Baby Doge Billionaire – All You Need to Know

When you hear Baby Doge Billionaire, a community‑run meme cryptocurrency built on the Binance Smart Chain, also called BDB, you probably picture a cute dog logo and a wild price chart. It is a type of meme coin, digital token that gains value mainly through social hype and viral memes. Like many meme projects, it often launches airdrops, free token giveaways that reward early supporters and boost community growth to spark momentum. Understanding its tokenomics, supply schedule, fee structure, and burn mechanisms is key before you trade it on crypto exchanges, platforms where users can buy, sell, or swap tokens. Baby Doge Billionaire blends playful branding with real blockchain tech, and that mix creates a unique set of risks and opportunities you’ll want to unpack.

Key Aspects to Watch

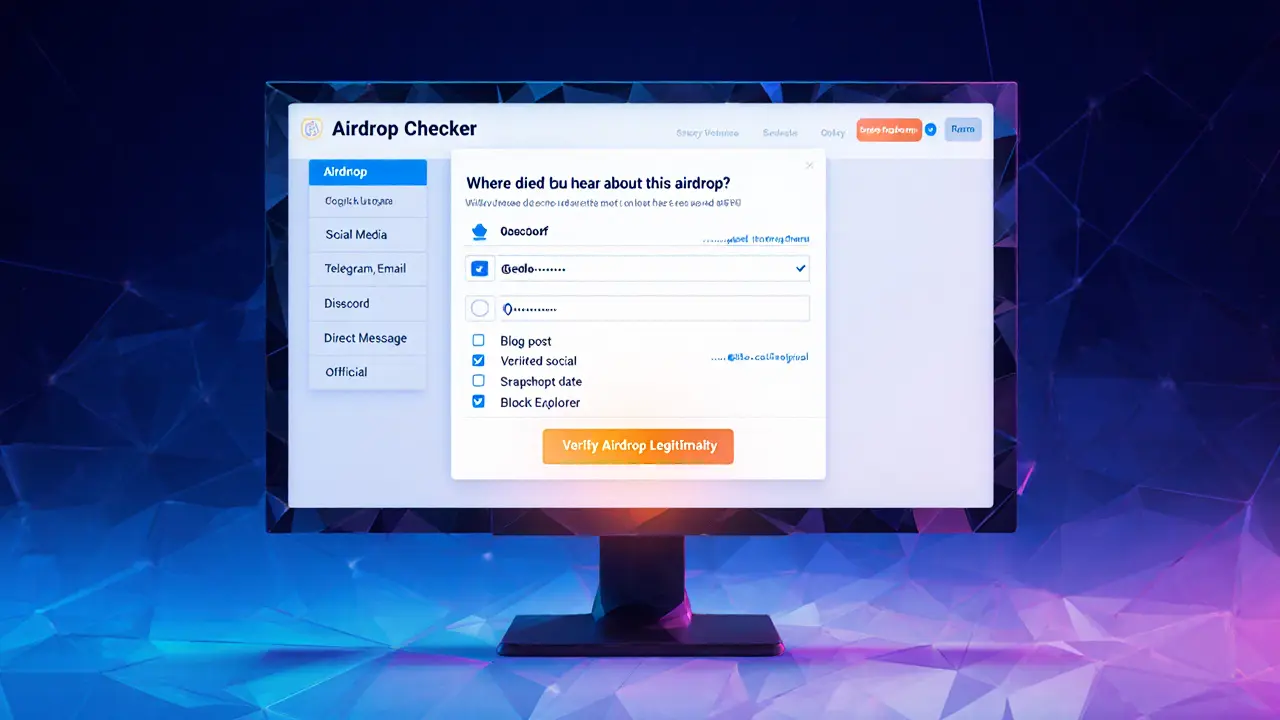

The first thing any trader checks is the airdrop schedule. Recent meme‑coin airdrops have shown a clear pattern: announce the event, require a small on‑chain action (like holding a paired token), then distribute the new tokens in a snap. Airdrop mechanics, eligibility rules, claim windows, and post‑airdrop lock‑up periods directly affect price volatility. Baby Doge Billionaire follows that template, rewarding holders of BDB on the Binance Smart Chain and offering bonus claims for sharing on social media. That means community engagement becomes a price driver – a classic meme‑coin trait where hype fuels demand. The underlying blockchain, Binance Smart Chain, known for low fees and fast confirmations also shapes user experience. Lower transaction costs encourage frequent swaps, which in turn inflate trading volume on exchange listings, the marketplaces where BDB can be bought or sold. When a new exchange adds Baby Doge Billionaire, the token usually sees a short‑term surge because fresh liquidity pops up. That surge is a direct result of the triple relationship: blockchain enables cheap trades, cheap trades attract exchanges, exchanges boost visibility. Tokenomics play a pivotal role as well. BDB caps its supply at 1 billion tokens, but a portion is earmarked for weekly burns, reducing circulating supply over time. The burn schedule is coded into the smart contract, so it’s transparent and immutable – a hallmark of blockchain immutability, the feature that prevents post‑deployment changes to contract code. Reduced supply, combined with steady airdrop inflows, creates a balancing act: new tokens flood the market, but burning pulls them back. Understanding this balance helps you gauge long‑term price pressure. Finally, community tools matter. Most meme‑coin fans track sentiment on Discord, Telegram, and Twitter. Baby Doge Billionaire’s official channels post weekly updates on airdrop eligibility, burn events, and upcoming exchange listings. Engaging with these groups gives you early insight into potential price moves, which is valuable when you’re timing a trade.

Putting all these pieces together – airdrop design, blockchain choice, tokenomics, and exchange dynamics – gives you a roadmap to evaluate Baby Doge Billionaire’s real potential. The articles below dive deeper into each of these topics, from detailed airdrop guides to exchange reviews and token‑safety checklists. Browse the collection to see how each factor plays out in practice, then decide whether BDB fits your trading plan or long‑term portfolio.

Get the real facts on the BABYDB airdrop, why it doesn't exist, and how the genuine PAWS token airdrop from BabyDoge works. Learn verification steps and avoid scams.

- Read More