Astra Protocol x CoinMarketCap Airdrop: What's Real and What's Confused

There’s a lot of noise online about an "Astra Protocol x CoinMarketCap airdrop." If you’ve seen posts promising free ASTRA tokens from CoinMarketCap, you’re not alone. But here’s the truth: there is no confirmed Astra Protocol airdrop tied to CoinMarketCap. What you’re likely seeing is confusion between two completely different projects - Astra Protocol (ASTRA) and Aster (AST).

Let’s cut through the hype. If you’re looking to claim tokens, understand what’s real, or just avoid getting scammed, this is what you need to know - no fluff, no guesses, just facts based on current data as of February 2026.

What Is Astra Protocol (ASTRA)?

Astra Protocol is a decentralized KYC platform built for Web3 compliance. It doesn’t trade crypto or run a DEX. Instead, it helps crypto apps meet legal requirements across 155+ countries. Think of it as a background system that lets exchanges, DeFi protocols, and wallets verify users without seeing their real identities. It uses patented tech to check names against global sanctions lists - FATF, OFAC, EU lists - and connects to real legal firms via its Decentralized Legal Network (DLN).

Right now, ASTRA is trading at $0.001742. Its market cap is around $645K, with a fully diluted value of $1.75M. The total supply is 1 billion tokens, and about 367 million are circulating. Over the last week, it’s dropped 17%, while the broader crypto market rose 1.2%. That’s a red flag. If this were a hot project getting major exposure, the price wouldn’t be sinking like this.

What About CoinMarketCap’s CMC Launch?

CoinMarketCap didn’t launch an airdrop for Astra Protocol. But it did launch something else - CoinMarketCap CMC Launch. This is a new program to spotlight pre-TGE projects with serious backing. The first project chosen? Not ASTRA. It was Aster (AST).

Aster is a perpetual trading platform built on BNB Chain and Arbitrum. It combines yield farming with high-leverage trading (up to 1001x). Its token, AST, launched in September 2025. Within 24 hours, it jumped 134% to $0.198. That’s real momentum. Aster’s airdrop system works through two point types: Au points for holding assets like ALP or USDF, and Rh points for trading on Pro Mode. These points determine future token allocations. No ASTRA token was involved.

Why the Confusion?

The names are too similar. Astra Protocol. Aster. Both start with "A". Both have "A" tokens. Both are in crypto. But they’re not connected. One is compliance tech. The other is a trading platform. Mixing them up is like confusing a fire alarm with a fire truck.

Here’s a quick breakdown:

