Quantum Computing Threat and Its Impact on Crypto

When working with Quantum Computing, the use of quantum bits to solve problems far faster than traditional computers. Also known as QC, it poses a major risk to the encryption methods that secure digital assets.

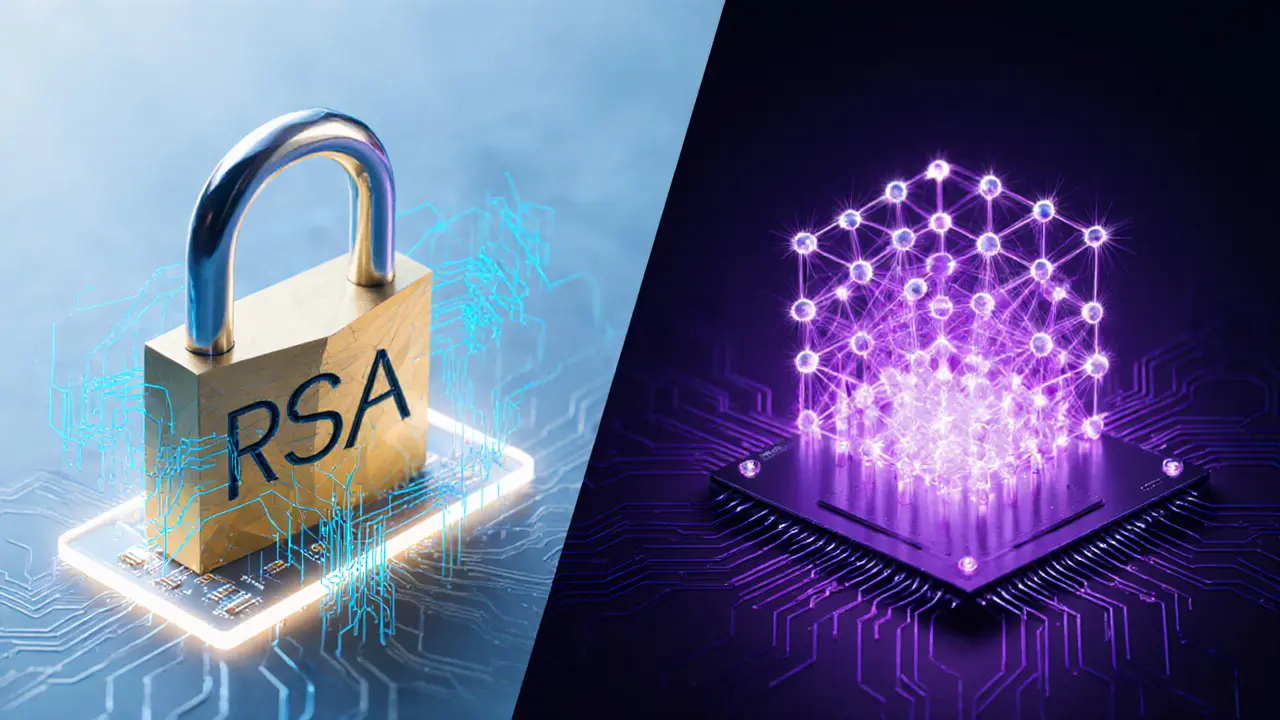

Enter Cryptography, the science of encoding information to keep it private. Cryptography is the backbone of blockchain security, ensuring that transactions stay tamper‑proof and wallets remain safe. When quantum computers become powerful enough, they could break many of the current algorithms—like RSA and ECC—that protect crypto wallets and smart contracts.

That’s where Blockchain, a distributed ledger that records transactions across a network of computers comes into play. Blockchain relies on cryptographic hashes and digital signatures to maintain integrity. If those signatures are compromised, the whole trust model collapses, and attackers could rewrite history or steal assets. This direct link creates a clear semantic triple: Quantum Computing threatens Cryptography, and Cryptography secures Blockchain.

Why the quantum risk matters for DeFi and exchanges

Decentralized finance (DeFi, financial services built on blockchain without traditional intermediaries) depends on the same cryptographic guarantees. From lending protocols to automated market makers, every smart contract assumes the underlying signatures are unbreakable. A quantum computing threat could expose millions of dollars locked in liquidity pools, swapping services, and staking contracts.

Crypto exchanges—whether centralized platforms like DA.SG, KuMEX, or emerging players—face similar challenges. They store private keys for hot wallets, manage user authentication, and safeguard API endpoints. If quantum algorithms crack the keys, an exchange could lose custody of user funds, eroding trust overnight. This is why many exchange reviews now discuss quantum‑ready security measures alongside fees and usability.

To counteract these dangers, the industry is racing toward Post‑Quantum Cryptography, cryptographic schemes designed to resist attacks from quantum computers. Lattice‑based, hash‑based, and code‑based algorithms are being evaluated for blockchains, wallets, and exchange APIs. The goal is to replace vulnerable primitives before quantum machines reach a breaking point, creating a safety net for the entire crypto ecosystem.

Regulators are also paying attention. In the US, the SEC and CFTC are reviewing the quantum risk as part of broader crypto oversight, while the EU’s MiCA framework hints at mandatory post‑quantum standards for financial services. This regulatory push adds another layer of urgency for projects that want to stay compliant and avoid future legal headaches.

Practically speaking, developers can start preparing by integrating hybrid key‑generation, supporting multiple signature algorithms, and running quantum‑risk assessments on their codebases. Investors should watch for projects that publicly commit to post‑quantum upgrades, as those signals often correlate with stronger long‑term resilience.

Below you’ll find a curated list of articles that dive deep into the quantum computing threat, explore how it intersects with crypto security, and offer actionable steps for traders, developers, and anyone holding digital assets. From exchange reviews that mention quantum‑ready features to guides on post‑quantum cryptography, the collection gives you the context you need to stay ahead of this emerging challenge.

- Apr, 26 2025

Explore why quantum computers threaten RSA, what post‑quantum cryptography is, and how organizations can build crypto‑agile, zero‑trust systems before the 2026 compliance deadline.

- Read More