Cryptocurrency Exchange Safety

When you think about cryptocurrency exchange safety, the practice of protecting digital‑asset platforms from hacks, fraud, and regulatory breaches. Also known as exchange security, it forms the backbone of any trustworthy trading experience.

One of the most concrete ways to measure safety is through crypto exchange security audits, independent reviews that examine smart‑contract code, wallet architecture, and operational controls. These audits directly influence a platform’s risk profile, making them a critical factor for users who care about asset protection. Another pillar is regulatory compliance, the set of licenses, AML/KYC procedures, and reporting standards a platform follows to stay within the law. Compliance not only reduces the chance of sudden shutdowns but also shapes how exchanges handle user data and dispute resolution. cryptocurrency exchange safety also depends on liquidity – the ability of an exchange to match large orders without slippage – because low liquidity can force traders into unfavorable price moves, increasing exposure to market manipulation. Finally, transparent fee structures matter; excessive or hidden fees can erode profits and mask underlying cost‑inefficiencies that signal a platform’s overall health.

What to Look for When Picking an Exchange

To evaluate an exchange, start by checking whether it has recent security audit reports and whether independent firms signed off on its hot‑wallet isolation methods. Next, verify the jurisdiction and licensing information; a platform operating under a clear regulatory framework usually offers stronger consumer protections. Look at the order‑book depth and average daily volume – these numbers tell you if the market can absorb your trades without big price impacts. Compare fee schedules for maker, taker, and withdrawal charges; a clear breakdown helps you avoid surprise costs that could affect your strategy. Finally, read community feedback on support responsiveness and incident history; real‑world experiences often reveal hidden strengths or weaknesses that official documents don’t cover.

Armed with these criteria, you’ll be able to sift through the dozens of listings below and spot the exchanges that truly prioritize safety. Below, you’ll find in‑depth reviews, fee breakdowns, and security assessments that let you match your risk tolerance with the right platform.

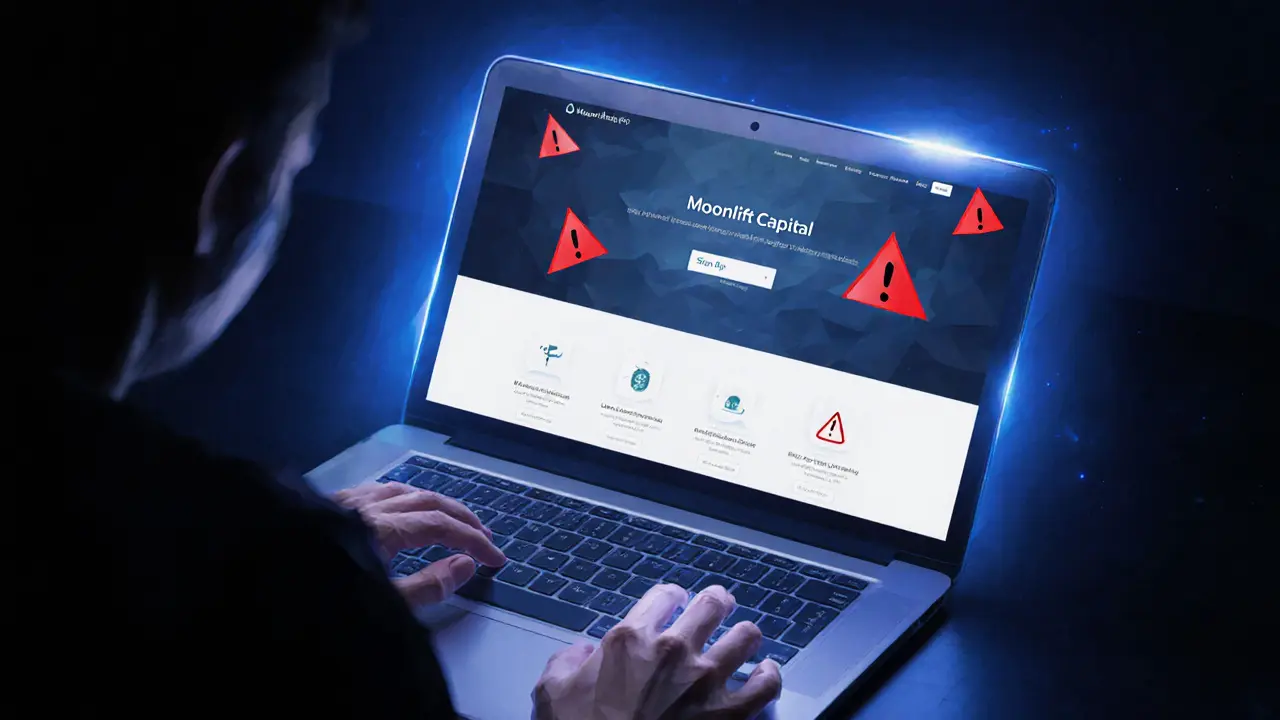

A thorough review of Moonlift Capital highlights its lack of transparency, missing regulatory info, and high risk compared to established exchanges like Coinbase.

- Read More