| Feature | Astra Protocol (ASTRA) | Aster (AST) |

|---|---|---|

| Primary Purpose | Decentralized KYC & Compliance | Perpetual Trading DEX |

| Token Symbol | ASTRA | AST |

| Contract Address | 0x2013...351e | Not publicly listed yet |

| Launch Date | 2023 | September 17, 2025 |

| CMC Launch Involvement | No | Yes - inaugural project |

| Airdrop Status | No confirmed airdrop | 704M AST airdropped in 2025 |

| Current Price (Feb 2026) | $0.001742 | $0.14 (post-surge drop) |

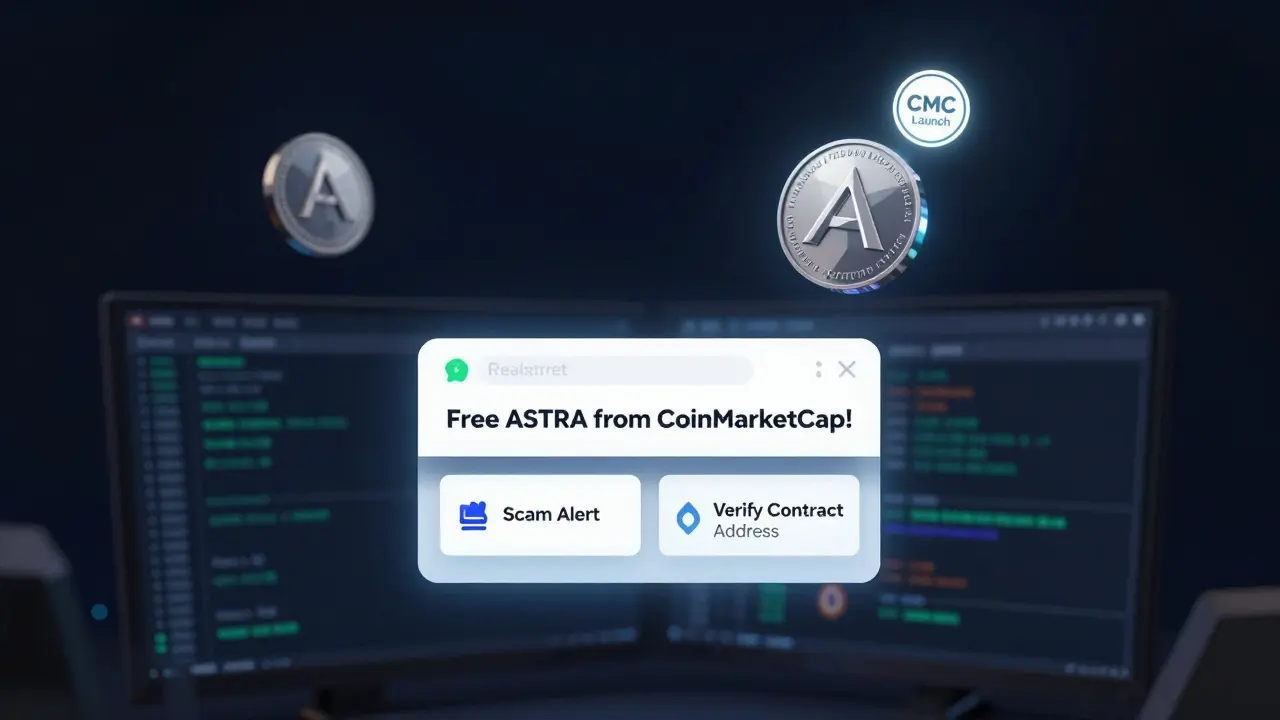

Scammers know this confusion exists. They’re posting fake links, fake Telegram groups, and fake CoinMarketCap banners claiming you can claim "free ASTRA" by connecting your wallet. Don’t do it. If you’re asked to sign a transaction or send crypto to claim tokens, it’s a scam.

What Should You Do If You Own ASTRA?

If you already hold ASTRA tokens, here’s what you can realistically expect:

- No airdrop from CoinMarketCap - they’ve never done one for ASTRA, and there’s zero official announcement.

- Check official channels - Visit astraprotocol.io (not Telegram or Twitter) and look for updates. Their roadmap mentions compliance integrations with DeFi protocols, not token distributions.

- Monitor price action - ASTRA is underperforming. If the team starts announcing partnerships with major exchanges or regulators, the price could rebound. But don’t hold your breath.

- Don’t chase hype - If someone says "CoinMarketCap is giving away ASTRA," they’re either misinformed or trying to steal your funds.

Is There Any Future for ASTRA?

Astra Protocol’s tech is solid. The world needs compliance tools for Web3. Banks and regulators are pushing for KYC on-chain. Astra’s DLN could be the bridge between legal systems and decentralized apps. But tech alone doesn’t drive token prices. Adoption does.

Right now, Astra Protocol is stuck in the "under-the-radar" phase. No big exchange listings. No major DeFi protocol integration announced. No airdrop. No marketing push. Without one of those, the token will keep drifting.

Compare that to Aster. It launched with CoinMarketCap’s stamp of approval. It has real trading volume, a clear product, and a token distribution that rewarded early users. That’s how you build momentum.

What About Other "Astra" Projects?

Don’t get mixed up with Astra DAO (ASTRADAO), either. That’s a separate Ethereum-based DAO that manages crypto investment portfolios. It’s not related to Astra Protocol or Aster. Three different projects. Three different teams. Three different tokens. All with similar names. It’s a mess.

If you’re researching any "Astra" project, always verify:

- The official website (check the domain - no typos!)

- The contract address on Etherscan

- Whether CoinMarketCap or CoinGecko lists it as an official project

- Whether there’s a press release from a known source (Forbes, Bloomberg, CoinDesk)

Final Reality Check

As of February 2026, there is no Astra Protocol x CoinMarketCap airdrop. Period. The only airdrop tied to CoinMarketCap’s CMC Launch was Aster (AST) in September 2025. ASTRA is a compliance project with weak market performance. Don’t confuse the two.

