Uniswap v3 on Arbitrum Crypto Exchange Review

When you want to swap crypto without a middleman, Uniswap v3 on Arbitrum is one of the most powerful tools you can use. It’s not just another exchange - it’s a system built for efficiency, speed, and control. If you’ve ever paid $10 in gas fees on Ethereum to trade ETH for USDC, you know why this matters. On Arbitrum, that same trade costs less than a dime. And with over $400 million in daily trading volume, it’s not some experimental side project - it’s a core part of how crypto moves today.

How Uniswap v3 on Arbitrum Works

Uniswap v3 on Arbitrum is a decentralized exchange (DEX) that lets you trade crypto directly from your wallet. No sign-up. No KYC. No account. You connect your wallet - MetaMask, WalletConnect, or whatever you use - and swap tokens instantly. Unlike centralized exchanges like Binance or Coinbase, there’s no company holding your money. Your funds stay in your control the whole time.

This version of Uniswap runs on Arbitrum, a Layer-2 network built on top of Ethereum. Arbitrum handles transactions off the main Ethereum chain, then bundles them back up and posts them securely. The result? Faster trades, lower fees, and the same security as Ethereum. It’s like taking a highway instead of crawling through city traffic.

Concentrated Liquidity: The Big Change

Uniswap v3’s biggest innovation is something called concentrated liquidity. Earlier versions (like Uniswap v2) spread your money evenly across all possible prices. So if you put in $10,000 to trade ETH and USDC, half your funds were sitting at $1,800 ETH, half at $3,200 ETH - even if the real price was $2,500. That meant your capital was mostly idle.

