Crypto Exchange Scam: Spotting Fraud Before It Hits Your Wallet

When dealing with Crypto Exchange Scam, a deceptive platform that pretends to be a legitimate cryptocurrency exchange but aims to steal users' funds or data. Also known as exchange fraud, it often mimics well‑known interfaces and promises low fees or huge bonuses. Crypto Exchange services are supposed to offer secure trading, custody, and market access, but when fraudsters hijack that trust, the result is massive losses. Detecting these scams relies on Fraud Detection Tools like on‑chain analytics, community watchdogs, and automated blacklist databases. Meanwhile, Regulatory Bodies such as the SEC or EU's MiCA framework provide legal oversight, but enforcement varies across jurisdictions. Understanding how these pieces fit together helps you stay one step ahead of the bad actors.

Key Signals and Protective Measures

First, look for mismatched URLs or misspelled brand names – scammers often register domains that differ by a single character. Second, check the exchange’s licensing status; a genuine platform will display clear registration numbers and links to official regulator sites. Third, examine withdrawal limits and sudden changes in fee structures – hidden fees or abrupt freezes are classic red flags. Fourth, use crypto exchange scam trackers that aggregate user reports and on‑chain transaction patterns; these tools can flag addresses linked to known fraud rings. Fifth, stay updated on regulatory news because new rules can render previously compliant services illegal, turning them into de‑facto scams. By combining these practical checks with community vigilance, you build a layered defense that reduces the chance of falling victim.

The collection below brings together in‑depth reviews, safety analyses, and real‑world case studies of exchanges that have faced scandal, regulatory action, or user backlash. Whether you’re comparing fee structures, evaluating security audits, or learning from past fraud incidents, these articles give you actionable insight to navigate the market safely.

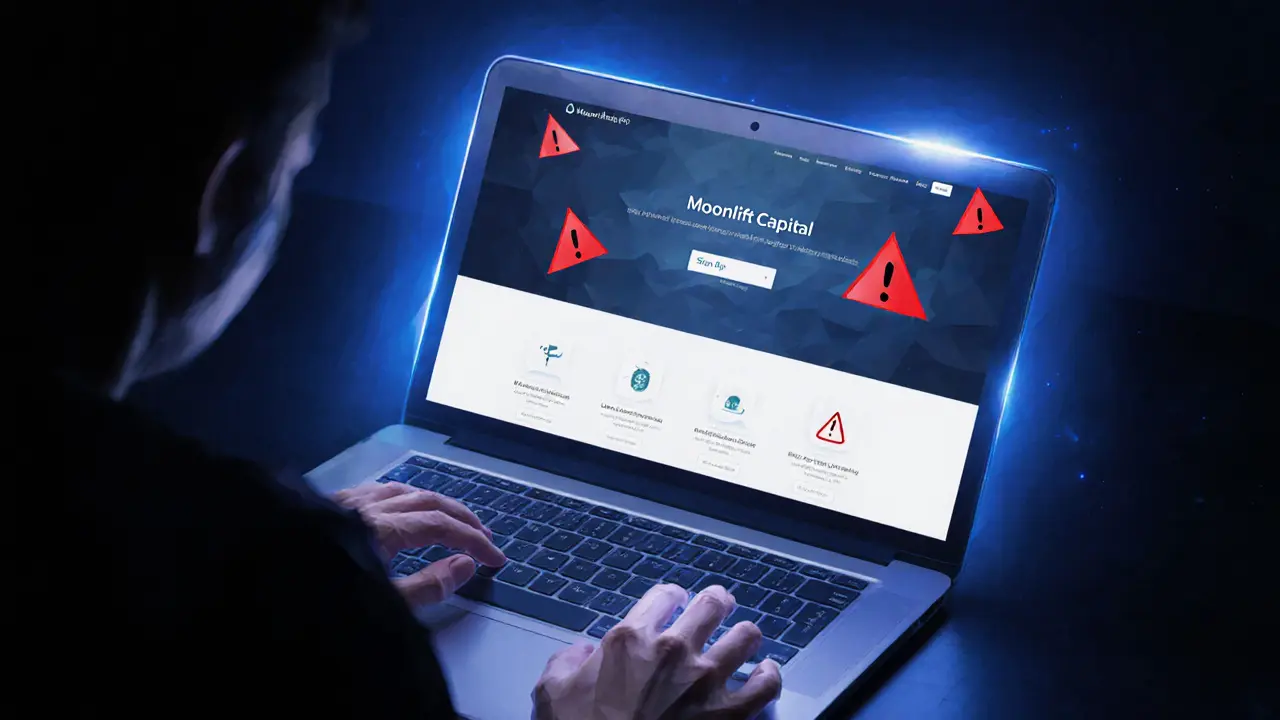

A thorough review of Moonlift Capital highlights its lack of transparency, missing regulatory info, and high risk compared to established exchanges like Coinbase.

- Read More