If you’re looking for real airdrops, focus on projects with:

- Clear, public airdrop mechanics

- Official announcements on their website and Twitter

- Partnerships with established platforms (like CoinMarketCap, Binance, or Coinbase)

- Verified contract addresses

And if someone tells you they can send you free ASTRA from CoinMarketCap? Block them. Report them. Walk away.

Is there a real Astra Protocol airdrop happening right now?

No. There is no confirmed airdrop for Astra Protocol (ASTRA) as of February 2026. Any claims of an "ASTRA x CoinMarketCap airdrop" are false. CoinMarketCap’s CMC Launch platform only featured Aster (AST), not ASTRA. Be wary of scams asking you to connect your wallet or pay fees to claim tokens.

What’s the difference between ASTRA and AST?

ASTRA (Astra Protocol) is a decentralized KYC platform for Web3 compliance. AST (Aster) is a perpetual trading DEX with high leverage and dual trading modes. They’re unrelated. ASTRA’s contract is 0x2013...351e. AST launched in September 2025 with a 704M token airdrop. Confusing them is a common scam tactic.

Can I still claim tokens from the Aster airdrop?

The main Aster (AST) airdrop ended in September 2025. If you participated in minting or trading on the platform before that date, your tokens were distributed automatically. There are no ongoing claim periods. Beware of fake websites claiming you can still claim AST - they’re phishing traps.

Why is ASTRA’s price dropping?

ASTRA has underperformed the market for weeks, dropping 17% in the last 7 days. This is likely due to lack of adoption - no major DeFi protocols have integrated it yet, and there’s no marketing push. Without real-world usage or partnerships, token prices stagnate or fall. It’s not a technical issue - it’s an adoption issue.

Should I buy ASTRA tokens now?

Only if you believe in long-term Web3 compliance infrastructure and are okay with high risk. ASTRA has no airdrop, no major exchange listing, and weak trading volume. It’s not a speculative play. If you’re looking for growth, focus on projects with clear product-market fit and recent traction - like Aster or others with verified partnerships.

Ekaterina Sergeevna

February 13, 2026 AT 10:57Oh sweet merciful DAO, another "Astra Protocol" post. Let me guess - someone just got their wallet drained by a Telegram bot claiming "free ASTRA from CMC" and now they’re crying in the comments. The real tragedy isn’t the scam - it’s that people still think CoinMarketCap is some kind of crypto fairy godmother handing out free tokens like Halloween candy. CMC Launch is a marketing pipeline, not a charity. ASTRA? More like ASTRA-gone-wrong. At least Aster had a product. This? It’s a compliance spreadsheet with a token attached. And no, I’m not buying the "Web3 compliance is the future" pitch. We’ve had 100 of these. None of them shipped. None of them mattered. Just stop.

krista muzer

February 14, 2026 AT 23:46i just wanna say… i totally get confused by asta vs asta vs ast… like my brain just shuts down when i see "a" tokens. i thought astra protocol was the one with the cool nft badges for compliance? or was that astradao? idk. i just checked my wallet and i have 0.00001 ASTRA and i’m like… did i miss an airdrop? or am i just hallucinating? lol. also i think coinmarketcap has too many things going on now. they’re like a crypto walmart. you walk in looking for apples and you leave with 7 different kinds of crypto and a toaster. 🤷♀️

Michelle Cochran

February 16, 2026 AT 12:44Let’s not pretend this is just about token confusion. This is about the moral decay of Web3. We’ve turned financial literacy into a scavenger hunt where scammers write the clues. Astra Protocol isn’t just underperforming - it’s being actively erased by a culture that rewards hype over substance. And CoinMarketCap? They’re not neutral. They’re gatekeepers. By elevating Aster - a high-leverage gambling platform - they’re saying: "We don’t care if you lose everything. We care if you click."