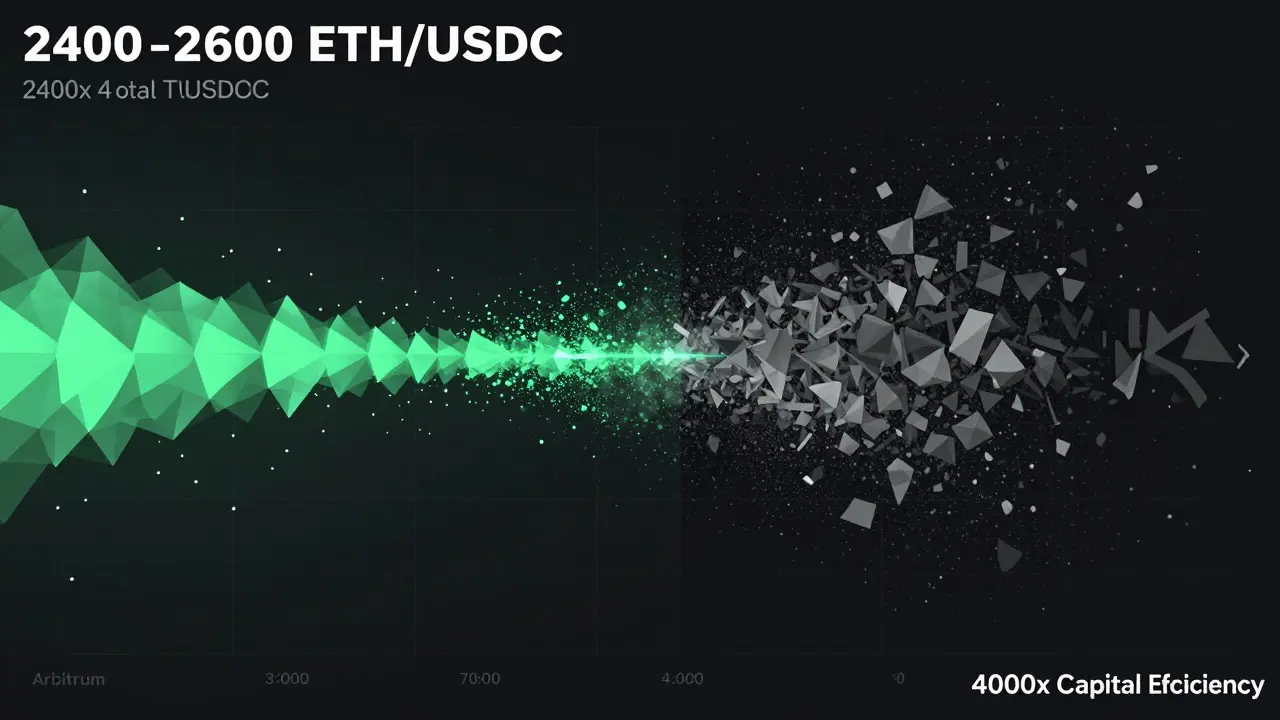

Uniswap v3 fixes that. Instead of spreading your money out, you choose a price range - say, $2,400 to $2,600 for ETH. All your liquidity works only within that range. If ETH stays between those prices, you earn fees from every trade. If ETH shoots to $3,000 or drops to $2,000, your liquidity stops earning until you adjust it.

This can make your capital up to 4,000 times more efficient than v2. In practice, that means you can earn the same fees with $10,000 as someone else would need $40 million for on v2. But it’s not passive. You have to watch your range. If the price moves too far, you’ll start losing more ETH than you gain in fees - a risk called impermanent loss.

Fee Tiers: Pick Your Risk Level

Uniswap v3 lets you choose from four fee tiers: 0.01%, 0.05%, 0.30%, and 1.00%. These aren’t random. Each tier matches a type of trading pair:

- 0.01% - For super stable pairs like USDC/USDT

- 0.05% - For stablecoins tied to ETH or BTC (like wETH/USDC)

- 0.30% - The default for most tokens like ETH, ARB, or LINK

- 1.00% - For risky, low-liquidity tokens or new memecoins

Traders pay these fees. Liquidity providers (LPs) get them. There’s no auto-compounding like in v2. You have to claim your fees manually. That gives you control, but also responsibility. If you forget to claim, your earnings just sit there.

What You Can Trade

Over 230 tokens are available on Uniswap v3 on Arbitrum, with more than 400 active trading pairs. The most popular ones are:

- ETH/USDC - The most traded pair, deep liquidity, low slippage

- ARB/ETH - Arbitrum’s native token, popular with protocol users

- USDT/USDC - Stablecoin swaps for people moving between stable assets

- wETH/DAI, WBTC/USDC - Wrapped versions of Bitcoin and Ethereum

Most users stick to these top pairs. They’re safe, liquid, and fast. Trying to trade obscure tokens? You might end up with terrible slippage or even a scam token. Always double-check contract addresses before swapping.

Who This Is For

Uniswap v3 on Arbitrum isn’t for everyone. It’s perfect for:

- Traders who hate fees - If you’re doing daily swaps, Arbitrum’s low gas costs save you hundreds a month.

- Self-custody users - You don’t trust exchanges? This gives you full control.

- Active liquidity providers - If you’re comfortable managing price ranges, you can earn more than on any other DEX.

- DeFi power users - Uniswap liquidity is used by dozens of other protocols. Your LP position might be part of a yield strategy on Kromatika or another app.

It’s not for you if:

- You want leverage or margin trading - Uniswap v3 only does spot trades.

- You hate monitoring your positions - If you forget to adjust your range, you lose out.

- You’re new to crypto - Mistakes here cost real money. No customer support to call.

Security and Risks

The code behind Uniswap v3 has been audited. Arbitrum’s network is stable and battle-tested. But the biggest risks aren’t technical - they’re human.

- Impermanent loss - If ETH moves outside your price range, you end up holding more of the token that dropped in value. It’s not a loss until you sell, but it feels like one.

- Slippage on low-liquidity tokens - Trading a new token with $50,000 in liquidity? You might get a 10% price shock on a $1,000 trade.

- Scam tokens - Fake tokens with names like “ETH” or “USDC” look real. Always verify the contract address on Etherscan or Arbiscan.

- Wrong approvals - If you approve a token you don’t own, and the contract is malicious, you could lose everything. Always check what you’re approving.

