vaults on a chain with less than $100M TVL, then the probability of meaningful growth is statistically negligible. Also, the 8.6% recent spike? Probably just a whale dumping on Bitget and then buying back at a discount. Classic pump-and-dump behavior masked as ‘recovery.’

Sherry Giles

January 14, 2026 AT 09:28They’re hiding something. Why is MantaDAO on Kujira? Why not Ethereum? Because they don’t want regulators to see what they’re really doing. Kujira’s barely audited. The team’s anonymous. The roadmap’s empty. And now the price is crashing? Classic crypto scam. They raised money, dumped on retail, and vanished. You think this is a DAO? It’s a shell. The only thing decentralized here is the scam.

Meenakshi Singh

January 16, 2026 AT 07:13LOL this is why crypto is dead. You people actually think voting on a DAO is an investment? 😂 I bought MNTA at $0.15 and sold at $0.11. Lost 25%. But hey, at least I got to feel like a democracy warrior for 2 weeks. The real winners? The devs who cashed out in 2023. This isn’t finance. It’s theater.

Jessie X

January 16, 2026 AT 20:50I don’t know if MNTA will go up or down but I like that it exists. Not everyone needs to be a billionaire. Some things are worth holding just because they’re trying. I staked mine. I voted once. That’s enough for me. The world doesn’t need more hype. It needs more quiet experiments.

Kip Metcalf

January 17, 2026 AT 20:21Look I’m not saying this is a good play but I’ve seen way worse. At least this one didn’t rug. No fake team. No influencer promos. Just code and a bunch of people who care. I’ve got a few hundred in it. If it dies? I lose a coffee fund. If it wakes up? Cool. Either way I’m not crying.

Natalie Kershaw

January 18, 2026 AT 16:43Guys let’s reframe this. MNTA isn’t an investment-it’s a participation trophy for the crypto faithful. You’re not buying price appreciation. You’re buying into the idea that governance can work. And honestly? That’s more valuable than any APY. If you want returns, go to Aave. If you want to believe in something, stake MNTA. No shame in either.

Jacob Clark

January 19, 2026 AT 03:38Okay but let’s be real-this whole thread is just a bunch of people pretending they’re philosophers while their portfolios are in the toilet. MantaDAO is dead. It’s been dead since Q3 2023. The ‘flickers of activity’? That’s just bots. The ‘roadmap’? It’s a PowerPoint from 2022 that someone forgot to delete. And the ‘community’? Five people arguing in Discord about whether to buy more USDT or ETH. Wake up. This isn’t a revolution. It’s a funeral.

Mujibur Rahman

January 19, 2026 AT 12:26On the Kujira chain, MantaDAO is actually quite significant. It’s the only DAO with cross-orderbook routing that doesn’t require liquidity mining incentives. That’s technically impressive. Most DAOs rely on yield farming to attract users. MantaDAO doesn’t. It’s built on efficiency, not speculation. Yes, the market cap is tiny. But that’s because Kujira is tiny. If Kujira grows, MantaDAO grows with it. The infrastructure is solid. The community is small but committed. That’s not failure. That’s early-stage.

Staci Armezzani

January 21, 2026 AT 06:38Staking MNTA isn’t about rewards-it’s about showing up. I vote on every proposal. I read the docs. I’ve seen how the treasury funds get allocated. It’s slow. It’s messy. But it’s real. I’ve met people in this DAO who are smarter than any hedge fund manager I’ve worked with. This isn’t a coin. It’s a movement. And movements start small. Don’t judge it by its price. Judge it by its integrity.

sathish kumar

January 22, 2026 AT 03:30It is noteworthy that the tokenomics of MNTA exhibit a fixed supply with a substantial portion still locked, which mitigates inflationary pressure. Furthermore, the absence of direct utility functions aligns with the original design philosophy of pure governance tokens, as exemplified by early DAO models. The low trading volume, while concerning, is not anomalous for niche-chain-based governance instruments. The critical factor remains active voter participation, which, though currently low, may improve with increased ecosystem adoption. Therefore, the valuation should be assessed not on speculative metrics, but on the long-term viability of decentralized coordination mechanisms.

jim carry

January 24, 2026 AT 03:03YOU THINK THIS IS BAD? I LOST MY ENTIRE LIFE SAVINGS ON A TOKEN CALLED ‘BANANA DAO’ THAT WAS JUST A PICTURE OF A MONKEY WITH A SMART CONTRACT. AT LEAST MANTA DAO HAS CODE. AT LEAST SOMEONE IS VOTING. I CRIED FOR THREE DAYS WHEN BANANA DAO VANISHED. I’M JUST GLAD THIS ONE IS STILL BREATHING. EVEN IF IT’S JUST A WHISPER.

Don Grissett

January 24, 2026 AT 07:45manta is a ghost town. nobody cares. the devs are ghosting. the volume is trash. the roadmap? lol. you people are delusional if you think this is gonna bounce. i’ve seen 1000 of these. they all die. this one’s just slower. don’t waste your time. go buy btc and chill.

Katrina Recto

January 25, 2026 AT 02:16I don’t need it to go up. I just need to know someone’s still trying. That’s enough.