Meanwhile, Astra Protocol is building the invisible infrastructure that could prevent millions from being exploited. But who wants to fund compliance? No one. Because compliance doesn’t have memes. It doesn’t have influencers. It doesn’t have 1000x returns. It just… works. And that’s why it’s dying. We’re not failing because of tech. We’re failing because we’ve forgotten what ethics even looks like.

monique mannino

February 18, 2026 AT 01:47Thank you for this!! 🙌 Seriously, I was about to connect my wallet to some "ASTRA airdrop" link because I saw it on Twitter. So glad I double-checked. Just a quick reminder: if it’s too good to be true, it’s probably a phishing site. Always check the contract on Etherscan. And if it’s not on CoinGecko or CMC? Skip it. 💡 Stay safe out there! ❤️

Holly Perkins

February 19, 2026 AT 23:47wait so astra and aster are different? i thought they were the same thing lmao. i just lost 0.5 eth on a "claim your asta" site. now i feel dumb. also why does coinmarketcap even have a launch thing? like… who even uses that? idk anymore.

Will Lum

February 21, 2026 AT 01:51Real talk - most people don’t care about KYC infrastructure. They care about getting rich quick. That’s why Aster blew up. Astra Protocol? It’s like building a fire extinguisher while everyone’s throwing gasoline on the floor. The tech is cool. But if no one’s using it, it’s just code in a GitHub repo. Not a bad thing. Just not a trading opportunity. Chill. Wait for the next one.

Sanchita Nahar

February 21, 2026 AT 15:43ASTRA price down 17%? That’s not a red flag. That’s a warning siren. If you’re holding this, you’re already late. Aster had 700M tokens dropped. Astra? Nothing. No hype. No team. No roadmap update in 6 months. Don’t be emotional. This is crypto. If it’s not moving, it’s dying. Sell. Move on.

Ben Pintilie

February 22, 2026 AT 21:28lol i just saw a guy on discord saying "i claimed 5000 ASTRA from coinmarketcap" and he had a screenshot of a fake site. i asked him for the link. he said "it’s gone now lol". yeah. because it was a scam. 🤦♂️

Sakshi Arora

February 23, 2026 AT 11:11i think the real issue is we have too many projects with similar names and no one checks anything. i saw "astra" and thought it was the one with the mobile app. then i saw "aster" and thought it was the same. now i have 3 different tokens in my wallet and i don’t even know which is which. also i think coinmarketcap should just stop doing launch stuff. it’s too confusing.

bala murali

February 24, 2026 AT 08:53I appreciate the clarity here. It’s rare to see a breakdown that doesn’t just say "don’t get scammed" but actually explains the *why*. Astra Protocol’s tech is genuinely important - especially as regulators tighten KYC rules globally. But adoption is slow because no one wants to build on something invisible. That’s the tragedy of infrastructure projects. They’re essential, but never glamorous. Aster had flash. Astra has function. We need both. Just… maybe don’t buy ASTRA hoping for a miracle.

Desiree Foo

February 26, 2026 AT 05:00It’s irresponsible to let projects like Aster - with 1001x leverage - be promoted as "CMC Launch" without a single warning label. You’re enabling financial ruin. Meanwhile, Astra Protocol is quietly building the safety net that could prevent people from losing everything. And yet, the market rewards the casino and punishes the firefighter. This isn’t innovation. It’s moral bankruptcy. If CoinMarketCap is going to endorse projects, they need to take responsibility for the consequences. Not just slap a "new launch" banner on a gambling platform and call it a day.

Kaz Selbie

February 27, 2026 AT 11:25Let me be the first to say this: ASTRA is dead. Not "underperforming." Not "undervalued." Dead. The team hasn’t tweeted since October. No new partnerships. No liquidity pool updates. The contract is on Etherscan like a tombstone. Meanwhile, Aster had a real team, real marketing, and real volume. This isn’t a "confusion" - it’s a corpse being mistaken for a living person because both have two eyes. Stop romanticizing dead projects. Move on. Your portfolio will thank you.

Robbi Hess

March 1, 2026 AT 02:56THE ASTRAL AIRDROP IS A LIE. A LIE I TELL YOU. I WAS THERE. I SAW THE BANNERS. I SAW THE TWEETS. I SAW THE FOMO. AND THEN - NOTHING. THE CONTRACT WAS A DUSTBIN. THE WEBSITE WAS A PHISHING PAGE. I LOST $237. I DIDN’T LOSE MONEY. I LOST TRUST. IN CRYPTO. IN MARKETCAP. IN HUMANITY. I DON’T BELIEVE IN AIRDROPS ANYMORE. I BELIEVE IN BLOCKCHAIN. AND I’M DONE.