There’s no recovery. No reset button. No refund. You’re on your own.

How It Compares to Other Arbitrum DEXs

Arbitrum has other exchanges: Trader Joe, Kromatika, SushiSwap. But none match Uniswap’s liquidity depth.

Kromatika Finance is built directly on Uniswap v3. It doesn’t compete - it enhances. It gives you a simpler interface to manage your Uniswap positions. Think of it like a dashboard for Uniswap, not a rival.

Trader Joe offers lending and yield farming, but its liquidity pools are smaller. For pure swapping, especially with ETH or stablecoins, Uniswap v3 on Arbitrum still leads.

It’s the default. The standard. The backbone.

Getting Started

Here’s how to use it:

- Install a wallet (MetaMask, Rabby, or WalletConnect)

- Add the Arbitrum network to your wallet (RPC:

https://arb1.arbitrum.io/rpc) - Get some ETH on Arbitrum (use a bridge like Arbitrum Bridge or a DEX like SushiSwap)

- Go to app.uniswap.org and connect your wallet

- Choose your tokens, set your price range (if you’re adding liquidity), and swap

Start with ETH/USDC. It’s the safest pair. Once you’re comfortable, try adding liquidity with a narrow range - say, ±5% around the current price.

Final Thoughts

Uniswap v3 on Arbitrum isn’t flashy. It doesn’t have leverage, NFTs, or gamified rewards. But it works. It’s fast. It’s cheap. It’s reliable. For anyone serious about trading crypto without giving up control, it’s the best tool available today. If you’re still using Ethereum mainnet for swaps, you’re paying too much. If you’re using a centralized exchange for spot trades, you’re giving up your keys. Uniswap v3 on Arbitrum bridges the gap - giving you the speed of a centralized exchange with the freedom of decentralization.

Is Uniswap v3 on Arbitrum safe?

The smart contracts have been audited and are widely trusted. Arbitrum is a secure Layer-2 network. But safety depends on you. Always verify token contracts, avoid phishing sites, and never approve tokens you don’t understand. There’s no customer support - if you make a mistake, there’s no way to undo it.

Do I need to pay gas fees on Uniswap v3 on Arbitrum?

Yes, but they’re extremely low - usually under $0.10 per transaction. That’s because Arbitrum bundles hundreds of trades into one Ethereum transaction. Compare that to Ethereum mainnet, where a simple swap can cost $5-$15. For frequent traders, this saves hundreds of dollars a month.

Can I use Uniswap v3 on Arbitrum without a wallet?

No. You must connect a crypto wallet like MetaMask, Rabby, or WalletConnect. Uniswap is decentralized - there are no accounts, emails, or passwords. Your wallet holds your keys and your funds. If you lose access to your wallet, you lose access to your assets.

What’s the difference between Uniswap v3 and v2 on Arbitrum?

Uniswap v2 spreads liquidity evenly across all prices, making capital inefficient. v3 lets you concentrate liquidity in a custom price range, boosting fee earnings by up to 4,000x. v3 also has multiple fee tiers (0.01% to 1.00%), while v2 used a fixed 0.30%. v3 fees must be claimed manually; v2 auto-compounded them. v3 is more powerful but requires active management.

Can I earn yield with Uniswap v3 on Arbitrum?

Yes, but not directly. By providing liquidity to trading pairs, you earn a share of trading fees. This is called yield, but it’s not guaranteed. If prices move outside your range, you might earn less or even lose value compared to holding the tokens. Many users combine Uniswap LP positions with other DeFi protocols to boost returns, but that adds complexity and risk.

Is Uniswap v3 on Arbitrum better than centralized exchanges?

It depends. For spot trading of major tokens like ETH, USDC, or ARB, Uniswap v3 offers lower fees, faster execution on Arbitrum, and full control of your funds. But centralized exchanges offer better customer support, fiat on-ramps, and margin trading. If you’re trading small amounts and value privacy and control, Uniswap wins. If you’re trading large amounts or need leverage, a centralized exchange might be more practical.